China’s Yingde Gases awaits offer from suitor as infighting between board continues

“When the snipe and the clam grapple, it is the fisherman who wins,” a Chinese proverb goes. In the case of Yingde Gases Group’s infighting among its board of directors and major shareholders, a “win-win” scenario is possible if the fisherman – United States-based Air Products – can offer a good enough price to buy out Yingde’s shareholders.

But amid ongoing bickering between the two camps of Yingde’s directors, and the absence of a solid offer from global rival Air Products which in December expressed a non-binding interest to take over Shanghai-based Yingde, it is far from clear how the corporate drama will end.

What’s clear is that there is no sign the rift between the opposing sides has narrowed.

At stake is the future of one of China’s largest suppliers of industrial gases such as oxygen, hydrogen and nitrogen, with some 70 facilities supplying many of the nation’s steel and chemical plants, in an industry that has seen global consolidation in recent years.

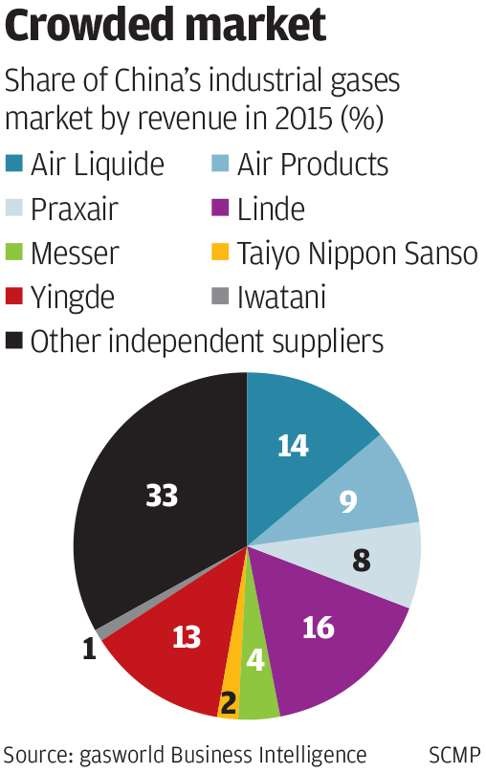

According to UK-based gasworld Business Intelligence, in 2015 Yingde had a 13 per cent share of China’s industrial gases market by revenue, compared to 16 per cent for Germany’s Linde, 14 per cent for French supplier Air Liquide and 9 per cent for Air Products.

Yingde chairman Zhao Xiangti, who in early November replaced former chairman and chief executive Sun Zhongguo, claimed to be the saviour of a debt-troubled company.

“I felt it was my responsibility to restructure the businesses and bail out Yingde,” he told the South China Morning Post in an interview in Shanghai where the firm is headquartered. “I have big support from the majority of the board directors, employees and business partners.”

Zhao was an executive director previously responsible for managing Yingde’s domestic financial planning and operations before being elevated to chairman in a November 5 board meeting.

The meeting’s validity was contested by ex-chairman Sun and former chief operating officer Trevor Strutt, who were re-designated as non-executive directors from executive directors by a vote in the meeting on grounds of their “unsatisfactory performance”.

Sun and Strutt, as major shareholders, last week sent a request to Yingde’s board to hold an extraordinary meeting to let all shareholders decide on their proposal to reinstate their executive roles and to remove the newly appointed directors.

This was followed by a request by Zhao in a stock exchange filing on Thursday to hold an extraordinary meeting for shareholders to vote on his proposal to remove Sun and Strutt as non-executive directors.

Among other reasons, Zhao cited the pair’s initiation of a 25 per cent pay cut in early 2015 for most staff earning more than 15,000 yuan a month, while enjoying bonus increases of 45 to 100 per cent themselves that year.

Sun and Strutt were “long term friends and business partners” who before founding Yingde worked for UK-based international industrial gas supplier BOC Gases, now part of rival Linde Group, according to Yingde’s listing prospectus.

Strutt told the Post the November board meeting that stripped his and Sun’s executive roles was deliberately held at short notice so they could not attend. A Yingde spokesperson denied the claim, saying the board’s legal advisor had confirmed the “legality and fairness” of the issuance of the board meeting notice.

A day after Zhao unleashed the allegations against Sun and Strutt, Yingde issued a stock exchange filing at midday Friday (January 20) saying Air Products’ possible offer was HK$5.5, which could rise to as high as HK$6 subject to satisfactory due diligence results.

Yingde shares jumped as much as 25 per cent to HK$4.9 soon after their trading resumed at 1pm Friday.

On Tuesday (January 17), Zhao called a board meeting to be held on Monday (January 23) to consider the establishment of an independent board committee and appointment of an independent financial adviser to work on considering the potential takeover offer, “with the wish” that Sun and Strutt would withdraw their challenge over validity of the November board meeting and the board’s composition, so as to “facilitate the progress of the subject matter”, the filing added.

Sun and Strutt’s relationship with Zhao dates back at least to 2001, when the pair co-founded Hunan Yingde with Torch Automobile Group and 31 of its former managers, including Zhao, who was a former supervisor of the heavy-duty truck maker.

Hunan Yingde was the principle subsidiary of Yingde Gases before it was restructured and listed.

Torch, listed in Shenzhen at the time, in 2007 merged into Hong Kong and Shenzhen-listed vehicle engine and parts maker Weichai Power.

In the joint venture, Sun and Strutt provided professional knowledge, industry expertise and funding, while Torch and its former managers contributed local knowledge, management skills and funding.

Net profit growth, however, stalled at 904 million yuan in 2014, and fell by 41 per cent in 2015 to 536 million yuan due to sharp increases in finance costs from 382 million yuan in 2013 to 968 million in 2015.

How relationships among the directors soured was unclear to outsiders, but the consequences of the rift were there for all to see. At the November 5 board meeting, He Yuanping, chief financial officer of Shenzhen-listed waste-water treatment firm Beijing OriginWater Technology, was named Yingde’s chief executive.

On the same day the Yingde board – excluding Sun and Strutt – struck a deal to sell new shares to Beijing OriginWater, which would see the latter’s stake rise from 4.2 per cent to 20.2 per cent, becoming its largest shareholder.

This drew a strong reaction from Sun and Strutt, who paid for newspaper advertisement to publish an open letter to all shareholders, claiming Zhao and OriginWater should be deemed as parties acting in concert.

Their combined stake would exceed the 30 per cent threshold, triggering a mandatory offer to buy all the shares they don’t already own, Sun and Strutt argued.

After an investigation by Hong Kong’s Securities and Futures Commission took a preliminary view that Zhao and OriginWater were acting in concert, the Yingde board – excluding Sun and Strutt – reduced the proposed share sale to OriginWater so that the combined stake with Zhao was smaller than 30 per cent.

The sale plan was dropped altogether after two board meetings on January 10, attended by Sun and Strutt, and replaced by a share placement to be conducted via an independent agent.

Still, this did not result in a truce between the feuding directors.

Zhao told the Post last week that under Sun, Yingde was on the verge of collapse and had plenty of disgruntled employees and clients.

We have been managing the company for over 15 years. We have taken the company from zero to 9 billion yuan of annual revenue. Can that be considered bad management?

“Key managers and executives lodged numerous complaints about Sun’s management style and his way of doing businesses,” Zhao said. “A one-man show is detrimental to the company’s operations and development.”

In response, Strutt told the Post: “Key employees can probably only say words that are music to the ears of Zhao, if they want to keep their jobs. The reality is very different to that painted by Zhao.”

Strutt also took issue with Zhao’s claim that Yingde was in such bad shape that it needed to be restructured and bailed out, saying that while its debt was high it is not out of line with that of the industry as a whole. Strutt added that its cash flow and operating profits have been growing “healthily” and the company had no problem servicing its debt.

According to its interim report, Yingde’s current liabilities exceeded current assets by 31 per cent as of June 30 last year, and it had a relatively high net debt-to-shareholders’ equity ratio of 121 per cent.

Still, Yingde’s chief financial officer Samantha Wong Sze-wing told analysts via a teleconference last week that the firm’s operating cash flow was estimated to have risen to 2 billion yuan in 2016, from 1.37 billion yuan in 2015 and 925 million yuan in 2014.

Its expenditure on new production and distribution facilities was expected to have fallen to around 1 billion yuan in 2016 from 1.12 billion yuan in 2015 and 2 billion in 2014, Wong said.

Fitch Ratings associate director Jenny Huang told the Post: “Given Yingde’s current cash position and unused onshore bank credit facilities, without taking into account of any share placements, at the current stage we believe its liquidity is sufficient to support its short-term debt repayment. However, further complications in its ongoing shareholder disputes may put pressure on its liquidity, and thus the ratings.”

To bolster his claim of mismanagement against Sun and Strutt, Zhao showed the Post a circular issued by Yingde’s human resources department in October last year ordering the chief and finance head of each of Yingde’s gas plant to meet certain credit line-raising quotas by November 30.

Those failing to find an additional 5 million yuan of credit line would be subject to a pay cut equal to two months salary, while those obtaining new lines exceeding 10 million yuan would be rewarded.

In his defence, Strutt said that the need for raise additional funding was created by Zhao, who was responsible for Yingde’s finance.

We should not be surprised to see Air Products approaching Yingde

“We sensed that the finance department had not been performing, [but] obviously we did not know that Zhao and the department had planned to create a situation so that an equity financing would be needed,” he said. “Therefore we tried to motivate the operational managers to [raise] some financing.”

With each plant’s facilities valued at around 200 million yuan, Strutt said it was “easy” to raise 5 million yuan each and garner some 300 million yuan of cash reserves.

Zhao also told the Post that Sun and Strutt’s management saw workers at Yingde’s customer Hebei Jingye Iron and Steel occupy Yingde’s gas supply facility nearby, to protest in 2015 against the latter’s supply suspension.

Jingye, which fell into operational difficulties, had asked Yingde to help it “cope with the short term difficulties”, but Sun and Strutt refused, resulting in Jingye’s decision to build its own facility and terminate its supply contract with Yingde, Zhao said in a filing to Hong Kong’s stock exchange.

Between 2014 and the first half of 2016, Yingde’s customers in Hebei and Jiangsu provinces took Yingde to court over disputes in relation to Yingde’s services, and these customers also planned to build their own facilities, he added.

Zhao said that since the “new management” took over, it has adopted a “brand new philosophy of technology, service and co-existence and employed a number of effective measures to amend customer relationships”.

“The unfavourable situation began to come around, and many disgruntled, confronted and pessimistic customers not only resumed cooperation with us but also requested to extend the cooperation period based on the original terms or expand the work scope,” Zhao added.

In response Strutt said: “We don’t know what inducement the current management may have offered to customers … we have strict contracts that are valid for 15 to 20 years … we can’t start giving concessions, otherwise it will set a precedence and impact on our revenues. The majority of our customers are very happy.”

“One only has to look at Yingde’s operational performance to see that we have done a good job in increasing its operational cash flows – which were up over 40 per cent from 2014 to 2015 and up over 40 per cent again from 2015 to 2016, while improving its [operating profit], despite the poor economic conditions,” Strutt said.

“We have been managing the company for over 15 years. We have taken the company from zero to 9 billion yuan of annual revenue. Can that be considered bad management?”

As Yingde’s founding shareholders continued to squabble, global rival Air Products moved in with an expression of interest to take it over.

“We should not be surprised to see Air Products approaching Yingde,” said Morgan Stanley analyst Vincent Andrews. “Air Products has US$3 billion of excess cash following the spin-off of [its electronic materials division] Versum and its asset sale to Evonik.

“Air Products management has been clear that it would look to redeploy this cash flow, with acquisitions being called out as a key priority, though only if the return parameters were in excess of its [minimum return] hurdle rate.”

While Andrews believes Air Products is also seeking opportunities to buy individual on-site industrial gases plants from owners to build a portfolio of plants, he said such an approach would take time.

“A Yingde transaction would allow for a single substantial investment in a concentrated geography, which in turn could mean greater synergies,” the Morgan Stanley analyst wrote.

Zhao said he would take an open attitude toward the takeover attempt by Air Products, or offers from any other “powerful” investor, but added that it was advisable for Yingde to nominate third-party financial advisors and professional services firms to review and handle the potential transactions.