The Insider | Stock sales put the spotlight on Huishan Dairy chairman

Share buybacks seen in Cheung Kong, Agile Property, Human Health Holding and China SCE Property

The buying by directors rose for the sixth straight week based on filings on the Hong Kong stock exchange from March 20 to 24 with 21 companies that recorded 77 purchases worth HK$99.7 million. The number of firms and trades were sharply up from the previous week’s 15 companies and 61 purchases. The buy value, however, was down from the previous week’s acquisitions worth HK$139 million. The selling, on the other hand, rose for the second straight week with 10 companies that recorded 55 disposals worth HK$344 million. The number of disposals was not far off from the previous week’s 59 transactions while the number of companies and value were up from the previous week’s eight firms and HK$207 million.

Aside from directors, the buyback activity rose with 11 companies that posted 39 repurchases worth HK$1.616 billion based on exchange filings from March 17 to 23 (Friday to Thursday). The figures were up from the seven firms, 19 trades and HK$1.112 billion in the previous five-day period.

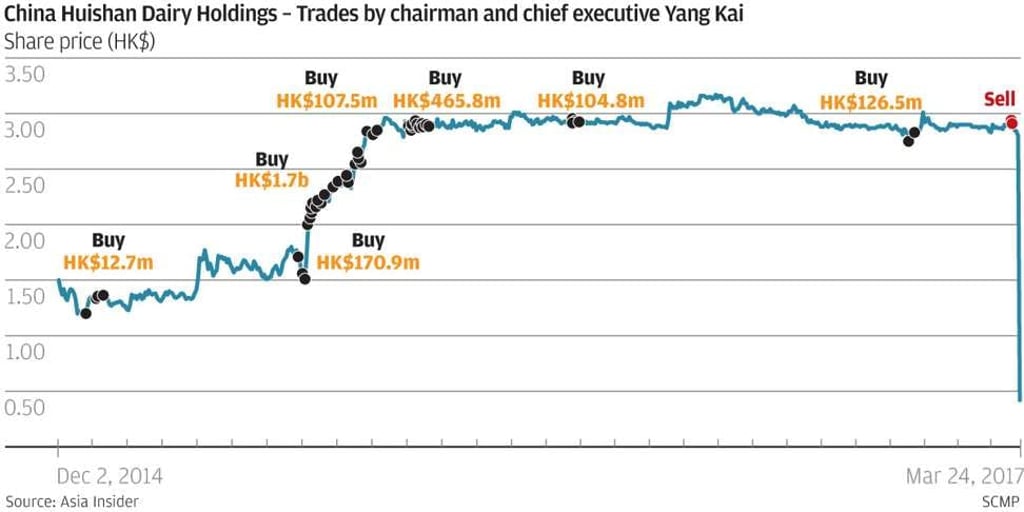

Although directors are on a six-week heavy buying streak, the top story last week was a disposal in China Huishan Dairy by chairman and chief executive officer Yang Kai. The chairman was the top seller last week in terms of value with HK$199 million worth of sales. The timing of the sale, however, is questionable as it was made a week before the company met its creditors which resulted in a major price plunge the following day.

On the positive side, Cheung Kong Property Holdings resumed buying back at higher than its previous acquisition prices. The recent buybacks are consistent with chairman Li Ka-Shing’s recent statement that he expects the Hong Kong property market to remain buoyant this year. On the directors’ side, there were rare insider buys in China SCE Property Holdings and Agile Property Holdings following the sharp gain in their share prices. Lastly, there were first-time buys in Human Health Holdings following the sharp fall in the share price.