Chow Tai Fook to shutter up to eight stores in prime locations

Latest shock to jewellery sector, as company chief warns he expects industry to suffer a further double-digit fall in sales over the next three months

Hong Kong’s biggest jewellery chain is to shutter as many as eight of its key stores in the city, as earnings continue to be battered by dwindling mainland visitors, and lukewarm retail sentiment.

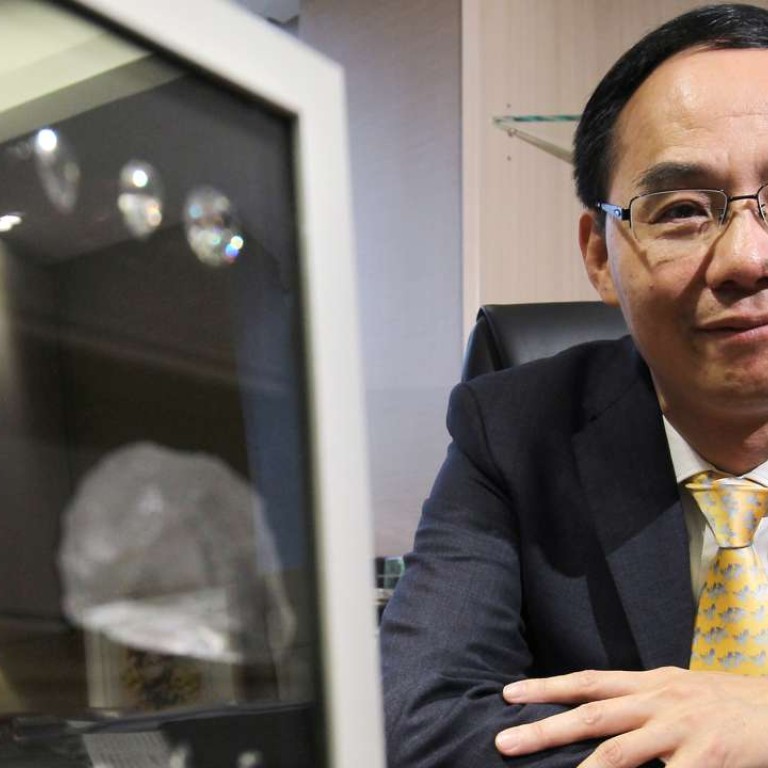

Speaking on local radio, Kent Wong Siu-kee, managing director of Chow Tai Fook Jewellery Group, warned he expected the sector to suffer a further double-digit fall in sales over the next three months.

He also said he thought Hong Kong was losing its shine as an overseas travel destination because of loosened visa policies in the other countries, and the strengthening Hong Kong dollar.

“Seven to eight of our stores, in tourist areas, are set to close in the 2017 financial year, and those that have renewed their tenancy contracts, even in these populous areas, we have seen their landlords on average slash rents by 40 to 50 per cent this year,” he said.

The low base effect created by last year’s figures, and the onset of the “peak season for weddings”, however, could help narrow Chow Tai Fook’s revenue decline in the coming half, Wong said. The company is also considered the world’s largest publicly-traded jeweller.

On Friday, Chow Tai Fook revealed its unaudited same store sales growth (SSSG) — a crucial gauge of a retailer’s revenue growth — dropped by a fifth from April to June this year in Hong Kong and Macau, while in the mainland it tumbled 17 per cent from a year earlier.

The same day, rival retail chain Chow Sang Sang Holdings International warned the stock exchange, that its net profit for the first six months of the year was expected to slump by 50 to 60 per cent from a year earlier.

Its chairman Vincent Chow Wing-sang blamed weak consumer demand and losses from gold-hedging activities had led to the anticipated plunge.

Luk Fook Holdings, another top Hong Kong jewellery chain, said earlier last week that its SSSG in Hong Kong and Macau for the same period, tanked 24 per cent year on year.

US investment bank Jefferies predicted recently that Hong Kong’s retail jewellery sector “was unlikely to rebound meaningfully, in the near term”.

Its analysts, led by Kevin Chee, wrote in a note, however, that the recent gold price rally may provide some upside potential for the stock prices of troubled home-grown jewellers.