Fast Retailing to hold out on raising product prices

Japanese fashion retailer to boost production outside of China amid pressure from weaker yen and rising labour costs on the mainland

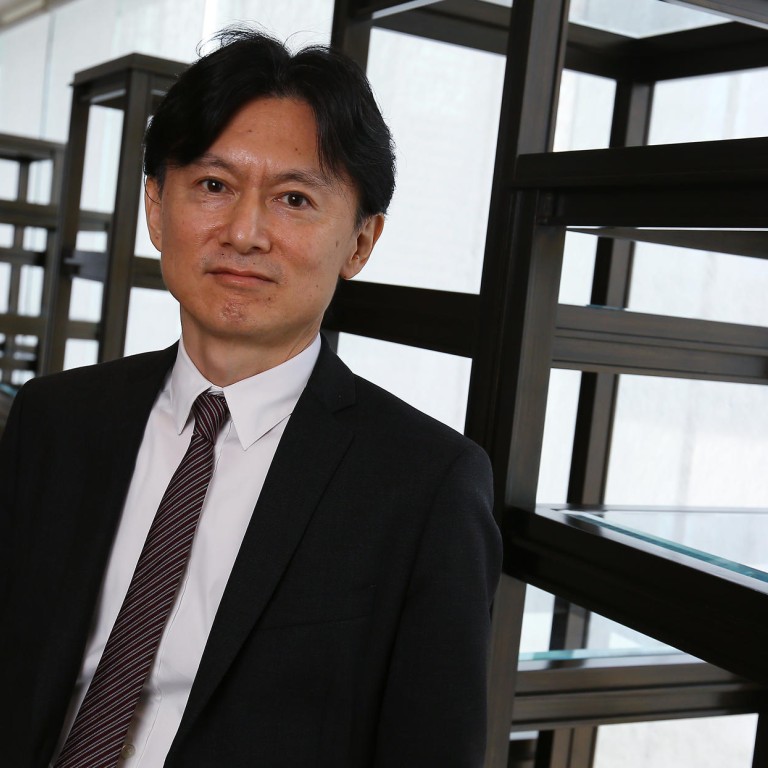

Uniqlo owner Fast Retailing said it would hold out on raising product prices despite the weakening of the yen and rising labour costs in China where it does much of its manufacturing, its chief financial officer Takeshi Okazaki said yesterday.

"We will have to raise prices in the future, but in terms of Japan, we would like to always be the last to raise prices among the competitors," he said.

Okazaki said the firm expected labour costs to rise 0.1 to 0.2 percentage point against sales.

Although he underscored the importance of China in its supply chain, the retailer expects to increase its manufacturing in other countries.

"Because of our high growth targets, we also have to increase the capacity outside of China as well. In terms of supply countries, the portion of China may decrease but the absolute volume will not decrease," he said.

The company, which also owns affordable luxury brands Helmut Lang, J Brand and Theory, among others, is intent on becoming the world's largest retailer in five years.

It has set an internal target to achieve turnover of 2.5 trillion yen (HK$163.2 billion) in sales by 2017, then double that amount by 2020. The Tokyo and Hong Kong-listed firm is now in fourth place after Inditex, H&M and Gap.

"We should be able to achieve this with no problem," Okazaki said. "If we can keep the store opening pace and the growth of the existing store base, then 2.5 trillion yen sales [by 2017] is within reach."

The firm recorded 479.5 billion yen in revenue, up 23.3 per cent from a year ago, in the most recent quarter ended November.

Okazaki said the company would have more stores overseas than in Japan by August, although overseas sales would take about three years to exceed its home market.

The company said the growth of its China business was above target in spite of a slowing economy, and it would continue to open about 100 stores a year. It currently has 341 outlets on the mainland.

"Our existing [Chinese] store sales are trending very well," Okazaki said. "Rather than being economy-sensitive, because we are daily life products, we are impacted more by the weather than the economy.

"We do hear about the slowing in the consumer sector but we are not feeling that impact."

While its US operations are still loss-making, Okazaki said brand recognition and sales were picking up well.

"Our focus is how to balance the sales as well as the costs," he said. "In order for our stores to reach stable profitability, it takes about one to two years. Because of our rapid expansion in the US, it tends to have unstable profits."

A January 11 report from a non-governmental organisation said there were unsafe working conditions at two of Fast Retailing's Chinese sub-suppliers - Dongguan Tomwell Garment and Pacific (Pan Yu) Textiles. The company has responded by enforcing more stringent oversight of its supply chain.

Okazaki said the issue was a "very high priority" and that the violations occurred because they had "been monitoring environment conditions but not the labour conditions" of the firm's sub-suppliers.

"We will be doing monitoring unannounced rather than scheduled and more frequent visits," he said.