What is the MSCI index, and why does it matter so much to China?

Global index compiler MSCI will add mainland Chinese stocks, or A-shares, to its benchmark Emerging Markets Index from next year, marking a financial milestone in the opening-up of the world’s second-largest economy

Here is what you should know about MSCI, the inclusion, and why it’s important to China.

What is MSCI?

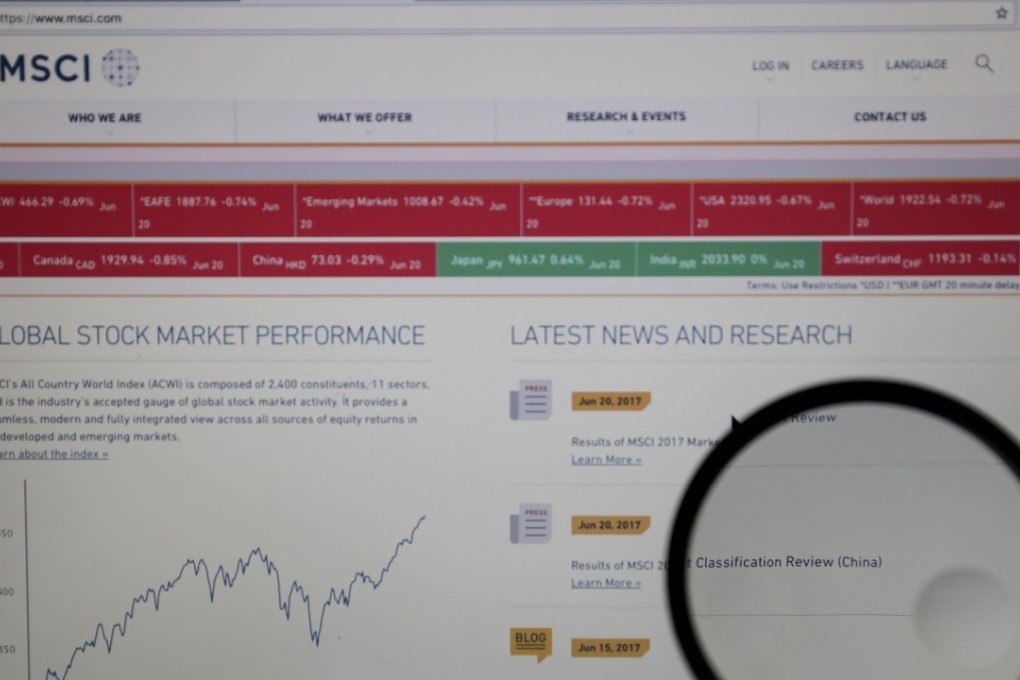

Morgan Stanley Capital International, better known as MSCI Inc, compiles influential indices tracked by global investment managers.

Its indices cover thousands of stocks in different geographic sub-areas and cap sizes. They are often used as benchmarks to measure portfolio performances.

One of the most popular MSCI indices is the MSCI Emerging Markets Index (MSCI EM Index), which tracks equity market performance in a number of developing countries and regions.

Currently, MSCI indices have over US$10 trillion active and passive assets benchmarked against them, with US$1.6 trillion tracking the MSCI EM Index alone, according to data from the index compiler.