Global tech IPOs surge three times, but Hong Kong is out of the top 10

Even though funds raised from tech IPOs have jumped 30 times in Hong Kong, the city still lags rivals New York, Shenzhen and Singapore, according to Thomson Reuters data

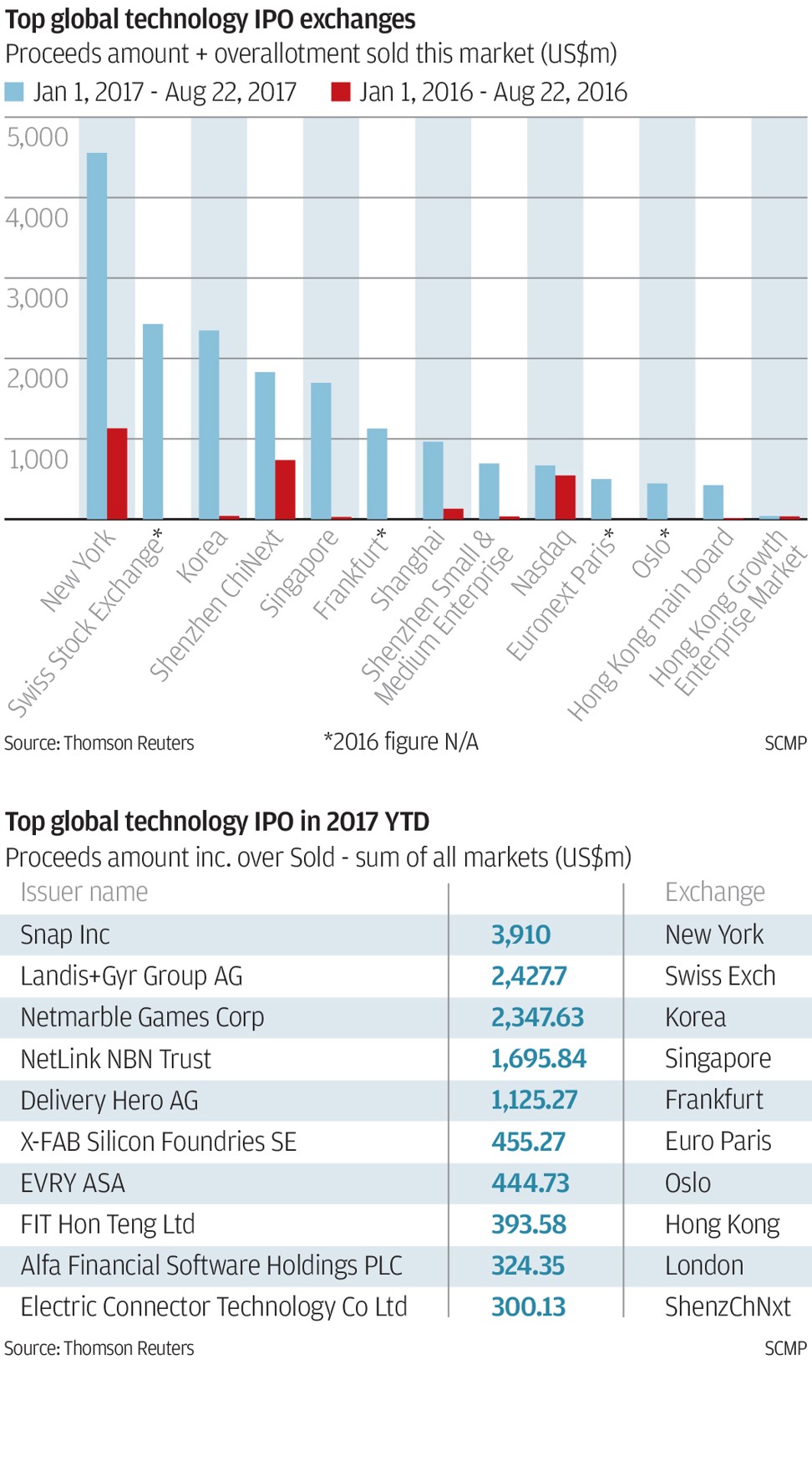

Hong Kong has failed to secure a spot in the top 10 league table for funds raised from IPOs of technology companies worldwide, which surged three times to US$18.87 billion in the first eight months of the year.

According to Thomson Reuters data, Hong Kong’s main board only ranked at the world’s 12th largest market in terms of IPO funds raised by technology companies, while the second board Growth Enterprise Market ranked 19th.

This marks a contrast to the ranking for the world’s largest IPO market, where Hong Kong’s main board is placed fourth as its strength lies in drawing financial firms to list, but not technology companies.

Yet, Hong Kong has seen improvement this year. So far, three technology firm IPOs have raised a combined US$424.1 million this year, which is 30 times higher than the same period last year when one firm raised US$14.8 million.

The increase is largely attributed to the IPO of FIT Hon Teng, a subsidiary of the world’s largest electronics contract manufacturer and maker of connectors for Apple’s iPhones that raised US$393.58 million in June. It was also the world’s eighth largest technology firm IPO this year.

The Swiss Stock Exchange ranked second and South Korea ranked third, while Shenzhen ChiNext ranked fourth, and Singapore was fifth.

“Hong Kong needs to launch the third board as soon as possible to catch up with other markets,” said Christopher Cheung Wah-fung, a lawmaker for the city’s financial services sector.

Hong Kong needs to launch the third board as soon as possible to catch up with other markets

“It has been a worldwide trend that there are more and more new economy and technology companies seeking for listings. They are the future driving force of the worldwide economy. If our market could not capture these companies to list, we would lag behind,” Cheung said.

HKEX has just completed a consultation to set up a third board to attract more technology companies to list, but it would still need a second round of consultation on the detailed rules. HKEX chief executive Charles Li Xiaojia wants the new board to be launched in the first half of 2018, but he will have to convince all stakeholders to accept the proposals that have received very mixed reactions during the two-month consultation.

The new board will have different regulations from the existing ones for the main board and the Growth Enterprise Market.

Hong Kong currently bans dual class shares which are allowed in the US. Dual class shareholding allows founders or key management of the companies to own shares with more voting rights than the others, which large technology firms like Facebook or Google preferred.

Snap, the largest technology IPO this year which raised US$3.9 billion on the New York Stock Exchange in March, also has a dual class share structure.

The chairman of the Chamber of Hong Kong Listed Companies, Francis Leung Pak-to on Monday showed support for a new market for the listing of dual class share companies with a market cap of HK$8 billion (US$1 billion), but opposed to a start-up board market as he said the risks of failures of these newly set up companies were too high.