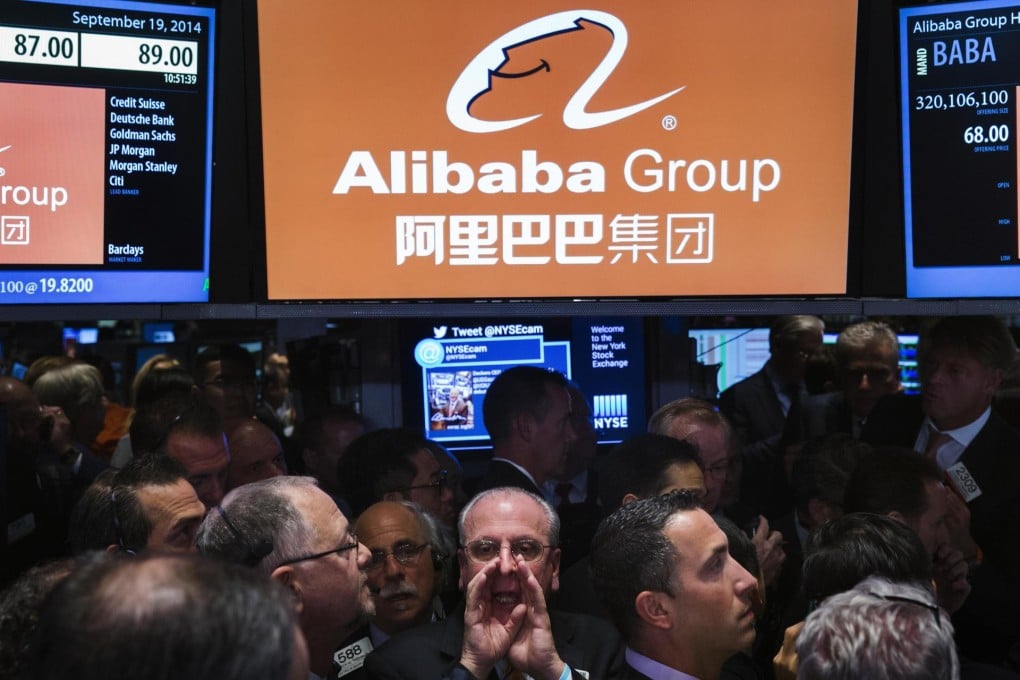

Update | Underwriting banks rake in US$300m windfall on fees for Alibaba IPO

The underwriters exercised a so-called greenshoe option to sell an additional 48 million American depositary shares, Alibaba said yesterday.

Alibaba's initial public offering in New York now officially ranks as the world's biggest at US$25 billion, netting underwriters of the sale a more than US$300 million windfall after the e-commerce giant and some shareholders parted with additional shares.

The underwriters exercised a so-called greenshoe option to sell an additional 48 million American depositary shares, Alibaba said yesterday. The fees are equivalent to 1.2 per cent of the total deal, with Alibaba paying US$121.8 million in commissions. Selling shareholders are set to pay another US$178.6 million, according to a filing with the US Securities and Exchange Commission.

Overwhelming demand saw the IPO initially raise US$21.8 billion, and then sent Alibaba stock surging 38 per cent in its debut on Friday, closing at US$93.89, up from the IPO price of US$68.

Alibaba fell 3.1 per cent to US$91 in early trading yesterday.

"With Alibaba, people are looking at that as a top in the market," Patrick Spencer, head of US equity sales at Robert W. Baird in London, said of Friday's close.

Friday's positive reaction to the listing prompted underwriters to exercise an option to sell additional shares, pushing the IPO ahead of the previous global record set by Agricultural Bank of China in 2010, when the lender raised US$22.1 billion.