China Molybdenum on the lookout for cheap mines overseas after fund raising, commodity cycle pick up

China Molybdenum, whose shares have tripled in the past 14 months during which it sealed three deals to buy US$5.3 billion worth of mining assets overseas at the trough of the commodities market, is eyeing more acquisition opportunities.

The company, based in Luoyang, Henan province, has pursued a strategy of buying up minerals that will undergo a tightening of the supply demand balance in the long term.

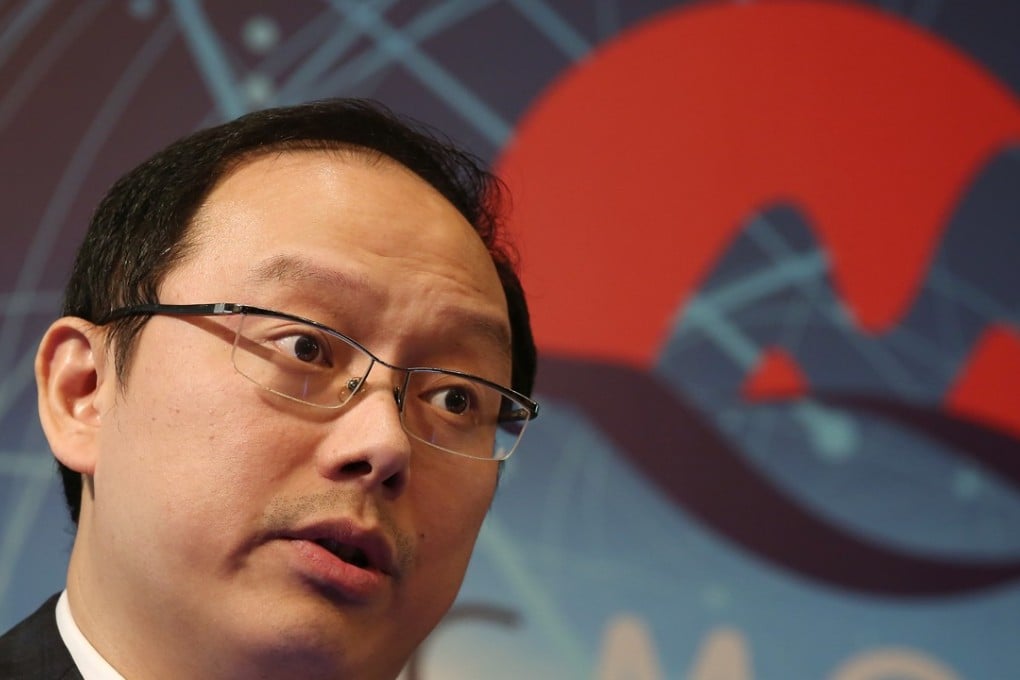

“Cobalt is a good example ... we will keep monitoring market trends,” Li Chaochun, China Molybdenum chairman told investors and reporters on Wednesday. “However, we must stick to our internal guideline that the target firm must rank among the bottom half on the production cost curve, which means even if half of global demand disappears [and the metal price fell by half], it will survive.

“Of course, the asset in question must also have a long mine life.”

China Molybdenum’s Hong Kong shares were 1.2 per cent higher in mid-morning trade on Thursday, adding to a 4.1 per cent gain on Wednesday.

China Molybdenum recently completed an 18 billion yuan (US$2.73 billion) private share placement, which resulted in a 49.4 per cent stake in the company’s shares split between private equity firm Cathay Fortune and state-owned Luoyang Mining Group.