White Collar | Hong Kong needs to widen the scope of its market indexes

The index compiler said last week it plans to add in red chips and privately owned mainland companies into its index, in addition to H-shares

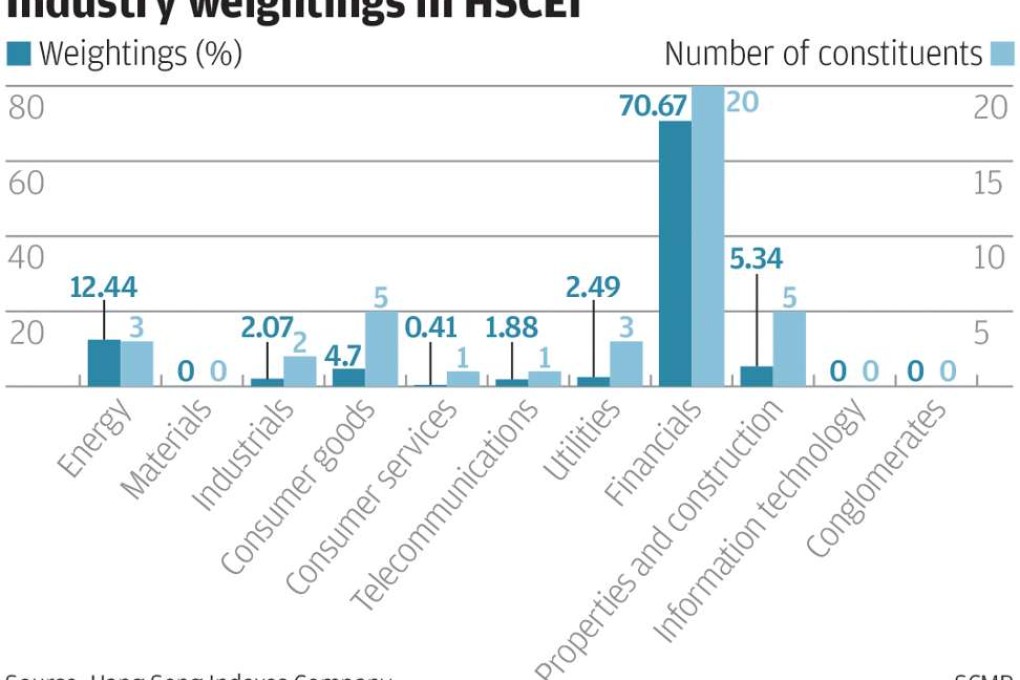

The latest move by the Hang Seng Indexes Company to revamp the composition of the Hang Seng China Enterprises Index reflects the changing nature of how more important a role Chinese companies, newly created start ups and private enterprises play in the Hong Kong economy.

On Friday, the index complier said it plans to add in red chips and privately owned mainland companies into its index, in addition to H-shares.

This is an interesting development. The Hang Seng China Enterprises Index first launched in August 1994, just a year after the first H-shares, Tsingtao Brewery, were listed in Hong Kong in July 1993.

H-shares refers to state-owned enterprises listed in Hong Kong and in 1993, this was the only format of Chinese enterprises listed in Hong Kong. This is why the index is also known as the H-share index.

Since then, the market has developed hugely and include H-shares and a of lot red chips, or companies incorporated in Hong Kong, but with a mainland Chinese parent.

By at the end of January, the market cap of the 153 red chips stood at HK$5.202 trillion, representing about 20.17 per cent of the total market value of the Hong Kong market.

That total is only slightly lower than the 219 H-shares which collectively are worth HK$5.470 trillion or 21.21 per cent, according to HKEX statistics.