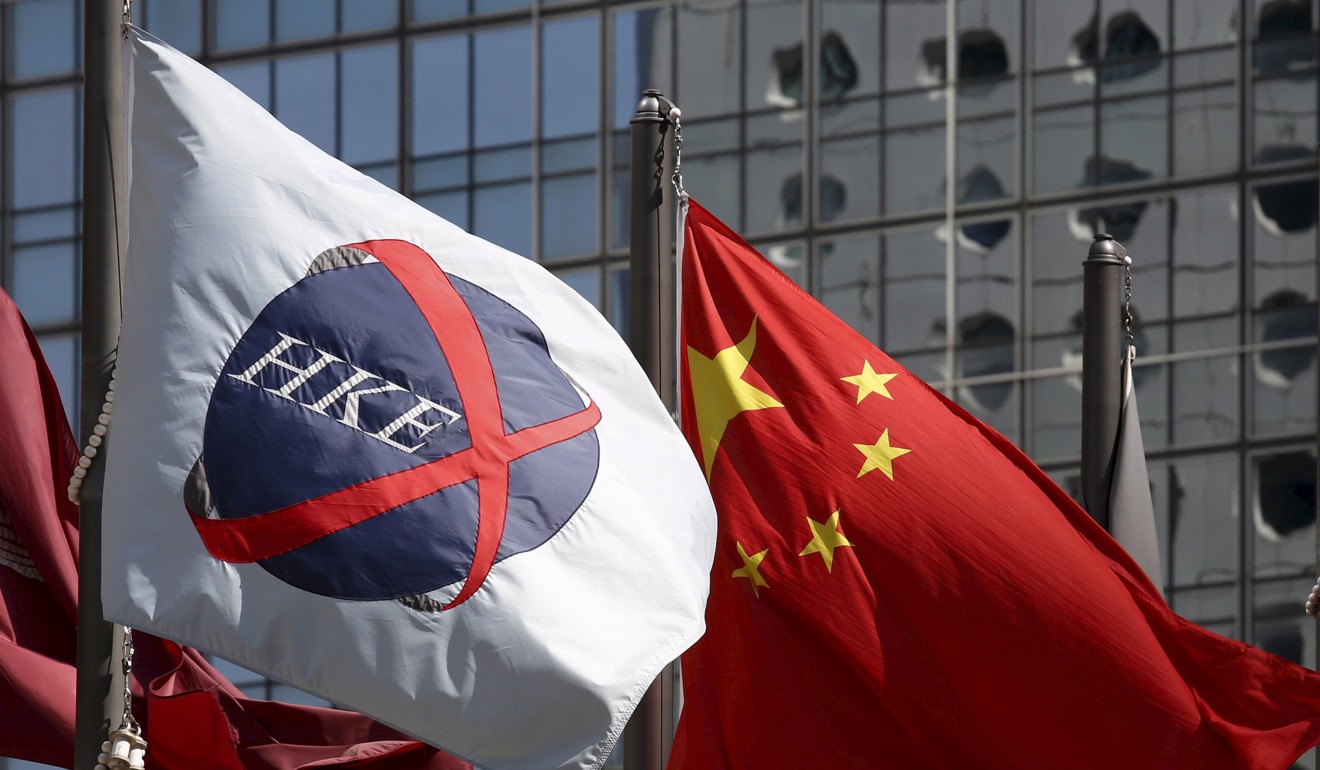

Buyout wave sparks concern over mainland control of Hong kong brokerages

As the mainland overtakes the US as the largest foreign owners of local brokerages, concerns have been voiced over aggressive selling, lax margin financing, and cutthroat competition over fees

China’s emergence as the largest foreign owners of local licensed brokers and financial firms could be fueling an environment of excessive risk taking that deserves closer examination by local regulators.

About 13 per cent of Hong Kong licensed corporations, including brokers, fund houses and financial advisory firms are owned by mainland entities, according to the Securities and Futures Commission.

Technically, this means that China is now a bigger player than the US in terms of foreign ownership of Hong Kong financial firms, according to the SFC.

On one hand, this is something we should feel proud about, as it means the city is attractive to overseas investors. The steady stream of initial public offerings and stock connect schemes underscores the vibrancy of Hong Kong as a financial hub.

Moreover, foreign investors are paying handsomely to gain a foothold in Hong Kong.

According to one industry insider, a local small broker with a securities trading license could fetch around HK$10 million, while a brokerage with a futures trading and asset management license could be worth around HK$30 million.

Buying a local brokerage, complete with staff, the necessary licenses and an active base of customers is faster than building up from scratch. It also provides a platform that complies with international standards and corporate governance, an important asset for mainland investors who have limited experience dealing internationally from within China’s domestic markets.

Among concerns, however, some brokerages under new ownership have taken a dramatic turn to more aggressive marketing practises.

On one hand, it’s understandable that the new owners want to see a return on investment, so they are pushing for higher trading volumes -- and this can mean fronting customers the margin financing to trade stocks.

However, its also disrupting some long standing industry practises.

Traditionally many Hong Kong brokers would only accept shares of blue chip companies as collateral for margin financing. Yet in some instances, mainland-backed brokers have been found to be lower quality assets as collateral.

In other instances, brokerages have lowered commission fees to lure customers, sparking cutthroat competition that does not bode well for the long term.

The SFC has taken note of this trend. In April it implemented a new “management in control” guideline which requires all licensed brokers and fund managers to compile a list of senior staff in charge of key functions. These include overall management oversight, key business lines, operational control and review, risk management, finance and accounting, information technology, compliance and anti-money laundering.

These new guidelines are in line with international standards and helps send a signal to mainland investors that, they should not only think about profiting in Hong Kong, but also the need to adhere with international standards.

Hong Kong is a free market, so we welcome mainlanders and other foreign investors participating in our brokerage industry, but let’s adhere to best industry practise.