Muddy Waters to target more Hong Kong-listed firms after Huishan

Carson Block said he would seek out more Hong Kong-listed companies to target, after the prominent short seller took aim at China Huishan Dairy Holdings with a report alleging the US$4.9 billion dairy farm operator was “worth close to zero.”

Block, founder of Muddy Waters Capital, said in an interview he’s concerned prices of stocks traded in the city can be manipulated because of the low 25 per cent free-float requirement. That also makes Hong Kong a challenging market to sell short, Block said by telephone from San Francisco. Separately, Huishan said the Muddy Waters allegations are groundless and contain misrepresentations.

“I’m always a fan of shorting total frauds and Hong Kong has its share so it will always be a place for us,” Block said, commenting generally about listed companies in the city. “The trading volumes generally aren’t that good and I think there are a lot of stock manipulations in Hong Kong and that’s a function of the volumes being poor.”

I’m always a fan of shorting total frauds and Hong Kong has its share so it will always be a place for us

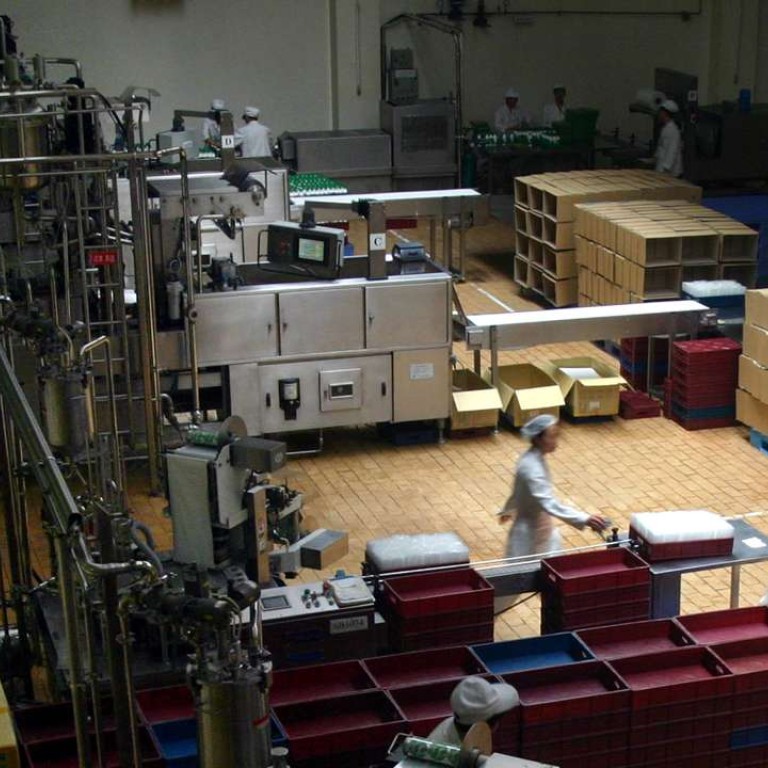

Huishan, China’s largest operator of milk farms, is the latest company to be targeted by short sellers, who borrow shares and sell them in the hope of profiting by acquiring them at a lower price later. Block said he’s hoping to level the playing field, and Muddy Waters renewed its assault on Shenyang-based Huishan Monday with a follow-up report that questioned the company’s reported revenue.

Huishan shares, which were suspended Friday after dipping on the Muddy Waters report, rose as much as 2.9 per cent as they resumed trading Monday. Shares that changed hands were more than seven times the three-month daily average. The benchmark Hang Seng Index fell 0.8 per cent. The company denied Muddy Waters’ latest allegation in an update Monday that the dairy operator’s reported revenue is also fraudulent. Huishan said the group’s consolidated revenue, prepared to international financial reporting standards, “fairly represents” its performance, according to a stock exchange statement Monday.

On Friday, Chairman and Chief Executive Officer Yang Kai lifted his controlling stake in the milk producer by buying shares through a company called Champ Harvest, raising it to about 73 per cent. That’s the same day Muddy Waters said it shorted the stock.

Huishan’s stock “seems to be rising because it’s in friendly hands due to the low free-float and the chairman owning the majority of the shares,” said Robin Yuen, an analyst at RHB OSK Securities Hong Kong. “Most of the major allegations have been rebuffed by the company, so that can allay some fears.”

Muddy Waters has made allegations “which are groundless and contains various misrepresentations, malicious and false allegations and obvious factual errors,” Huishan said in its Friday statement, which rebutted various points in last week’s report.

The company doesn’t have further comment, Chief Financial Officer Eddie So said in an e-mail Monday, before part two of the report was released.

Muddy Waters alleges Huishan recorded “fraudulent profits” tied to the company’s reports of production of alfalfa, which Muddy Waters said it purchases in large quantities from third parties. External purchases of alfalfa accounted for about 4.3 per cent to 9.2 per cent of the group’s supply of alfalfa and oats feed, according to Huishan’s statement.

Muddy Waters also alleged in its report that “a substantial amount” of Huishan’s shares are pledged to lenders and said that presents a risk to other shareholders because the borrowers could have their positions liquidated “in a disorderly fashion” if they are unable to meet a margin call by creditors.

Yang doesn’t have any unfilled margin calls or any impending margin calls that may be made against him or the companies he controls, Huishan said in Friday’s statement, which also noted that it is “not unusual for shareholders of listed issuers to pledge shares to secure financing.” The company said it would reserve its rights to take legal action, including starting litigation, in connection with the Muddy Waters report.

A buying spree by Yang as well as the company had supported the shares last year, making it a painful trade for short sellers. Bearish bets on Huishan tapered down to the lowest all year in May, down from a record last August, as short sellers exited their positions.

Other short sellers “were waiting around for the stock to break and it just never happened,” San Francisco-based Block said. “With us putting out the report, we’re hoping that that changes the equation.”

Block previously targeted Hong Kong-listed Chinese timber company Superb Summit International Group. Last December, the Securities and Futures Commission ordered the Hong Kong stock exchange to suspend all dealings in Superb Summit’s shares, which had stopped trading since November 2014. The Muddy Waters report on the company contained misleading statements and fabricated content, according to a Superb Summit statement to the exchange in January 2015.

Short interest in China Huishan Dairy was about 19 per cent of free float the day before Muddy Waters published the report. It’s the second-most shorted stock in Hong Kong after United Laboratories International Holdings, according to data compiled by IHS Markit and Bloomberg.