Dalian Wanda Group, one of the largest conglomerates in China, hit a major bump in its overseas expansion when in March, it was forced to abandon a US$1 billion takeover of Dick Clark Productions after failing to fund the deal because of China’s capital controls.

To add insult to injury, it has become one of the few conglomerates to be probed by China’s banking regulators last month amid government’s concerns on capital outflows and being over leveraged.

While no wrongdoing was indicated, the revelation on June 22 that it was being investigated sent Wanda Film Holding, a Shenzhen-listed subsidiary of Wanda Group, tumbling 9.9 per cent in two hours. The company had to apply for a trading halt in the afternoon.

Other Wanda onshore and offshore bonds also slumped on June 22. And trading of Wand Film shares remains suspended.

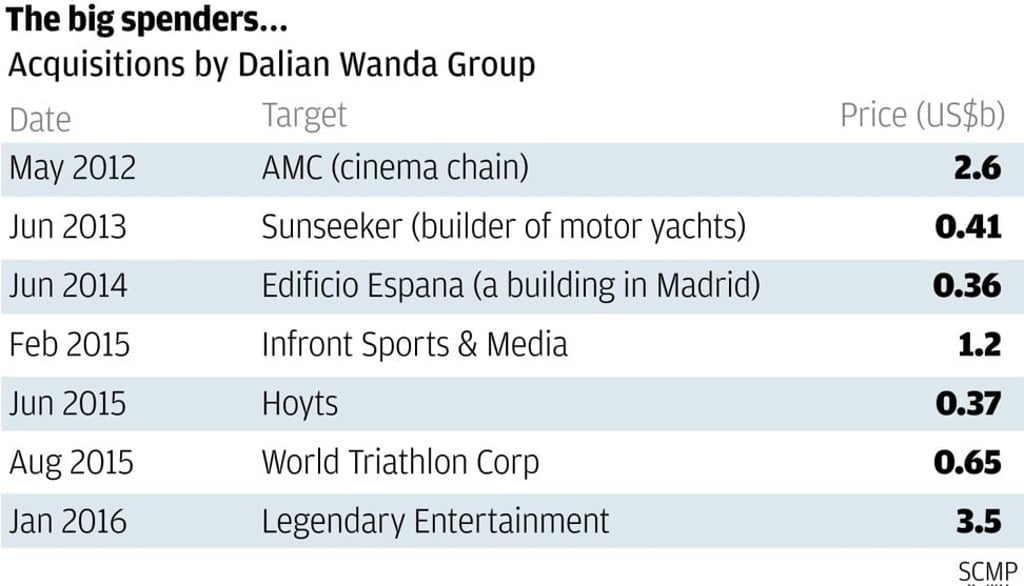

Before the current lull, group chairman Wang Jianlin’s spate of acquisitions included a 2012 takeover of AMC Theatres for US$2.6 billion, a 2015 purchase of 20 per cent stake in Atletico de Madrid football club, and the US$3.5 billion acquisition last year of the Hollywood studio Legendary Entertainment.