Hong Kong insider trading activity down last week but some rare buybacks seen

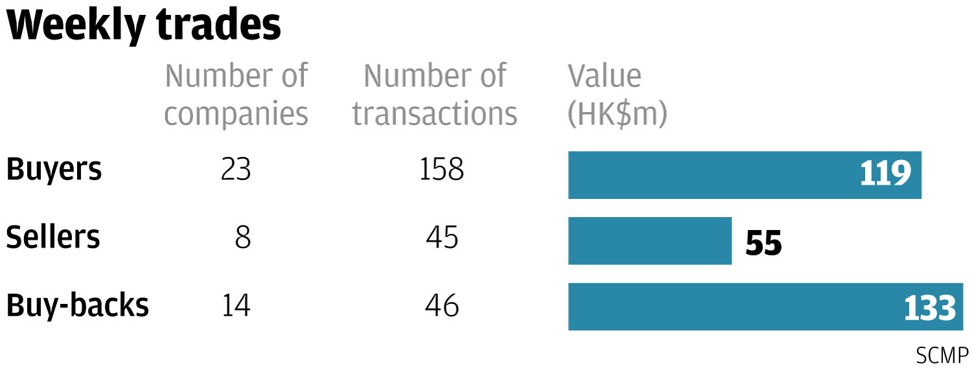

Insider activity fell based on filings on the Hong Kong stock exchange from July 24 to 28 with 23 companies that recorded 158 purchases worth HK$119 million versus eight firms with 45 disposals worth HK$55 million. The buy figures were down from the previous week’s 28 companies, 206 purchases and HK$129 million.

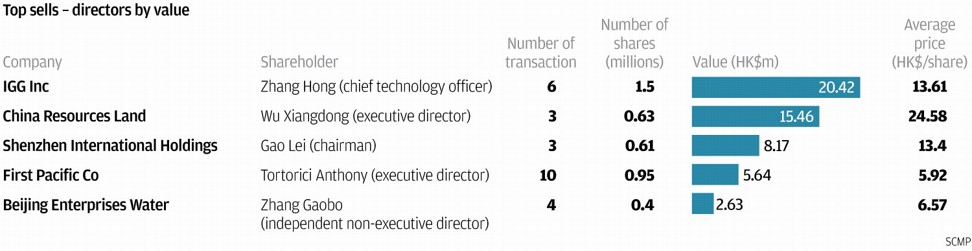

On the selling side, the number of firms and trades were down from the previous week’s 13 companies and 63 disposals. The sell value, however, was up from the previous week’s sales worth HK$41 million.

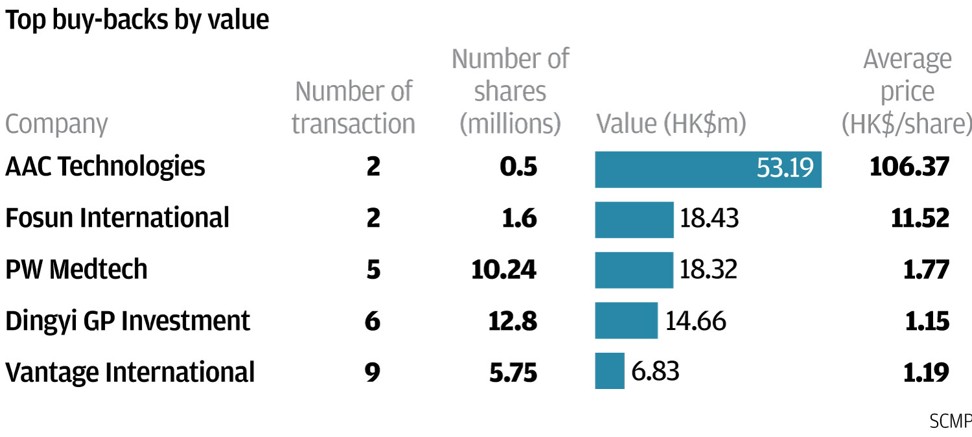

Meanwhile, the buyback activity fell for the third straight week with 14 companies that posted 46 repurchases worth HK$133 million based on filings from July 21 to 27. The figures were down from the previous 5-day period of 15 firms, 86 trades and HK$185 million.

Healthcare services provider Beijing Enterprises Medical & Health Group bought back 9.32 million shares on July 27 at HK$0.50 each. The group previously acquired 84.9 million shares from June to September 2016 at HK$0.54 to HK$0.42 each or an average of HK$0.47 each. Prior to the buybacks since 2016, the company acquired 24.94 million shares from April to December 2004 at an average of HK$1.07 each. The counter closed at HK$0.51 on Friday.

1. The group recorded its first buyback since September 2016

2. The buyback was made after the stock fell by 16 per cent from HK$0.59 in the last week of April

3. The stock rose by 30 per cent from the group’s average buyback price of HK$.45 in September last year to HK$0.59 in April this year

4. The group posted a lower annual loss from the previous year – the company announced in March an annual loss after tax of HK$97.891 million versus a loss of HK$135.12 million in the previous year.

Restaurants and bars operator and security trading firm Dingyi Group Investment bought back 12.8 million shares from July 21 to 26 at HK$1.16 to HK$1.11 each or an average of HK$1.15 each. The group previously acquired 240 million shares from January to August 2016 at HK$0.79 to HK$0.58 each or an average of HK$0.69 each.

Prior to the buybacks since 2016, the group acquired 168 million shares from July to December 2015 at HK$0.51 to HK$0.80 each or an average of HK$0.66 each and 140,000 shares in May 1998 at HK$0.38 each. The stock closed at HK$1.15 on Friday.

There are five significant points on the recent buybacks:

1. The group bought back for the first time since August 2016

2. The buybacks accounted for 36 per cent of the stock’s trading volume

3. The buybacks were made after the stock fell by as much as 24 per cent from HK$1.47 in May

4. This could be the start of another lengthy buyback spree as the group bought shares in every month from July 2015 to August 2016

5. The group posted a lower annual loss from the previous year – the company announced on June 30 a loss of HK$470.281 million versus a loss of HK$507.062 million in the previous year.

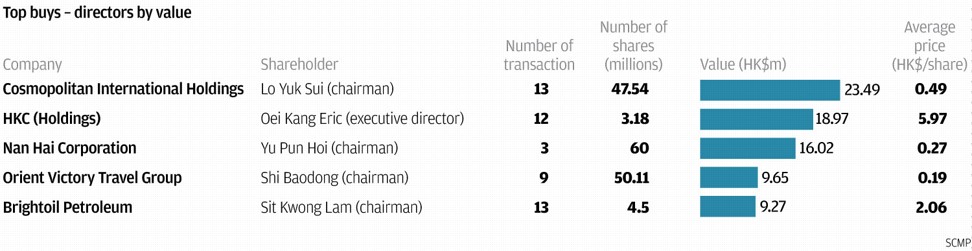

There are five significant points on the insider purchases:

1. Liu recorded his first trades since he joined the board in December 2015. He was appointed as non-executive director in December 2015 and was re-designated to executive director in June 2016

2. The purchases accounted for 24 per cent of the stock’s trading volume

3. The acquisitions were made after the stock fell by as much as 23 per cent from HK$2.88 since April. Despite the fall in the share price, the counter is still up since June 2016 from HK$1.35.

4. The purchases by Liu are the first trades by a director of the company since chairman Zhang Zhi Ping acquired 4.8 million shares in June 2004 at HK$0.50 each

5. The group announced on June 26 a 325.89 per cent gain in annual profit to HK$188.06 million

There are three significant points on the insider sales:

1. Wu Xiangdong recorded his first trade since his appointment in June 2009

2. The sale reduced his holdings by 39 per cent

3. The disposals were made after the stock rebounded by 42 per cent from HK$17.26 in December 2016. Despite the rebound in the share price, the counter is still down since May 2015 from HK$28.25

Robert Halili is managing director of Asia Insider