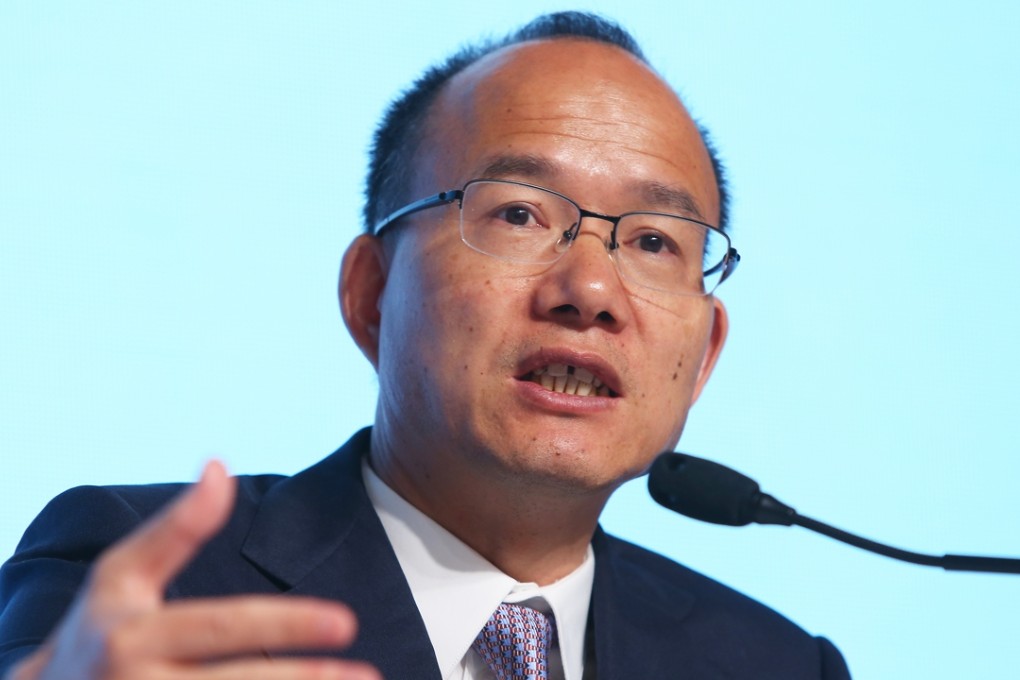

Is China’s Warren Buffett, Guo Guangchang, under arrest? Trading of stocks suspended as Fosun chairman ‘uncontactable’

Fosun Group chairman said to have gone missing amid conflicting reports over corruption crackdown claiming another bigwig

Speculation swirled over the fate of one of China’s most powerful tycoons, Fosun Group chairman Guo Guangchang, amid reports that he cannot be contacted.

Citing unidentified sources, mainland news outlet Caixin last night reported that the conglomerate could not contact Guo, dubbed China’s Warren Buffett, since noon and that it was still unknown whether he was detained on corruption charges or was assisting in probes into others.

UPDATE: Missing Fosun billionaire ‘allowed calls’, as company prepares announcement on disappearance of ‘China’s Warren Buffett’

Fosun International chief executive Liang Xinjun said in a Wechat group chat that senior executives were “handling the emergencies”, without elaborating, said a source at Fosun.

Calls made by the South China Morning Post to Fosun’s branding director Chen Bo and public affairs head Li Haifeng went unanswered. But two Fosun executives told the Post that the Caixin report was inaccurate and the company had reached Guo.“It’s a rumour,” said a Fosun executive who declined to elaborate, while another pointed out that it was unlikely that a man of Guo’s stature would be apprehended at the airport.