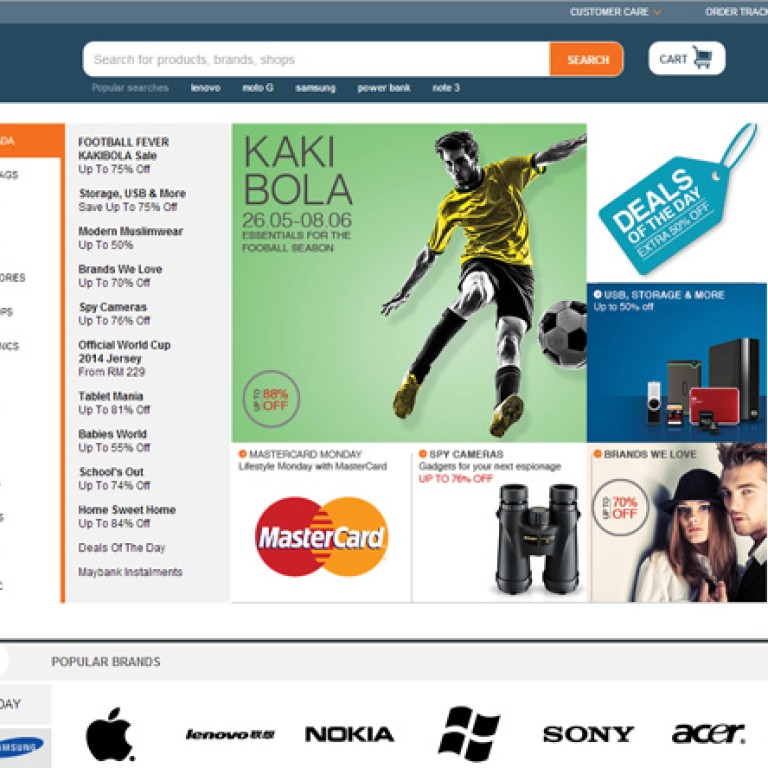

Lazada aims to become the go-to shopping site for Southeast Asia

Portal is among the top online retailers in Vietnam, Thailand, Philippines and Malaysia

China has Alibaba. America has Amazon. In Southeast Asia, the name that has quickly risen to dominate online sales - from electronic gadgets to toys and home appliances - is Lazada.

In just two years it has become one of the top online retailers in all the markets where it is present. In Indonesia, Vietnam, Thailand, the Philippines and Malaysia, with the aim to be the first website consumers think of when they need to shop.

Recently, it closed a round of funding bringing its total valuation to roughly US$430 million led by Tesco, the world’s second largest supermarket chain.

Although company headquarters has always been in Singapore, today marks the launch of a Singapore site. Chief executive Max Bittner, A McKinsey and Morgan Stanley veteran, shares on a recent trip to Hong Kong how Southeast Asia consumer profile is similar to the mainland of yesteryear and how he aims to replicate the success of Jack Ma Yuns Alibaba in these new markets.

“We’re called the Asian Amazon but we see of ourselves more as a Tmall or an Alibaba,” Bittner says.

“The reason is that the challenges that we face in Southeast Asia are more similar to the challenges that Tmall would’ve faced in China five to ten years ago rather than Amazon faced in the US 10 to 15 years ago.”

Bittner said there was a lack of offline retail presence especially in third or fourth tier cities---even more pronounced in places like Indonesia.

We’re called the Asian Amazon but we see ourselves more as … an Alibaba

“Of course you have everything you could possibly want to shop in Jakarta but as soon as you go to the second tier cities like Medan or Surabaya, the offline retail presence dramatically declines,” he explains. “The reason why it hadn’t happened yet was because of supply. The demand has been there.”

Historically, it was because of logistical barriers in sprawling archipelagos like the Philippines and Indonesia, where Lazada had worked hard to build a “unique, complex supply chain”.

“We deal with multiple logistic partners depending on the island,” Bittner said. Certain ones are better for Sumatra or Kalimantan. We’ve focused on the last two years to really bring together a seamless logistics and supply chain organisation. If you look at our orders, 50 to 60 per cent is coming from outside the big cities. The special skill that we have is reaching those people.”

The good news is that Southeast Asians are some of the most digitally savvy internet users in the world. Bangkok and Jakarta top the list of cities with the most active Facebook users. The Philippines was rated as the country with the highest number of online social networks per person.

“Line is massive in Thailand. People are extremely excited about anything online, open to sharing and voicing their opinions online, which we see as a prerequisite into converting to online shoppers.”

In the long run, Lazada may even have an edge over Chinese peers Jd.com and Tmall as parts of these Southeast Asian markets will never be interesting for brands to invest heavily enough to do themselves.

“For a big offline retailer, it will always make sense to build in China no matter what. You look at Southeast Asia and you have 600 million people but you look closer and its 70 million here, 30 million there. It doesn’t make sense to build an offline retail presence [outside the big cities]. We 100 per cent believe that the huge opportunity for people to enter Southeast Asia but only deal with one counterpart for the whole region--that one touch point rather than their own distribution network for each market.”

Lazada’s launch in Singapore represents the first time going into an established market. Bittner clarifies that although it presents a different set of challenges, it made sense because there was no one clear player dominating the market. There are no plans to branch out further to North Asia or other regions however.

“I’m pretty happy with Southeast Asia,” Bittner says. “That’s 10 per cent of the world’s population. That’s big enough. Let’s be very honest, the other markets are taken. China, US and India are already taken. You could look at the periphery of Southeast Asia like Myanmar and Bangladesh. These markets will sooner or later become very interesting.”

“Six years ago, the ecommerce market in China was 1 per cent of total retail sales. China is now at 8 per cent. If in six years we’re at 8 per cent [of Southeast Asian total retail sales], we’ll be very happy.”