The Financial Reporting Council will need more firepower to police the proposed third board

The Financial Reporting Council will need a bigger budget and more staff to cope with a rising workload if the proposed third board for start-ups is approved

Ten years on, Hong Kong’s independent auditor Financial Reporting Council has been up and running well, but with only 22 staff on hand we have to ask if this tiny regulator has the right resources to get its job done.

This is a timely question, coming as Hong Kong Exchanges and Clearing is proposing to introduce a third board next year. A public consultation underway until August will help determine whether there is a need for the new board, which will operate as two separate markets catering to different size companies and different share holding structures.

A premium market, open to all investors, will host companies that can meet the eligibility requirements for a main board listing, but which have a dual-class share structure currently banned on the main exchange.

As such, if this new start-up market is introduced next year, we can expect more investigations, which raises the question whether the council’s 22 staff are sufficient to handle the workload.

In terms of manpower, the Financial Reporting Council is far behind the Securities and Futures Commission’s 860 staff, and the new Insurance Authority, which is targeted to have 300 staff.

The government-appointed members of the Financial Reporting Council, which was established in 2007, have already taken over the investigation of audit failures from the Hong Kong Institute of Certified Public Accountants. The institute still retains routine inspection duties and decides on penalties if auditors are found to have breached the rules.

This situation has seen Hong Kong lag behind other financial centres such as New York, London, and Singapore, which have independent audit regulators. In September, Hong Kong lost out to Singapore in the Corporate Governance Watch 2016 rankings, a survey of regional corporate governance standards, because it did not have an independent audit regulator.

To be fair, during the past 10 years the Financial Reporting Council has completed 50 investigations, 11 enquiries and handled 400 complaints while it has passed on 67 cases to the Hong Kong Institute of Certified Public Accountants for follow up. That’s an accomplishment for a public body with limited resources.

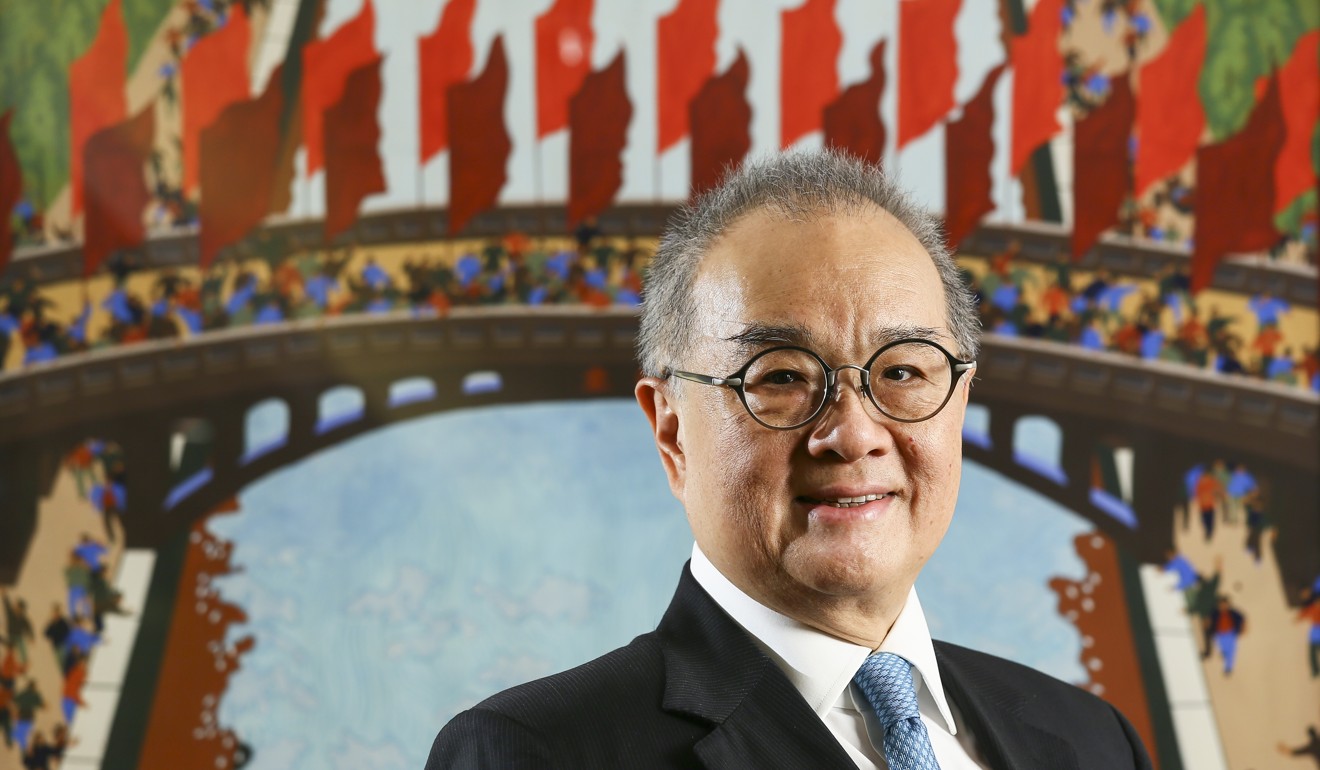

Financial Secretary Paul Chan Mo-po said the government later this year would submit a bill to the Legislative Council. If approved by Hong Kong lawmakers, the reforms would give the Financial Reporting Council the power to regulate auditors of about 2,000 Hong Kong-listed companies. The oversight of auditors for private companies would remain under the supervision of the Hong Kong Institute Certified Public Accountants.

We hope the proposed law will also allocate additional funding so that the council can bolster its headcount, giving it the investigative means to get its job done properly.