Wanda Hotel’s shares soar on Wang Jianlin’s plan to turn it into a hotel and theme park manager

The conglomerate plans to list its remaining subsidiary companies in domestic and overseas market in the next three years.

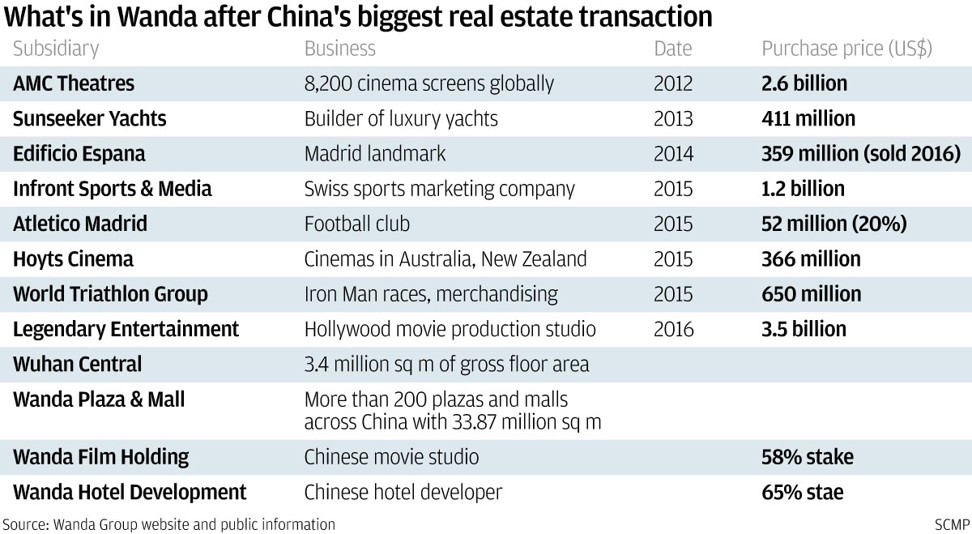

Chinese magnate Wang Jianlin, fresh from an epic sale of 77 of his hotels and 13 theme parks to pursue what he calls an “asset light” business model, has injected the management and operations of his erstwhile assets into one of his Hong Kong affiliates, as he rearranges his corporate portfolio after closing China’s largest real estate disposal.

The reshuffling turns Wanda Hotel Development into a professional manager and operator of theme parks and hotels. Its shares surged after the announcement, soaring by as much as 40.5 per cent to as much as HK$1.63 in Hong Kong, the highest intraday level in more than two years. Shares changed hands recently at HK$1.44.

It’s come under the scrutiny of Chinese authorities in recent months, over concerns of its borrowings and the exposure of China’s banks to its debt.

Last month, Wang sold the ownership of his 77 hotels and 13 theme parks to Sunac China and Guangzhou R&F Properties Co. for a combined US$9.4 billion to raise funds to repay loans, in the largest sale of property assets in mainland China’s corporate history.

After the assets disposal, Wanda Hotel Development will still be responsible for the design, construction and operation management of the travel-related elements of its Wanda City real estate projects, for which it will receive 13 billion yuan in royalty feeds from Sunac China over the next two decades. Sunac will maintain the residential-related elements of the projects.

The conglomerate also said it plan to list its remaining subsidiary companies, including financial services, internet technology and sports companies , in domestic and overseas market in the next three years.

The Hong Kong company was delisted last September for a US$4.4 billion buyout price, pending Wang’s promise to shareholders to re-list by August 31 next year the company on a stock exchange in mainland China, where companies on average trade at double the price-earnings ratio as their peers in Hong Kong.