Five things to know about Hong Kong stock market’s new closing auction session

A brief introduction to the closing auction system; how it works and why it is needed

How the closing auction system finds the closing price for each stock?

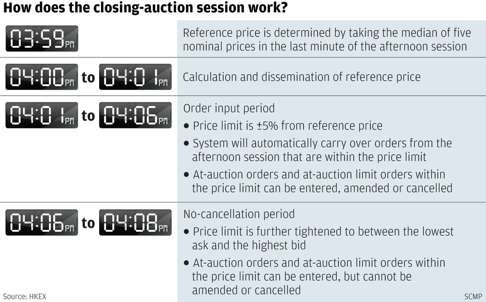

The closing auction session uses the tender method to determine market closing prices. The session continues for 8 to 10 minutes after normal market trading ends at 4pm. Unlike normal trading hours when orders are matched continuously, the auction session first lets investors input orders without matching them during the first eight minutes.

The final two minutes from 4.08pm to 4.10pm is the random closing period when investors can still input orders but are not allowed to cancel or amend them. The actual closing time is determined randomly by the trading system. The trading system will match all orders of the same closing price where the highest volume can be traded. The system would bring Hong Kong in line with major markets where they all use the system to close their market and hence could add in turnover.

Will this mean the market closing time changes?

Yes. This means stock market trading hours will be extended by 8 to 10 minutes starting Monday and will randomly close anytime between 4.08pm and 4.10pm on normal trading days compared with the fixed 4pm close previously.

If it is a half trading day, the market will close between 12.08pm and 12.10pm.

The derivative market closing time will also change to 4.30pm from 4.15pm on a normal trading day, and to 12.30pm on a half trading day. The evening futures trading session will change to 5.15pm from 5pm.

All investors can input at-auction orders during the closing auction session, via their brokers. Both retail and institutional investors can trade during the closing auction period. However, there is a price limit where the input orders cannot be 5 per cent higher or lower than the reference price.

Can investors freely input any price?

No. The closing auction trading period has a price limit. The exchange will first calculate the reference price of each stock based on the median of the five-snapshot nominal prices in the last minutes of trading between 3.59pm to 4pm. Investors can only input orders that are 5 per cent up or down from the reference price and within the lowest ask and highest bid.

What happens next?

The closing auction session will be introduced in two phases. Phase 1 starts Monday July 25 and includes all major index stocks of the Hang Seng Composite LargeCap and MidCap indices, H-shares with corresponding A-shares listed on the mainland, as well as all ETFs. No short selling is allowed at this stage.

The second phase will be launched after a six-month review of phase 1 and is expected to include all other stocks, including small caps and Real Estate Investment Trusts. Phase 2 may allow short selling.