New | HKEx to see sterling quarterly results but headwinds loom

Q2 profit expected to double but recent market rout clouds outlook

Market operator Hong Kong Exchanges and Clearing is expected to report a more than doubling in earnings in the second quarter when it releases results on Wednesday, but analysts expect challenges ahead as turnover has turned sharply lower in recent weeks after a market rout shook equities in the city and mainland China.

Credit Suisse analyst Arjan van Veen expects the exchange's second-quarter net profit after tax to reach HK$2.66 billion, up 123 per cent year on year. He expects first-half results would also soar 79 per cent to HK$4.23 billion.

“The outlook for the stock of HKEx is more dependent on average daily turnover outlook, which is weakening,” he said.

The analyst said the strong growth trends were due to higher contributions from the London Metal Exchange, which increased its fees from January, while the LME Clear brought in new clearing fee income starting from September.

The exchange in April recorded an average daily turnover at HK$200 billion – triple its previous normal level. This took place in the midst of a rally that kicked off in earnest after mainland Chinese funds were allowed to invest in Hong Kong stocks, boosting shares to their highest levels in seven years.

This pushed the first six-month average daily turnover to HK$125.34 billion, doubling the level a year earlier, and in turn led to a doubling of the trading and fee income for the local bourse.

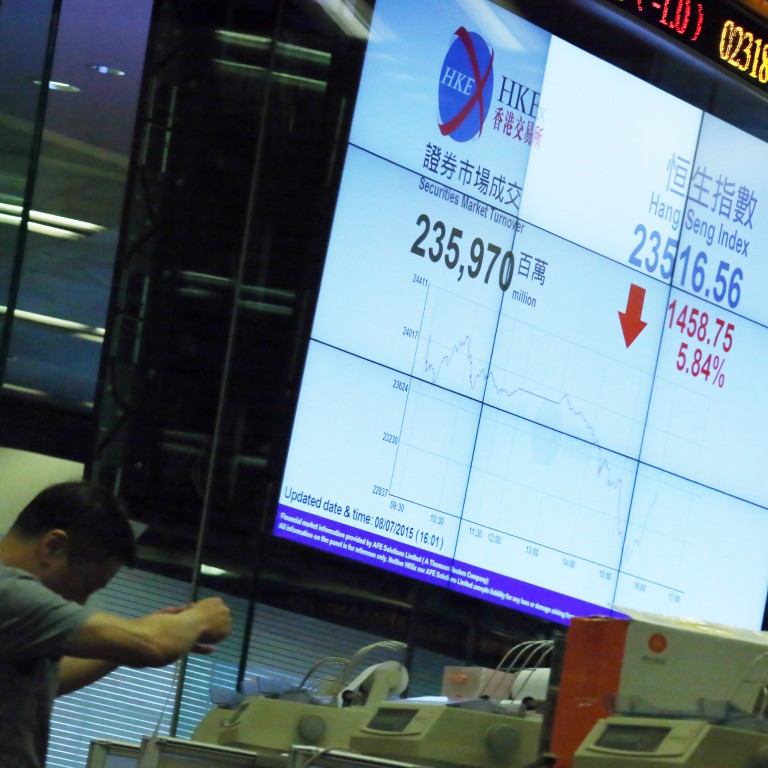

But the rout in the mainland Chinese markets since mid-June and the mixed measures Beijing has taken to prevent further falls have hurt Hong Kong's market turnover. Daily turnover went below HK$100 billion in the past two weeks, while Thursday's tally of HK$67.84 billion was down 50 per cent from the average in the first half of the year. Turnover on Friday reached HK$71.35 billion.

Jeffrey Chan Lap-tak, the chairman of the Hong Kong Securities Association, said the falling turnover was poised to hurt the profits of the exchange in the second half of the year.

“This has been reflected in the share price of HKEx, which has lost one-third from its peak,” he said.

The stock closed at HK$212.20 on Friday, against the recent closing high of HK$311.40.

Bank of American Merrill Lynch cut the target price for HKEx to HK$220 from HK$335 last week as it expects the average daily turnover to slide to HK$115 billion, down from its previous estimate of HK$150 billion.

It estimates net profit for the first half at HK$4.28 billion, up 82 per cent year on year, while second-quarter profit would soar 127 per cent.

Brett McGonegal, the chief executive of financial firm Reorient, said the first half of the year would be a strong period for HKEx but its recent performance reflected the choppy trading in the mainland Chinese market.

“The performance of the stock from March until the end of June would suggest that investors were anticipating a healthier business environment and execution as they increased their exposure to the stock. Subsequently, the stock fell some 30 per cent, mirroring the fall in the Shanghai Composite Index,” McGonegal said.

He believes the link with Shenzhen later this year should bolster HKEx.

“The Shanghai-Hong Kong stock connect was a huge driver in the volume increase HKEx has seen. The link to Shenzhen will also provide a much welcome tailwind,” he said.