Update | Hong Kong listed firms must do more to meet ESG reporting standards, says BDO

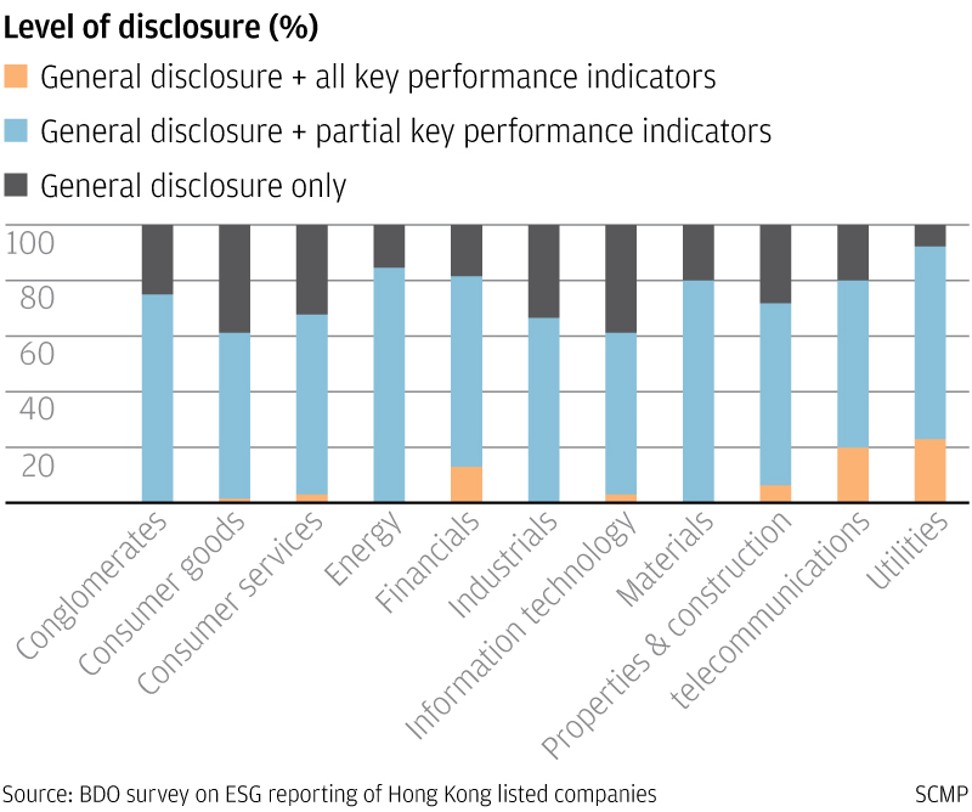

More than 60 per cent of Hong Kong listed firms which were required for the first time to report on their environment, social and governance (ESG) performance have exceeded the measures, but more needs to be done to reap benefits from ESG reporting to help firms identify and manage risks, according to a survey.

There is also much room for improvement on engaging external stakeholders to identify key ESG risks, according to BDO, the world’s fifth largest accountancy network, which conducted the survey on 300 firms whose shares are listed in the city.

“A majority of Hong Kong-listed companies went beyond meeting the minimum ESG disclosure requirements in their first ESG report after the new ESG reporting regulation was introduced, but related investment was still limited and reporting standard has room for improvement,” BDO said in a statement on Monday.

Ricky Cheng, head of risk advisory for BDO, told a press briefing that the 300 firms were chosen at random from the nearly 2,000 Hong Kong main board listed firms.

He noted requirements by the city’s bourse is less onerous than the internationally recognised Global Reporting Initiative (GRI) standards, and action is needed to raise the level of ESG reporting and quality of disclosure of Hong Kong firms to match international standards.

More than 80 per cent of the respondent firms said they do not have a comprehensive strategy, an ESG committee or dedicated personnel to deal with ESG matters. Less than half have engaged external stakeholders and conducted assessments to identify key ESG risks.

In December 2015 Hong Kong Exchanges and Clearing (HKEX), the operator of the local bourse, upgraded ESG disclosure requirements – which had been in effect since January 2013 – from “recommended and voluntary” to “comply or explain”.

It is now mandatory for listed firms to make general disclosures on their ESG policies, explain how they intend to deal with operational risks that have far-reaching implications for the environment and society at large, and whether they are in compliance with laws and regulations. The disclosures must be for financial years that begin after January 1 last year.

Lack of transparency on this front may affect stakeholders’ confidence

From January 1 this year firms will need to make further disclosures on measurable key performance indicators such as targets and achievements.

Failure to comply will require companies to explain why.

The BDO survey found that firms could do much more than the minimum reporting requirements.

While over 80 per cent of the respondent firms assessed their suppliers, less than 10 per cent provided support to enhance the suppliers’ ESG performance.

Despite more than 90 per cent of the respondent firms having anti-corruption systems in place, some 40 per cent did not voluntarily disclose whether they have concluded corruption cases within the financial year.

They are not legally allowed to disclose ongoing cases that are the subject of an investigation.

“Lack of transparency on this front may affect stakeholders’ confidence,” BDO said, adding that third party assurance on their ESG reporting can help enhance credibility.

Only 7 per cent of the respondents sought independent assurance and only 45 per cent of the assurance was for the entire report.

On the environmental front, only 30 per cent of those surveyed provided data on their green house gases emission reductions, while only 27 per cent disclosed data on occupational health and safety.

Richard Welford, chairman of CSR Asia, which helps companies create and monitor their sustainability strategies, told the South China Morning Post that leading Hong Kong-listed firms have already adopted GRI reporting standards.

“GRI is not as onerous as some believe,” he said. “If you focus on the most material indicators in GRI you can provide an accessible yet sophisticated report.

“But metrics and targets are an important part of this and this is where too many Hong Kong companies fall short of international best practice.”

Some 48 listed and unlisted Hong Kong firms and government units have adopted GRI, according to the Dutch-based non-profit organisation’s website, up from around 40 in December last year.