Hong Kong looks to innovation, new markets in battle to retain status as key exhibitions hub

Hong Kong’s has lost its crown as the capital of Asia’s convention and exhibitions market, but experts say it can remain an important destination by embracing key strengths and catering to shifting consumer markets

Twenty years ago, when the iconic phase II of Hong Kong Convention and Exhibition Centre (HKCEC) hosted the handover ceremony of Hong Kong to China, the city was enjoying the title of Asia’s convention and exhibition capital.

But today Hong Kong’s status is increasingly threatened by its Asian counterparts, especially mainland Chinese cities.

The number of visitors to Hong Kong related to meetings, incentives, conferences, and events (MICE) grew by 37.6 per cent during 2008-2012, but slowed to 17.7 per cent during 2012-2016, according to the Hong Kong Tourism Board.

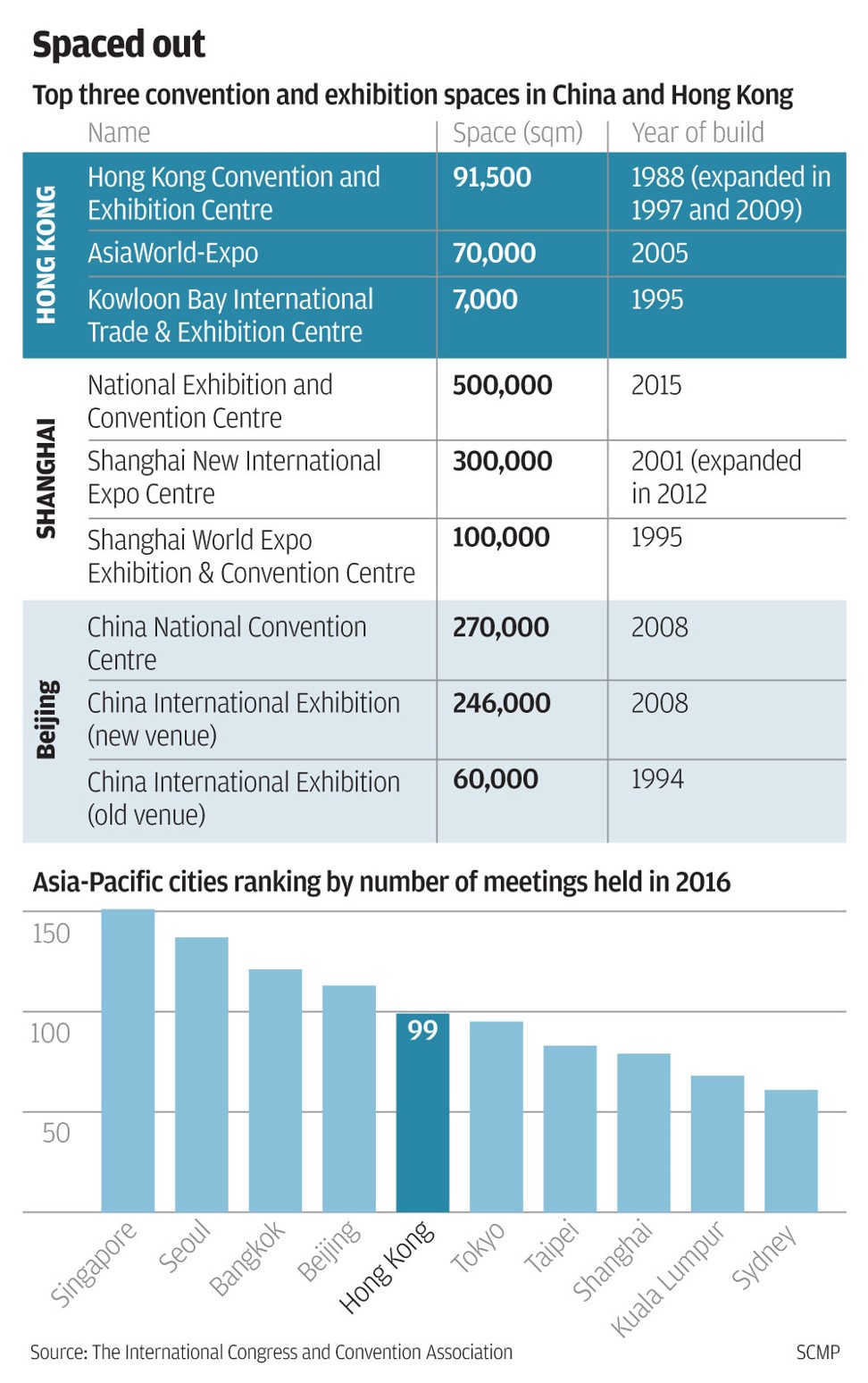

Among Asia-Pacific cities, Hong Kong last year dropped to fifth from third in 2015 by number of meetings held, data from International Congress and Convention Association (ICCA) showed.

“Hong Kong had an early start in the convention and exhibition industry. When it opened in 1988, HKCEC was the second-largest venue in Asia. The sector developed very fast at that time and the venue quickly became saturated in the 1990s,” said Monica Lee-Müller, managing director of HKCEC.

The HKCEC, Hong Kong’s biggest convention and exhibition venue, underwent two expansions in 1997 and 2009. The total leasable area stands at 91,500 square metres.

Even with AsiaWorld-Expo’s 70,000 sq m event space, Hong Kong’s two biggest venues cover an area less than one-third of Shanghai’s newly-opened National Convention and Exhibition Center.

“By size, our ranking now falls below 30 within greater China,” Lee-Müller said.

In addition to Beijing and Shanghai, other Chinese cities have joined the exhibitions arms race with an aim to become the regional leader in the trade and conventions market. Shenzhen, for example, is building a new convention and exhibition centre that will be the world’s largest when it opens in 2018.

To keep up with competitors, industry experts say Hong Kong should leverage its unique geographical advantages to attract exhibitors from all corners of the globe.

Theses include a Common Law framework, good infrastructure, and a leading role as the financial capital in Asia, said Stuart Bailey, chairman of the Hong Kong Exhibition and Convention Industry Association.

“Why we are better is partly because of ‘One Country Two Systems,’” he said. “People who want to sell to China are comfortable to do business in Hong Kong. Increasingly, Chinese businessmen who want to do business with the rest of world are using Hong Kong as a stepping board for going out.”

Lee-Müller said that Hong Kong’s geographic location, which places it within reach of half of the world’s population in just a five-hour flight radius, is another big advantage. It is also one of the most tax and visa-friendly economies, allowing visa-free entry to more than 170 countries.

However,China’s growing regional power and huge consumer market are consistently eroding Hong Kong’s edge as an exhibition hub.

Mainland cities are now home to some of the world’s most recognised events, from the Mobile World Congress to the Shanghai Auto Show. The world’s largest international shipping association Bimco has moved their annual conference from Hong Kong to Shanghai.

Still, Allen Ha Wing-on, chief executive officer of AsiaWorld-Expo, said Hong Kong’s experience and innovation should be seen as important assets.

Lee-Müller echoed the view, citing innovations that were introduced at Art Basel, including virtual reality experience and mobile champagne carts.

As it enters its 11th anniversary year, AsiaWorld-Expo – the exhibition facility near the airport – has recorded double-digit growth in business for seven consecutive years.

“We focus on experience not just at the event venue, but in collaboration with hospitality, dining and retailers,” said Ha.

Ha highlighted the Longines Masters Series, an indoor show jumping event held in Hong Kong, Paris and New York, which is renowned as one of the most prestigious equestrian events in the world.

He said for this year’s event in Hong Kong, held in February, the organising team at host venue AsiaWorld-Expo brought in a Michelin star chef, and set up unique events such as show jumping, an equestrian product exhibition, and a special area for youngsters.

Ha said he embraces the concept of “expotainment”, with the aim to combine cultural activities with business matching events.

As factories abandoned Hong Kong in favour of the mainland throughout the early 1980s and 1990s, so too did manufacturing-related exhibitions. What has arisen in their place are smaller exhibitions geared towards services and consumer consumption, including art, wine, and jewellery exhibitions. Today, with many mainland coastal cities shifting toward to the service industry, Hong Kong again finds itself at a cross roads.

Lee-Müller said Hong Kong should hold more high-end consumer-oriented fairs to tap into the fast-growing purchasing power of mainlanders. She also urged that it continue to host cutting-edge technology events, such as this year’s successful Cloud Expo.

“Hong Kong’s advantage will always be its internationalisation and global expertise, the events we do must have elements that can attract a global audience,” Ha said.

DrGu Consulting, a mainland exhibitor who attended Hong Kong’s International Travel Expo this year, said the organisers in Hong Kong were professional and experienced.

“The organisers helped us arrange a lot of business meetings with peers,” said Ariel Xia, marketing manager at DrGu.

Still, the most urgent problem facing the industry are capacity constraints. In the past three years HKCEC has turned down more than 70 exhibitions and conferences due to space limitations. AMR International estimates average unmet demand per day during peak exhibition months will reach 132,000 square metres by 2028.

“There’s a lot of scope for growth, but Hong Kong does need space for it,” said Bailey.

Others worry Hong Kong could suffer economically unless it refurbishes its appeal as a exhibition destination.

“Hong Kong has already lost many exhibitions, we need the sector to make the city have a diversified economy,” said Sin Yat-ming, a marketing professor at the Chinese University of Hong Kong.

According to the latest available figures from HKCEC, the exhibition industry contributed HK$52.9 billion (US$6.8 billion) to Hong Kong’s economy in 2014, or 2.3 per cent of GDP, up 30 per cent from 2012.