Murky waters surrounding Wu Xiaohui and Anbang

How has Wu Xiaohui, the boss of China’s once high flying overseas asset buyer Anbang Insurance Group, misbehaved?

It’s been four weeks since the group said Wu can’t perform his duty “for personal reasons”, and has delegated his authority to other executives, following mainland media reports that he was taken away for investigation.

The answer is still unknown.

But in late June analysts discovered that the main earnings of the group, premium income from Anbang life insurance policies, had plunged in May to a mere one per cent of what it earned in January.

Data from the China Insurance Regulatory Commission (CIRC) data had showed that life insurance premium income for May was 56.5 million yuan, compared with 85.3 billion yuan in January 2017, after the regulator tightened rules on risky short-term policies.

The CIRC has barred Anbang Life Insurance Co. from issuing new products for three months since early May.

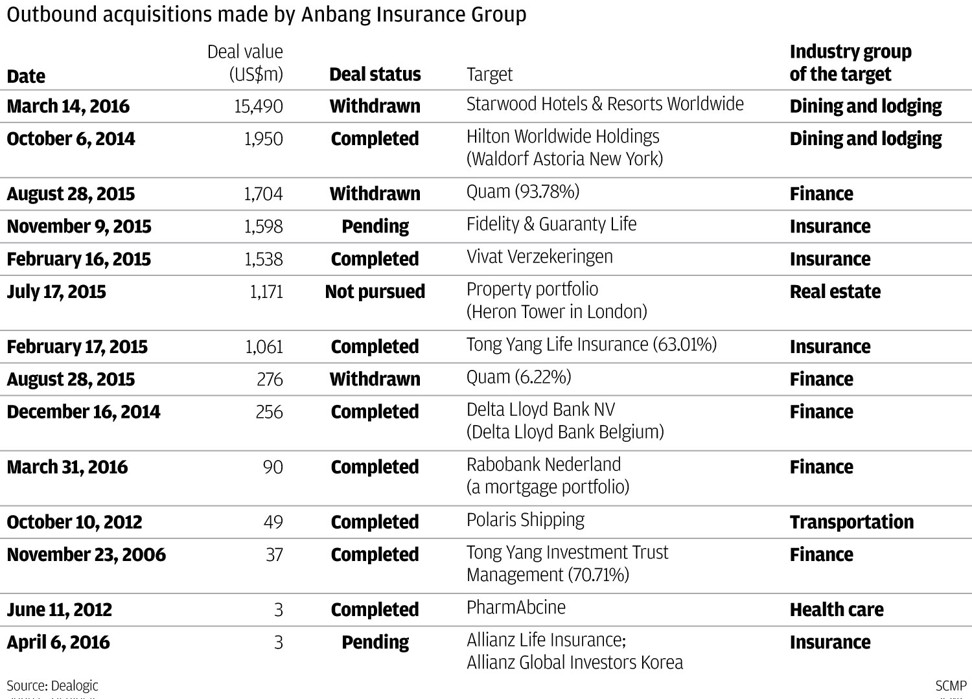

In the last few years, Wu’s Anbang has come across as one of most powerful and well-connected players on the domestic and overseas capital markets. It made global headlines in 2014, by acquiring the New York landmark Waldorf Astoria hotel for US$1.95 billion.

It was involved in a high-profile bidding war worth US$14 billion for Starwood Hotels last year, and has held talks with Jared Kushner, the son-in-law of US President Donald Trump, about buying into a skyscraper project in Manhattan.

But Wu’s empire has met more setbacks in the recent months, after two major acquisition deals, including the Kushner deal, were called off in the US due to regulatory hurdles at home and abroad.

Its flagship unit, Anbang Life Insurance which has been preparing for a public listing for years, is often mired in negativity relating to the group and the ownership structure.

Although the group remains private, it has heavily invested into dozens of mainland and Hong Kong listed companies.