Interactive | China Markets Live - Shanghai and Shenzhen shares finish strong on last-hour buying spree

Hong Kong matches China shares rally to close over 3 per cent higher

Welcome to the SCMP's live markets blog. The intense volatility of recent weeks has every chance of remaining the core underlying theme of activity. Investors are increasingly focused the broader question of how this episode might affect the wider economy as many suspect the equity bubble has yet to fully deflate. We'll bring you the key levels, trading statements, price action and other developments as they happen.

Here’s a summary of market action Monday and today, with analyst views:

- Shanghai up almost 3 per cent and Shenzhen jumps 3.8 per cent in last hour buying spree

- Hong Kong rallies to end over 3 per cent up, tracks Chinese shares

- China's forex reserves post record fall in month of August

- Investors eye resumption of trading in US after a holiday break there

- Market looks toward meeting next week by US Federal Reserve to see if they will decide on raising interest rates for first time in a decade

4:05pm: Hong Kong markets tracked mainland shares in the late afternoon with the Hang Seng Index closing 3.28 per cent higher or 675.52 points, at 21,259.04. The H-share index rose 4.13 per cent, 376.26 points, to finish at 9,479.48.

3:42pm: Goldman Sachs report said:

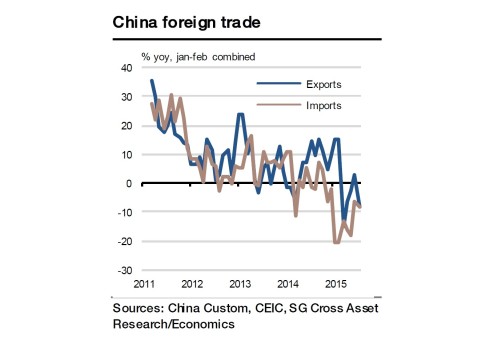

“August export data showed meaningful sequential improvement from the level in July, which likely provided some support to aggregate demand growth.

Exports by destination data showed that exports to the US contracted 1 per cent year on year vs -1.3 per cent year on year in July. Exports to Japan fell 5.9 per cent year on year in August, vs -13 per cent year on year in July, and exports to the Euro area went down 7.5 per cent year on year vs -12.3 per cent year on year in July. Exports to ASEAN contracted 4.6 per cent year on year vs +1.4 per cent year on year in July, and exports to Hong Kong declined 3.8 per cent year on year vs. -14.9 per cent year on year in July.

Import growth, on the other hand, was disappointing, reflecting weak domestic demand and the fall in upstream import prices. Data probably would have been stronger if it were not for the Tianjin explosion effects.

As Tianjin is one of the top three ports in the country, around 5 per cent of foreign trade passes through the region. Besides, foreign trade activities in other ports can be impacted temporarily as well because of heightened safety inspections in light of the Tianjin explosion. We expect any negative impacts of the explosion to dissipate going into fourth quarter as there are plenty of large ports nearby with spare capacity.

Weak exports will likely make policy makers very cautious when managing the exchange rate. The level of trade surplus was the second highest in history. Normally this would indicate appreciation pressures, but this is clearly not the case now as there is an even larger non-goods trade outflow.

While the yuan has strengthened against the USD since its trough on August 25, we believe the government will be unlikely to guide it meaningfully stronger. It is increasingly clear that the government wishes to maintain broad stability against the US dollar in the coming months, which is consistent with our exchange rate forecasts. ”

Click to enlarge the chart.

3:21pm: The Hang Seng is up 3.04 per cent, 626.72 points, at 21,210.24. The H-share index is up 4.56 per cent, 415.23 points, at 9,518.45.

3:12pm: Mainland Chinese stocks closed higher Tuesday thanks to some final hour buying.

The Shanghai Composite Index finished 2.92 per cent higher, or 90.03 points, at 3,170.45. The CSI 300 Index closed 2.57 per cent stronger, 83.53 points, at 3,334.02.

The Shenzhen Composite Index closed up 3.83 per cent, 64.21 points, at 1,741.54. The Chi Next Index rose 5.68 per cent, 107.64 points, to 2,001.16.

2:42pm: Credit Agricole head of G10 FX strategy Valentin Marinov said:

“In Asian hours risk sentiment was unstable, mainly on the back of weaker than expected trade data out of China. In particular more muted import growth is taken as an indication of slowing global growth conditions.

As such, the Japanese yen was among the strongest currencies. This is also due to slightly better than expected final second quarter GDP data, which is not increasing expectations of additional policy action by the Bank of Japan to be imminent.

The euro has been benefitting from unstable risk sentiment and a falling probability of the Fed considering higher rates next week. In the short-term additional upside cannot be excluded. However, we expect the currency to remain a sell on rallies, in particular against currencies such as the GBP.”

Click to enlarge both charts.

2:08pm: The Shanghai Composite Index trades at 3,086.15 point, up 0.19 per cent, or 5.73 points. The CSI300 index of Shanghai-Shenzhen large cap stocks trades at 3,248.83, down 0.05 per cent or 1.66 points.

2:08pm: The Shenzhen Composite Index trades at 1,674.17, down 0.19 per cent, or 3.17 points. The NASDAQ-style ChiNext Price Index gains 0.78 per cent, or 14.73 points to trade at 1,908.25.

2:03pm: The Hang Seng Index trades at 20,732.81 , up 0.73 per cent or 149.29 points. The China Enterprises Index (H-share index), which track Hong Kong listed Chinese companies, trades at 9.264.43, up by 1.77 per cent or 161.21 points.

2:03pm: Banking and insurance stocks led the gainers in afternoon trading in mainland Chinese markets. China Citic Bank soared 6.50 per cent to 6.23 yuan. China Everbright Bank climbed 3.97 per cent to 4.18 yuan. China Life Insurance jumped 3.22 per cent to 25.32 yuan, while Ping An Insurance rose 1.84 per cent to 29.41 yuan.

1:22pm: Shanghai Composite Index slides 1.571 per cent or 48.39 points to 3,032.03 at the open of afternoon trade. H-share Index trades at 3,192.93, down 1.771 per cent or 57.56 points.

1:21pm: Hang Seng Index adds 0.13 per cent or 27.75 points to 20,611.27 at the start of the afternoon session. H-share Index stands at 9,173.09, up 0.77 per cent or 69.87 points.

1:20pm: People’s Bank of China injected 150 billion yuan worth of liquidity into the system via seven day reverse repurchase agreements, the official Shanghai Securities News reports citing traders.

12:03pm: The Hang Seng Index closed the morning session up 0.04 per cent, or 9.15 points, to stand at 20,592.67, while the H-share Index added 0.74 per cent, or 67.79 points, to 9,171.01.

11:45am: The top five stocks with the largest turnover on Tuesday morning include Tencent, China Construction Bank, Industrial and Commercial Bank of China, China Mobile and Ping An.

Tencent dropped 0.71 percent to HK$125.5, with turnover at HK$814.28 million. CCB was down 0.4 per cent to HK$5.04, with HK$580.88 million turnover. ICBC was also down 0.23 per cent to HK$4.32. Its turnover reached HK$556 million. China Mobile fell 0.84 per cent to HK$88.55, and turnover at HK$481.07 million. Ping An rose 1.13 per cent to HK$35.95, and turnover was HK$452.37 million.

11:35am: Hong Kong loan provider Flying Financial Service Holdings dropped by 20.78 per cent to HK$6.1 to become the biggest loser in Hong Kong on Tuesday morning.

The company said in an exchange filing today it proposed to raise approximately HK$204.1 million before expenses by allotting and issuing 510,277,500 shares at the subscription price of HK$0.4 per offer share, on the basis of one offer share for every two shares held on the record date.

11:33am: The Shenzhen Composite ended the morning session at 1,662.17, down 0.90 per cent. The ChiNext Index shed 0.82 per cent or 15.48 points to 1,878.04 before the lunch break.

11:32am: The Shanghai Composite Index is down 1.375 per cent, or 42.37 points, to end the morning session at 3,038.05, and the CSI 300 Index stood at 3,198.34, down 1.604 per cent, or 52.15 points.

11:30am: The Hang Seng Index stood at 20,562.04, down 0.10 per cent or 21.48 points. The H-share Index climbed 0.40 per cent or 35.98 points to 9,139.20.

11:15am: Hong Kong dollar is trading Tuesday at 7.7501 against the US dollar, near upper end of the currency peg. Euro/dlr weakened by 0.05 per cent at 1.1164. Dlr/yen at 119.22, weakened by 0.05 per cent. Pound/dlr stronger by 0.08 per cent to 1.5289. Australian dollar to US dollar stronger by 0.39 per cent to 0.6951.

11:05am: The Energy sector is lifting the Hang Seng Index in the morning session. Petro China rose 1.08 per cent and was traded at HK$5.83 att 11 am. Kunlun Energy was 2.08 per cent up and traded at HK$5.4. China Shenhua grew 1.95 per cent to HK$12.58. Sinopec was also 2.53 per cent up to HK$4.87. Only CNOOC was 0.12 per cent down and traded at HK$8.67.

11:00am: Standard Chartered Bank report on yuan:

“Sentiment towards China’s growth and currency prospects has worsened materially (since August). Our new forecast profile still incorporates a mild appreciation path for the onshore yuan (CNY) next year, but onshore USD-CNY will likely remain above early-August 2015 levels even by end- 2016 (we forecast 6.35, versus 6.15 prior to the August FX adjustment).

We believe China’s latest fixing reform, to meet the IMF’s recent call for a more market driven FX regime, increases the yuan’s chance of special drawing rights (SDR) basket inclusion before end of 2015.”

Click to enlarge both charts.

10:55am: China Sevenstar, a chemical materials trader whose shares in Hong Kong surged 34 percent yesterday, jumped by another 31.37 per cent to trade at HK 67 cents by 10:48 am.

The company said in a filing last night that it was not aware of the reasons that triggered the price and volume surge, but made reference to its announcement made in late August about received approval to carry on acquisitions of the equity interests in YGD Securities (HK) Limited and Yuan Asset Management Limited.

10:45am: Daiwa Capital Markets Hong Kong executive director Jibo Ma wirtes:

“The PBOC’s move to depreciate the CNY by 3.2 per cent on 11 and 12 August saw the emerging-market sell-off spill over to developed markets. Investors’ concerns have mounted not only because of the timing and magnitude of the sell-off, but because the inter-market correlation is unprecedented in recent history.

The average 60-day correlation between the S&P 500 and major global indices now stands at 0.63 — much higher than at around the time of the global financial crisis and post-dotcom bubble.

Although the CNY accounts for only 2 per cent of global trade, its stability has been a big factor in global equity valuations in recent years. Indeed, the CNY/USD, the least volatile of the major currency pairings, in some ways served as the foundations for the US QE programme and the Europe and Japan variants.

However, that relative stability has clearly given way to a new set of dynamics, and currency and equity markets tend to be volatile during such transition periods. Global markets are in risk-off mode, with funds flowing out of equities and into bonds/money-market funds. Those still in equities are gravitating towards defensive sectors and value names.”

Click on chart below to enlarge.

10:43am: Hang Seng Bank acting chief economist Thomas Shik said:

“We forecast Mainland China consumer price inflation to reach 1.5 per cent for 2015 – up slightly from the 1.3 per cent recorded for the first seven months of the year, but far below the 3 per cent target set by the Central Government.

With modest inflationary pressures, the People’s Bank of China (PBOC) may engage in further easing of policies to help stimulate the economy. Our expectations are for the PBOC to slash the required reserve ratio (RRR) by 150 basis points and cut benchmark interest rates one to two more times before the end of the year.

In July, pork prices surged 16.7 per cent, the highest monthly increase in the annual rate since January 2012, and contributed 0.48 percentage points to the overall inflation rate of 1.6 per cent.

Some commentators have expressed concerns that rising pork prices may increase upward pressure on headline inflation down the road. Our view, however, is that the effect of pork prices should not be overstated. First, pork constitutes less than 3 per cent of the CPI basket. Second, though down by a 4.9 per cent annual rate in the first six months of the year, pork production has remained at a relatively high level overall.

Declines in world crude oil prices have clearly helped hold down inflation in many economies, including the Mainland. The price of Brent crude has been falling since the middle of 2014 and its annual pace of decline has reached about 50 per cent. As such, the Mainland’s transport and communications price inflation, accounting for 12.5 per cent of the CPI, has also fallen from around zero into negative territory.”

Click to enlarge both charts.

10:37am: Shenzhen Composite Index stands at 1,686.16, up 0.53 per cent or 8.83 points.

ChiNext rises 0.73 per cent or 13.74 points to 1,907.26.

10:34am: Shanghai Composite Index up 0.353 per cent or 10.87 points to 3,091.29. CSI300 Index down by 0.222 per cent or 7.23 points to 3,257.72.

10:33am: Hang Seng Index climbs to 20,720.68, up 0.67 per cent or 137.16 points. H-shares Index up 146.50 points or by 1.61 per cent to 9,249.72.

10:20am: Texhong Textile dropped 5.16 per cent to trade at HK$ 5.88, after the company yesterday reported an exchange loss of approximately 220 million yuan by August 31.

The company said in a filing to the exchange to warn its shareholders and potential investors that due to the reporting and operating currency of the group are denominated in Renminbi whilst most of the group’s liabilities are denominated in US dollars, the recent depreciation in RMB against US dollars since August 2015 has created loss and the loss may be enlarged if the RMB saw further depreciation.

10:16am: China’s Haitong Securities completed the 379 million euro buyout of BESI, the investment banking arm of Portugal’s Novo Banco.

Haitong said it would rename the bank Haitong Bank SA and plans to use the unit as a platform from which to access foreign markets.

“The purchase places Haitong Securities in the major financial hubs of London and New York, which will supplement its leading position in China where it has a strong presence in Shanghai and Hong Kong,” Haitong said in a statement on Monday.

Haitong is one of several mainland financial firms looking to expand abroad as China’s domestic economy slows down.

10:13am: The top gainer among the H shares goes to Chinese auto maker the Great Wall Motor, which surged 12.29 per cent and trades at HK$ 21.2 in Hong Kong by 10:05 am. Great Wall Motor yesterday reported a 17.13 per cent year-on-year growth in sales volume in August, although exports dropped 56 per cent year on year.

10:08am: Soceiete Generale analyst Michala Marcussen said:

“China is the dominant black swan. We have revised down our already below-consensus China forecast (from 6.3 per cent to 6.0 per cent in 2016) and maintain our 30 per cent probability of a hard landing over the coming year, given the still considerable downside risks. Moreover, it seems unlikely that the uncertainty on China, be it the real economy or policy, will fade anytime soon.

The recent market tumult offered a flavour of the type of market response a China hard landing might trigger. In such a scenario we would expect to see a further, and this time, sharp decline of the yuan. We defined a hard landing as 2 percentage points negative real growth shock to our baseline real GDP outlook. In 2015, that sets hard landing at 5 per cent, in 2016 at 4 per cent.

Click to enlarge chart.

“China’s financial integration into the global economy is low, making a replay of the 2008 crisis less likely. To our minds, such a scenario would bear a greater similarity to a “classic” emerging market crisis, such as the 1997 Asia crisis.

We expect to see a divergence of monetary policies. In the US, we look for gradual Fed tightening and expect the Bank of England to follow with a lag.

Both the Bank of Japan and the European Central Bank are expected to deliver further policy accommodation. In emerging markets too, we look for a range of policy reactions. Several economies are facing the classical monetary policy trilemma; not least those with high domestic inflation. The new feature in this GEO is the decoupling of US and Chinese monetary policies.”

Click to enlarge chart.

9:50am: Onshore yuan trades at 6.3671 to the dollar, weaker 0.04 per cent from previous close at 6.3644. Offshore yuan trades at 6.4847 to the dollar, off 0.06 per cent from the previous close at 6.4802.

9:43am: Commodity trading and mining giant Glencore saw its shares up 6.96 per cent when it resumed trading today, with shares rising to HK$16.16 in the first 10 minutes of trade. It had requested a halt in the trading of its shares on Monday, pending the company’s release of an announcement in relation to an update of its plans to reduce net debt. Shares of Glencore closed at HK$15.52 last Friday before its trading suspension.

9:37am: The Shenzhen Composite Index trades at 1671.56, down 0.34 per cent, or 5.78 points. The NASDAQ-style ChiNext Price Index loses 0.06 per cent, or 1.22 points to trade at 1892.30.

9:35am: Shanghai Composite Index inches down 27.28 points, or 0.886 per cent, to 3,053.14 at the preopening session. CSI300 Index slides 29.90 points, or 0.920 per cent at 3,220.59.

9:34am: The Hang Seng Index opens at 20,626.28, down 0.21 per cent or 42.76 points. The China Enterprises Index (H-share index), which track Hong Kong listed Chinese companies, opens at 28,294.40, down by 0.31 per cent or 88.33 points.

9:32am: Dragged by declining commission fees, margin lending profit, and shrinking stock trading gains, a total of 16 listed Chinese mainland based brokerages saw aggregate net profit drop by 32.5 per cent from July to 6.13 billion yuan in August, according to data from Minsheng Securities.

9:30am: SG Morning Call:

“We expect China’s export growth to have recovered from -8.3 per cent year on year in July to -3 per cent year on year in August, partly owing to a positive base effect. However, imports probably declined by 8 per cent year on year since domestic demand remained soft.

In Taiwan, CPI inflation likely rose fractionally to -0.6 per cent year on year in August from -0.7 per cent previously, as the decline in crude oil quotes probably offset part of a surge in food prices. Meanwhile, core CPI in Taiwan should have remained stable at 0.7 per cent year on year. Lastly, the second official estimate of Japan’s Q2 GDP is expected to be slightly weaker than the 1.6 per cent annualised decline initially reported. ”

Click to enlarge both charts.

9:27am: The PBOC set the yuan's mid-price at 6.3639 to the dollar, weaker by 55 basis points from the mid-price the previous day at 6.3584.

The onshore yuan closed yesterday at 6.3657. PBOC had set the yuan at a stronger level for five consecutive days.

9:15am: ING Morning Call:

"We don’t think it’s an accident that the US $93.6 billion decline in China’s foreign reserves in August, the largest-ever, roughly matched the 590 billion yuan of liquidity injections via OMOs, SLOs and MLF in the two weeks following the devaluation.

OMOs and reserve ratio requirement changes sterilize the domestic liquidity implications of swings in foreign reserves. The latest 50bp RRR cut took effect yesterday and injected a further 670 billion yuan (roughly US $105 billion).

We expect the PBOC to stabilize the USDCNY fixings in a narrow range for an extended period in hopes of reducing depreciation expectations as priced into the offshore market. We think the success of this approach hinges partly on the economic data evincing a recovering economy, one responding positively to policy stimulus.

Bottom line: We are reviewing our forecast of only one more 50bp RRR cut this year for upward revision and our yearend 6.55 USDCNY forecast for downward revision (spot 6.37, Bloomberg consensus 6.50, forward 6.50).

The Shanghai Composite fell 2.52 per cent yesterday in the first day of trading after PBOC Governor Zhou told the G20 that the stock market correction was largely behind and financial markets would be more stable.

We think he meant that the panic-selling was over. Sentiment is terrible and our baseline scenario is that the index declines to 2,000, which was support during the 2010-2014 bear market."

9:13am: The Hang Seng Index futures spot September contract adds 0.05 per cent or 11 points to 20,438 in the pre-opening session.

8:53am: Nine Shanghai listed A-share companies will resume trading today and four companies applied for voluntary suspension in the trading of their shares. The number of companies in trading suspension in Shanghai is 120 on Tuesday, representing 11.20 per cent of the total.

Fourteen Shenzhen listed A-share companies resume trading today while three companies suspended trading in its shares. The number of suspended companies in Shenzhen is 220 on Tuesday, representing 13.27 per cent of the total.

8:45am: A total of 49 mutual funds launched in China in August raised 24.059 billion yuan, the lowest monthly level on record, according to data released by mutual fund tracker Howbuy.

8:43am: Shenji Group Kunming Machine Tool said its shares will continue to be suspended from trading until September 17 due to a restructuring of major assets.

Shares of the company were suspended from trading since March 3. During the suspension, Shenyang Group intends to acquire the shareholdings of an overseas listed company by cash. The targeted company engages in information transmission, software and information technology services.

8:20am: Beijing offers tax incentives to individuals holding shares of listed companies for a longer term. Individuals who buy and hold shares of listed companies for more than one year will no longer be obliged to pay dividend yield tax, a note issued Monday by the Ministry of Finance showed.

8:18am: Chinese yuan remains the fifth most used currency in transaction payments worldwide for July, accounting for 2.34 per cent of the total global market share, the highest since the record became available, Swift data showed.

8:16am: Mainland Chinese stock exchanges plan to install bourse-wide "circuit breakers" to stop panic selling. Under the plan, the Shanghai and Shenzhen stock exchanges will halt trading for 30 minutes when the CSI300 index that tracks the 300 biggest mainland-listed firms jumps or slumps 5 per cent in intraday trading. They will stop for the day if it soars or dives by 7 per cent, the exchanges said yesterday.

7:57am: Onshore spot yuan closed at 6.3657 on Monday from the previous close at 6.3559. The offshore yuan traded at 6.4802 on Monday versus previous finish at 6.4669. The mid-price fix Monday was set by the People’s Bank of China at 6.3584.

7:54am: The one day chart of the Hong Kong market. Hang Seng Index (yellow), H-share index (purple). The percentage at the end show the differences from the opening, not the previous close. Click to enlarge.