The Insider | Directors return to buying after lengthy absence as share prices rise

Hopefluent co-founders acquire 1.05 million shares at an average HK$2.89 each on the back of a 49 per cent rise in the stock price since January

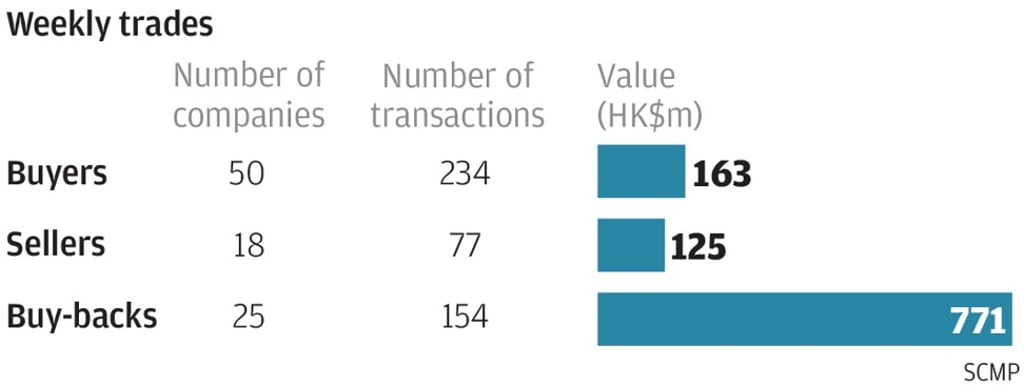

Insider activity rose last week, with 50 companies recording 234 purchases worth HK$163 million versus 18 firms with 77 disposals worth HK$125 million.

The number of companies and trades on the buying side were up from the previous week’s 47 firms and 206 purchases. The buy value, however, was down from the previous week’s acquisitions worth HK$217 million, while sales were up from the previous week’s 15 companies, 71 disposals and HK$107 million.

There was a common trading theme last week as several directors bought shares following steep gains in their companies’ share prices. Even more significant, the purchases were made following a lengthy absence by directors. Among the stocks that recorded insider buys on strong share price gains are Hopefluent Group Holdings, Chinney Investments and Forgame Holdings.

There are six significant points on the Hopefluent trades: