What’s blocking strategic change for banks and insurers?

‘Conflicting priorities, complex operations and limited workforce adaptability are the biggest practical barriers to organisational change programmes’

One of the biggest hurdles financial services firms face are regulatory issues. Any bank, insurer or wealth management provider doing cross-border work must be compliant in multiple jurisdictions. And that can be a headache for management teams.

Among financial services institutions, 84 per cent say regulatory requirements are impeding their ability to adequately fund major strategic changes, according to survey of nearly 800 executives in 10 countries by Accenture.

Banks, wealth managers and insurance companies are increasing their investments in regulatory compliance but they are also still focused on cost-cutting. At the same time, they recognise a need to invest in new digital technologies to cater to customer service expectations. You can break it down into four key areas:

• Efficiency and cost control

• Customer service and experience

• Risk and regulatory compliance

• Digital technology and channels

Think about it – as a customer, you probably do not care about the regulatory challenges a bank faces but you do care how long it takes to make an online payment and how much you get charged for it.

Financial services leaders need to create an inspiring vision that puts people at the heart of changes and allows them to acquire new digital skills and create space for innovation and creativity

And you would prefer to be able to transact seamlessly through whichever device you choose for as many transactions as possible. You may not care about insurance regulations but you do care about how quickly you can settle a claim and how high your premium is. And you suddenly do care about compliance if it means your digital data is at risk if a financial institution does not comply.

Such conflicting priorities, complex operations and limited workforce adaptability are the biggest practical barriers to organisational change programmes, according to two newly published reports. That provides challenges for management teams.

Most workers are open to change

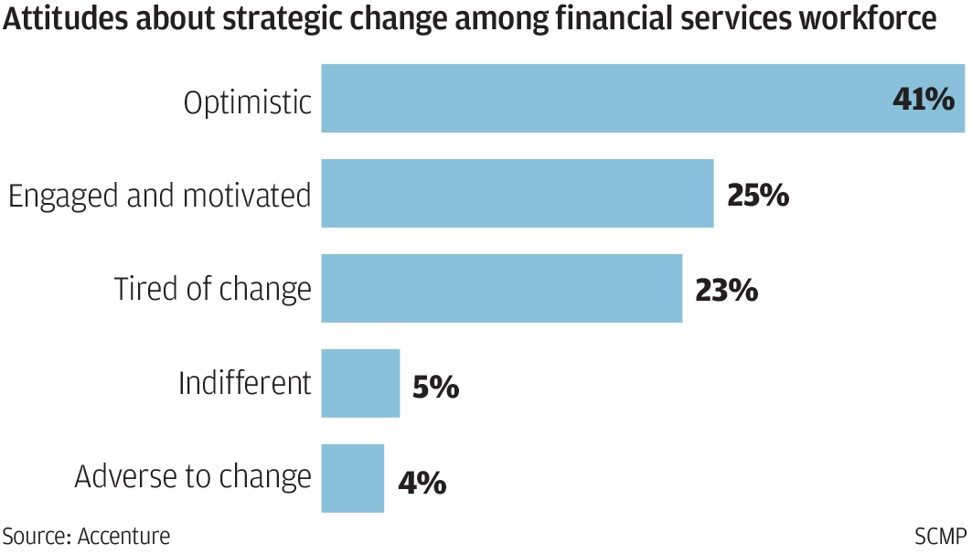

However, people can be the biggest barrier to change. After all, nearly a third of those surveyed said they were tired, indifferent or adverse to change. This means that financial services leaders need to create an inspiring vision that puts people at the heart of changes and allows them to acquire new digital skills and create space for innovation and creativity. That is what is needed to make employees want to embrace the new world order.

Financial services firms that focus on reskilling teams to deliver these services with new digital capabilities will be the ones best positioned to maintain and capture market share. Those that inspire their staff to embrace reskilling and retooling to remain adaptable will be the winners.

Companies with strong change leadership and capabilities and adaptable workforces will be hard to beat; those without them will increasingly struggle.

Andrew Woolf is Accenture’s global talent and organisation lead, financial services