Alex Wolf, emerging markets economist for Standard Life Investments, said in a report retail sales data in China is often overstated because sales are "tallied when suppliers ship goods to retailers, rather than when goods are actually sold to consumers".

Wolf said that is one key reason why "it is difficult to gauge the state of the consumer in China" and why retail sales data has continued to outpace personal income growth. As things stand, he said the picture in different sectors tends to be mixed.

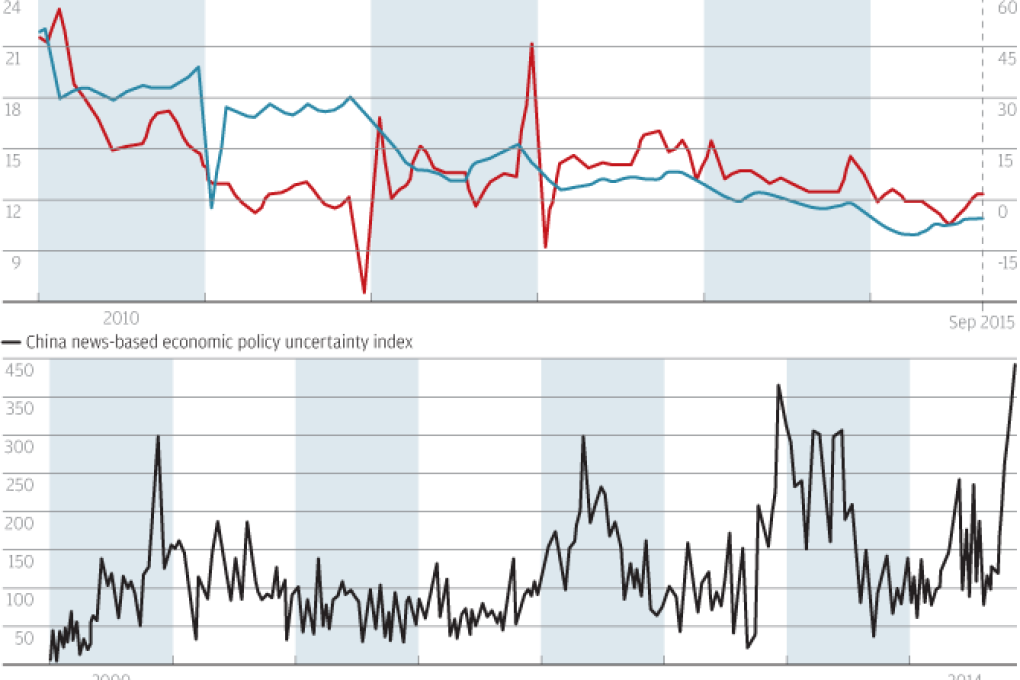

Car sales are weak (top chart), Alibaba has downgraded its forecasts and Yum sales are soft; but Apple and Nike among others are reporting strong sales growth in China.

"In an economy where profits are down, the stock market has sold off, capital outflows are accelerating and uncertainty is riding high (bottom chart), it is unlikely that consumer spending can outpace GDP growth," Wolf concluded.

The report said new sources of household income growth would be needed to continue driving consumers. "China's 'old economy' still dominates, accounting for a large share of income and employment," he said.