China’s telecoms, handset makers face challenging year ahead as smartphone subscriber growth cools

Intensifying competition will put further pressure on corporate profits, but could benefit market leaders

Competition is expected to intensify for China’s smartphone makers and telecom operators in an already saturated market, pushing companies to evolve as the country’s economy undergoes a transformation.

From falling smartphone sales to weakening corporate profits, China’s smartphone and telecommunication industry faces numerous headwinds during this economic cooling.

As the country’s economy undergoes a transition from a manufacturing-led model to one led by the service economy, analysts say it poses an opportunity for the technology industry to thrive.

“The 13th Five-Year Plan talks a lot about using technology and innovation to try to drive economic growth, and it nicely coincides with the transformation into a digital economy,” said Steve Lo, a technology, media and telecommunications managing partner at Ernst and Young.

“All in all, [the slowing economic growth] is not really a challenge, but it can be seen as an opportunity for the Chinese technology industry...The outlook is definitely positive,” Lo added.

The 13th Five-Year Plan, outlined by China’s legislature, set out a plan whereby 85 per cent of the total population would be covered by a mobile broadband network by 2020, up from the current 57 per cent.

Lo said that meant the technology industry would be seeing immense support from the government in terms of investment.

The support would help state-owned China Mobile, the world’s largest wireless network operator by subscribers, whose first quarter net profit edged up 0.5 per cent year-on-year.

China’s second-largest wireless network operator, China Unicom posted a 85 per cent year-on-year plunge in net profit to 480 million yuan (HK$573.51 million) during the first quarter.

China Unicom cited network expansion costs which soared 36.6 per cent year-on-year to 13.26 billion yuan, as reasons for the profit decline.

China Unicom, along with China Telecom, are battling China Mobile, which leads the pack in terms of the size of its fourth generation (4G) network subscriber base.

China Mobile had 377 million 4G customers at the end of march, out of a total mobile subscriber base of 834 million. In comparison, China Unicom has 59.3 million 4G subscribers, out of its total of 258.9 million.

The two smaller players are teaming up to narrow the 4G network gap with China Mobile. They plan to share costs in an effort to expand their 4G network coverage.

“Increasing competition from China Unicom and China Telecom may reduce China Mobile’s dominance in the 4G market...we expect [these rivals] to improve their network quality significantly in the next one to two years,” said Michael Meng, head of equity research at Bank of China International.

The intensified competition is arriving in an already saturated market, according to analysts.

China’s smartphone subscriber growth rate in 2015 eased to 2.5 per cent on year, from 19.7 per cent in 2014, according to International Data Corporation (IDC).

“IDC expects the smartphone growth in China to be flat in 2016, and this is largely due to the maturing market rather than the slowing economy,” said senior market analyst at IDC, Tay Xiaohan.

The flatlining growth rate largely is due to falling handset sales, as 93 per cent of its entire population or 1.28 billion people, already own at least one mobile phone, according to figures from market researcher Statista.

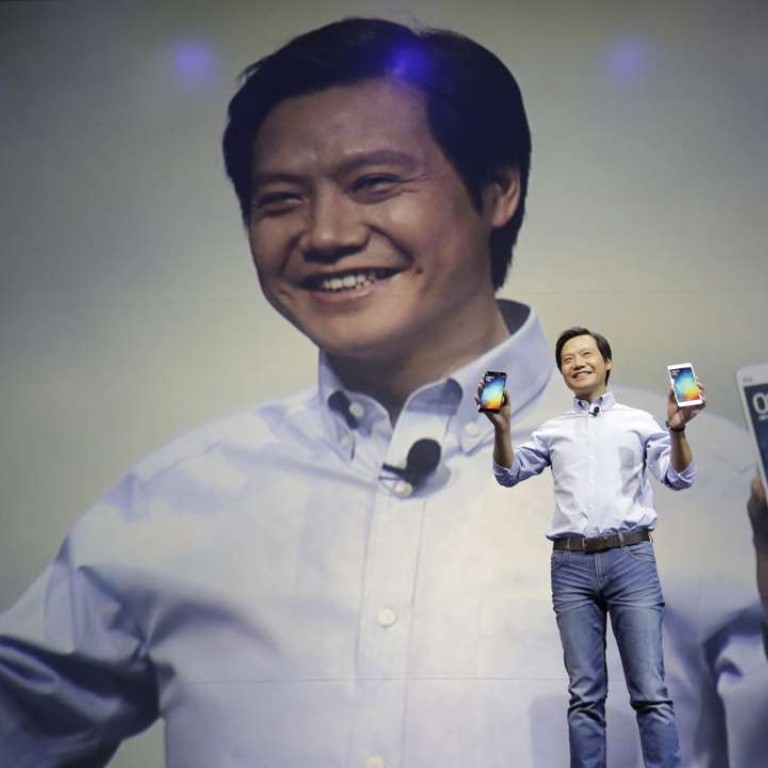

Xiaomi, which accounts for the largest smartphone handset market share in China at 15 per cent, sold 70 million smartphones in 2015, short of their forecast of 80 million, which had already been adjusted down from 100 million in 2014.

The changing landscape is pushing companies to evolve in a highly competitive environment.

“Chinese manufacturers’ recipe over the past few years of offering cheap products with similar features and design to the iPhone may not be sufficient to drive further growth in China,” said Nino Siu, an analyst at credit rating agency Moody’s.

Siu added that future demand will focus on replacement rather than first-time purchases.

“Customers in a replacement market seek upgrades for a taste of luxury, new design, special mobile features and functions,” said Siu.

Huawei, China’s No. 2 handset maker by sales, has made inroads into the market by slashing prices down to razor-thin margins. Huawei’s average handset price was US$213, according to IDC.

The smartphone vendor recently launched its latest high-end release, the P9, which retails for around HK$5,000.

It’s also the first phone that comes with two full resolution cameras on the back.

“Despite the economic headwinds, we expect major vendors such as Apple and Huawei to continue to do well in 2016 as consumers seek more sophisticated products,” said IDC’s Tay.