New | Chinese tenants queue up to take over Central’s office space

In the first two months of 2017, JLL has been asked to secure about 150,000 sq ft of office space in Central for mainland corporates – 40pc of the total amount leased in the whole of last year

Mainland Chinese firms are showing no signs of slowing their expansion in Hong Kong, the world’s most expensive office market.

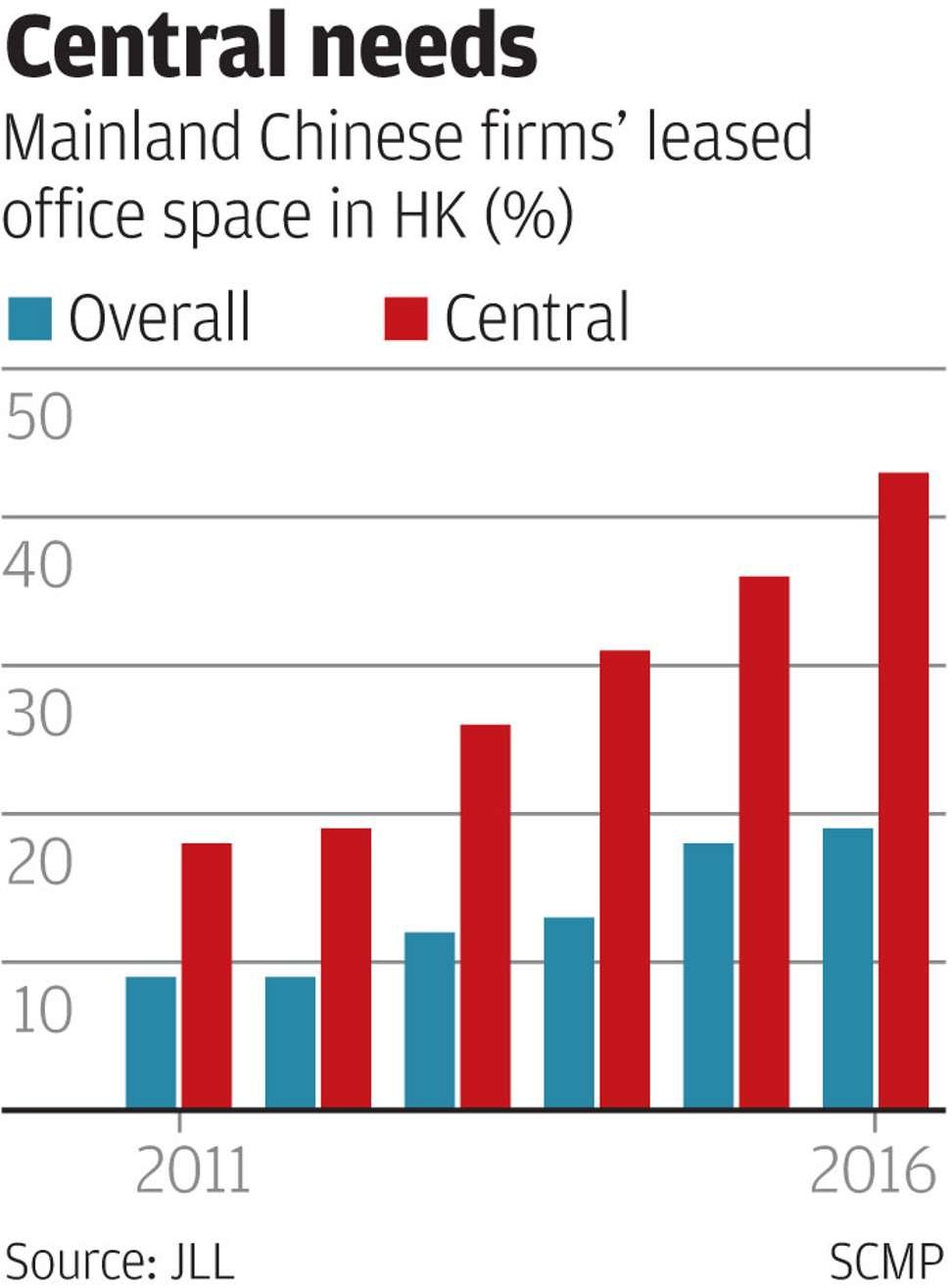

After a record year of mainland enterprises snapping up 43 per cent of all new lettings in the city’s Central financial district, industry experts say demand continues to grow as firms remain on the “waiting list” to take space in skyscrapers in the area.

“Our team continues to carry a heavy book of mainland Chinese client requirements,” said Paul Yien, regional director of Hong Kong markets at JLL.

In the first two months of 2017, the property agent has been asked to secure about 150,000 square feet of office space in Central for mainland corporates, representing 40 per cent of the total amount leased in the whole of last year.

China’s capital markets opening up and ongoing improved access between Hong Kong and the mainland, has led to increased demand for office space in Central in the past few years. The vacancy rate was as low as 1.5 per cent in the area at the end of February.

“It is worth setting up an office in Central, despite the higher rental cost,” said Oscar Liu, deputy chief executive at US-listed mainland wealth management company Noah International (Hong Kong).

The firm leased half a floor of space, about 6,600 square feet, at One Exchange Square in Central last year for expansion and upgrading of its services in the city.

Liu said having an office in Central can help the company grow its business and build its brand image because of its convenient location and the district’s unique position as a financial hub.

Like Noah, cash-rich Chinese tenants, mostly those engaged in banking, securities trading and asset management, are especially keen on landmark Grade-A buildings in Central, such as International Finance Centre (IFC), Exchange Square, AIA Central and Cheung Kong Center, for not only brand building, but also to join what have become clusters of mainland firms in high-profile, high-rise sites.

HNA Group, the acquisitive Chinese conglomerate, in October secured two more office lots in the 88-storey Two IFC, tripling its total leased space in the building to 24,000 sq ft.

Mainland firms are also said to be in talks to take up the eight floors which are currently occupied by French bank BNP Paribas in Three Exchange Square, with the latter already confirming it plans to move out when its lease expires.

And not surprisingly these aggressive expansion plans have pushed Central’s monthly rentals sky-high, with it replacing London’s West End as the world’s most expensive office market last year.

Its average monthly rents surged 9.6 per cent in 2016, and increased another 1.5 per cent in the first two months of this year, to HK$113.8 per sq ft, according to JLL.

For a space in the city’s top-notch building, such as TWO IFC, companies must pay 50 per cent higher than in London and New York, or nearly HK$200 per sq ft per month.

“The frenzy shows no sign of cooling down, sometimes there are three, four mainland clients competing for one vacant space, ” said John Siu, managing director and head of office agency at DTZ/Cushman & Wakefield.

While Chinese companies are moving in, a growing bunch of European and US companies operating in Hong Kong are being forced out because of the growing rentals.

New York-based asset manager Alliance Bernstein, for instance, will vacate its 30,000 sq ft office at One IFC at the end of 2017, moving its entire team into a similar-sized office in Quarry Bay, in the east of Hong Kong Island, where rates can be a low as half than in Central.

Legal firm Freshfields Bruckhaus Deringer is also making a similar relocation from Two Exchange Square to the One Island East office building, in Quarry Bay, in the first quarter of 2018.

“Some landlords are now trying to maintain a certain proportion of multi-national companies in their buildings by offering reasonable rents,” said Siu, a sort of risk management for owners, Yien added, by not having too much of a concentration of one nationality of tenant.

“But they still won’t be too concerned, if their multinational companies choose to leave, as mainland firms are queuing up on the waiting list.”