China insurance regulator bars Anbang from new product issuance for three months

The high-profile overseas acquirer may face liquidity pressure if consumers ask for policy surrender collectively after regulatory crack down, analyst says

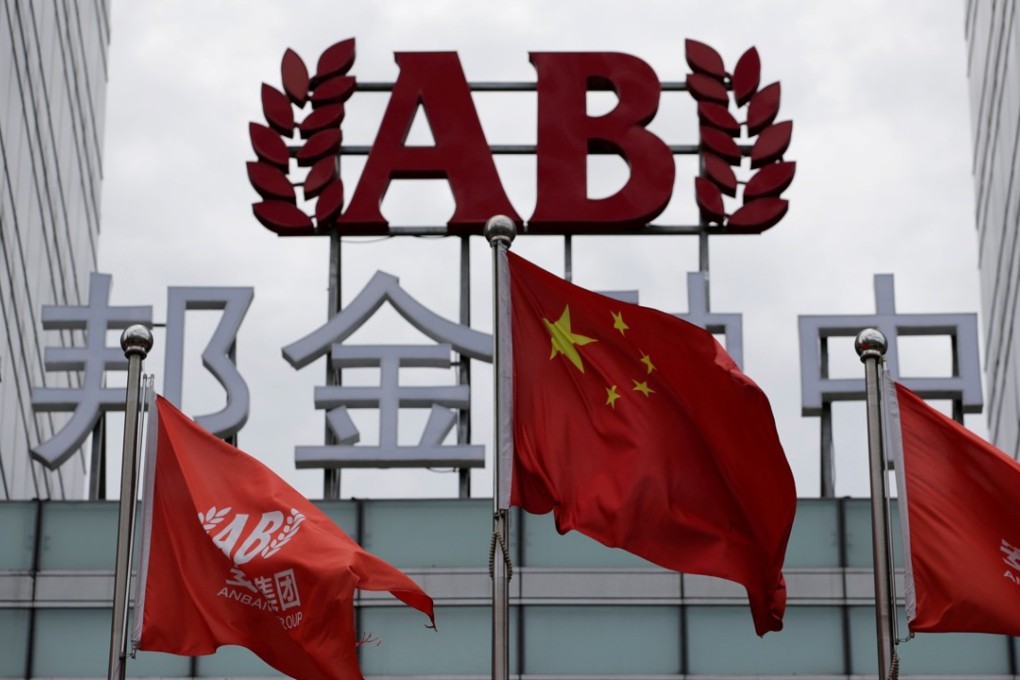

Anbang Life Insurance company, the flagship of China’s Anbang Insurance Group, the country’s highest-profile cross-border acquirer, has been punished and reprimanded by China’s insurance regulator for breaking industry rules.

Anbang Life is now banned from new product issuance for the next three months, after the China Insurance Regulatory Commission (CIRC) found one of its annuity products had violated the regulator’s rules governing short-term insurance products and disturbing market order, a statement issued by the commission said on Friday afternoon.

The regulator has also asked Anbang to “immediately” suspend the products failed to meet regulatory standards, while urged the later to “pay high attention to problems in products development, take responsibilities, and rectify its work by strictly adhere to regulatory policies and requirements”.

“The CIRC would take the next regulatory step based on the condition Anbang implement the rectification,” the statement said.

Given Anbang has been aggressive in issuing short-term insurance policies with flexible terms for surrender, the impact brought by surrender might be bigger than on its peers

Dayton Wang, a leading insurance analyst formerly with Guotai Junan International, said the “most concerning part”, is not the three-month suspension for issuance of new products, “but the potential liquidity crunch Anbang faces if consumers lose confidence in the brand and ask for surrender collectively”.