Evergrande finds a lifeline in back door listing, thanks to soft-touch regulators

Questions went unasked about the developer’s plan to transfer its core assets into a Shenzhen-listed company

Thanks to our unquestioning regulators, Evergrande Real Estate, which has been kicking and paddling to stay afloat in a sea of debt, is finally next to a lifeboat.

Last week, the developer said it has signed a cooperative agreement with a company listed in Shenzhen that might result in the injection of its core business into the latter in return for controlling stakes.

Though this would do little to trim Evergrande’s 450 per cent gearing - the ratio of its debt to equity capital - the A-share company would provide it with a new fund raising platform.

This would have not have been possible, had the regulators been more inquisitive about certain aspects of the corporate restructuring which paved the way for the deal.

Among them was Evergrande’s disposal of its spring water, dairy, grain and oil businesses to three unheard-of Shenzhen companies on the same day and with the same three-year instalment payment.

Why and how are they paying 2.7 billion yuan for the loss-making operations? Our regulators chose to ask no questions

The businesses have been losing billions of yuan. Should they stay, the non-real estate businesses that remain in Evergrande following the spin-off cannot possibly meet the regulator’s profit requirement.

A search online found the buyers to be a car distributor, an auto shop and a trading firm with 10 million yuan in capital. Why and how are they paying 2.7 billion yuan for the loss-making operations? Our regulators chose to ask no questions.

If that disposal was not eye-catching enough for the watchdogs to respond, then Evergrande’s announcement that it will guarantee a total profit of 88.8 billion yuan for the next three years from its real estate asset to be spun off should be.

That’s twice the market consensus for the company’s profit and represents 82 per cent growth from the 2015 record that pushed the stock up by 6.7 per cent upon announcement. What material information has been kept from the market to make everyone so “wrong”? Again, there is no enquiry.

Evergrande is now only a few strokes away from the lifeboat. It should be a smooth sail because chairman Hui Ka-yan has successfully made the company too big to fail.

By June this year, the developer owed 23 mainland banks and numerous bondholders 300 billion yuan. There is little chance of mainland regulators rejecting it, should Evergrande manage to conclude a deal with the Shenzhen company.

Neither would their Hong Kong counterparts, who have never rejected any application for a spin-off in the A-share market.

There is, however, not much about the spin-off for the minority shareholders to be jubilant about.

They are not entitled to shares of the spun off entity, as required by the listing rules, because China does not allow individual foreigners to hold A shares.

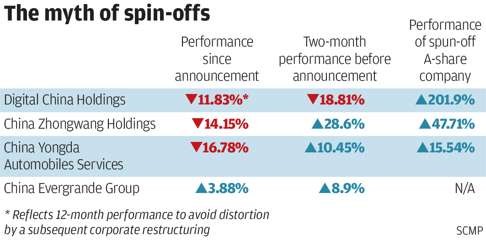

Theoretically, the higher valuation of the spun off company up north will spill over to the price of the parent company listed in Hong Kong. In reality, this is a myth.

There is not much about the spin-off for the minority shareholders to be jubilant about

All three precedent cases - aluminium producer China Zhongwang, IT company Digital China and Yongda Automobile – performed badly following a knee-jerk spike when the news broke. (see table)

Only those knowledgeable or lucky enough to have accumulated the stock before the announcement have benefited.

There will be none, as predicted by the previous cases which all followed the same script dictated by mainland regulators.

Valuation and pricing of the asset injection have to be approved and therefore controlled by mainland regulators whose primary job is to benefit Chinese investors; not those in Hong Kong. Besides, any premium will become reserve instead of profit under the accounting rules.

The share sale to strategic investors would be done by the A-share company, not Evergrande. The price will be the same as what Evergrande is getting, which does not reflect the restructuring benefit.

As always, the genuine benefactors of these strategic investors who will get to pocket the massive upside will remain anybody’s guess.

Evergrande will have to wait for 36 months before it can sell any of its stakes in the A-share company, provided that the regulators agree.

Its shareholders should be thankful though; the developer will not be drowned.