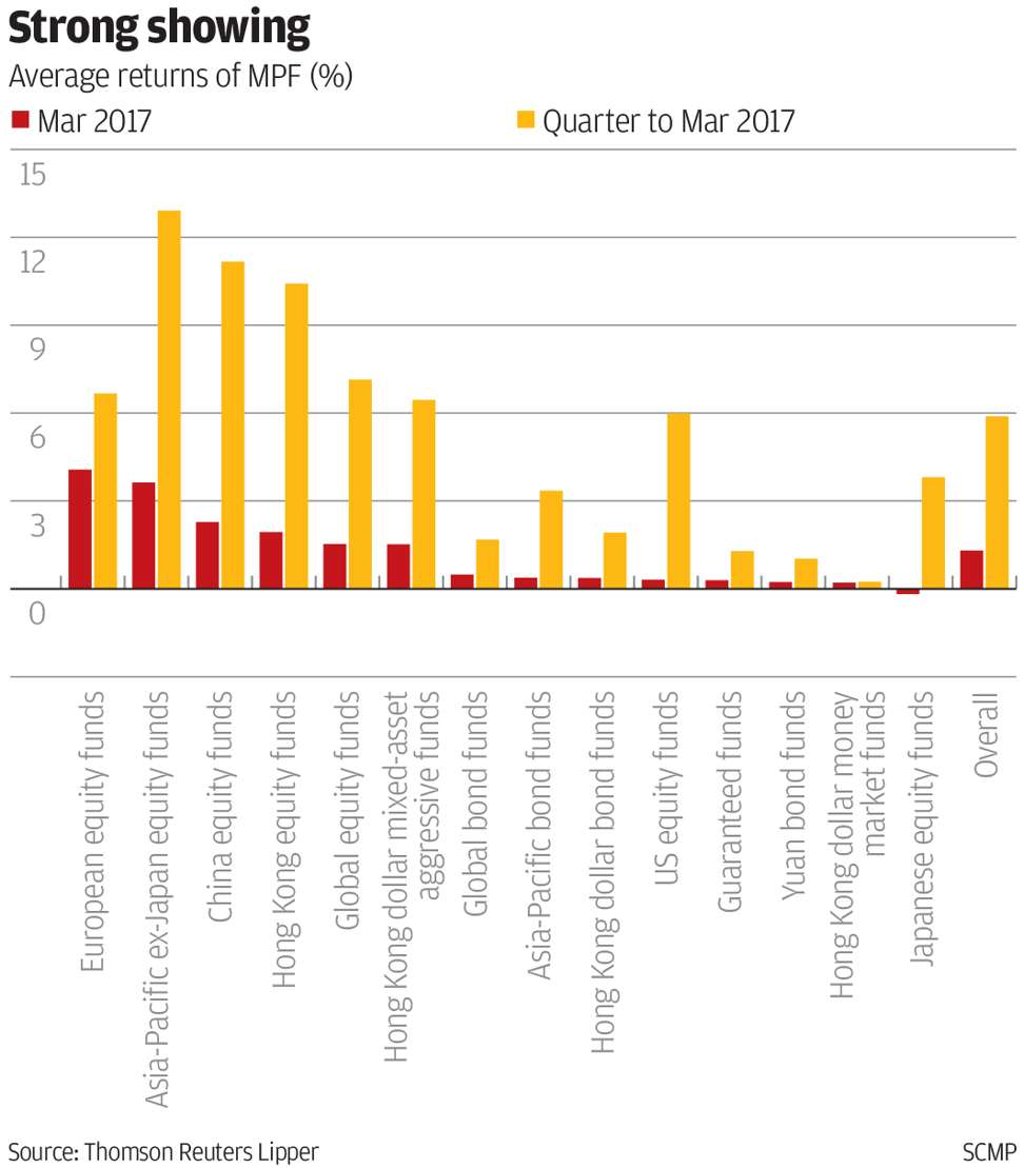

MPF achieves best first-quarter returns since 2013 at 5.89 per cent

Strong stock market performance drove growth as all 429 funds avoided losses during the first three months of 2017

Hong Kong’s Mandatory Provident Fund has delivered its best first-quarter results in four years.

The compulsory retirement pension scheme generated average gains of 5.89 per cent, thanks to a bull run in the stock markets during the quarter, according to Thomson Reuters Lipper. That was far higher than the average 1.26 per cent it returned in the whole of last year.

None of the MPF’s 429 funds suffered a loss during the first three months of the year, the data showed.

The scheme generated average profit for employees of HK$10,596 in the period, according to calculations by Convoy Financial.

But the performance was still significantly better than the deposit rates offered by local banks, which are close to zero.