Hong Kong director and buy-back activity slows after two week surge

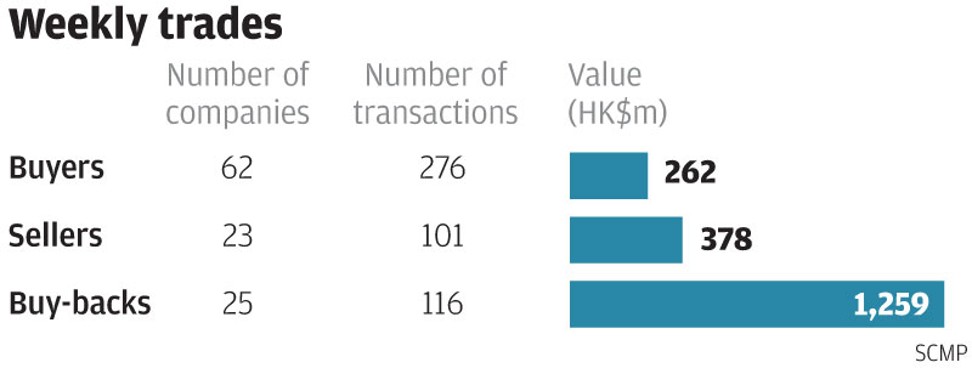

The director and buy-back activity slowed after surging for two straight weeks based on filings on the Hong Kong stock exchange from September 4 to 8, with 62 companies that recorded 276 purchases worth HK$262 million (US$33.5 million) versus 23 firms with 101 disposals worth HK$378 million.

The number of firms on the buying and selling side were not far-off from the previous week’s 61 and 25 companies, respectively. The number of trades and value, however, were down from the previous week’s 302 purchases and HK$333 million on the buying side and 125 disposals and HK$963 million on the selling side. On the buy-backs side, a total of 25 companies posted 116 repurchases worth HK$1.259 billion, which were down from the previous week’s 28 firms, 132 trades and HK$1.466 billion.

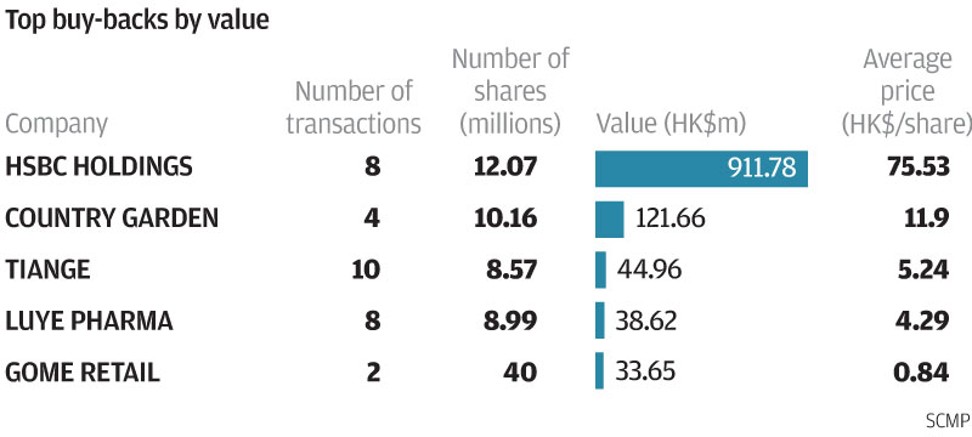

There were buy-backs and purchases by vice-chairman Yang Hui Yan in Country Garden Holdings with a combined 52.46 million shares bought from August 30 to September 13 at HK$9.88 to HK$12.00 each or an average of HK$10.85 each. The group bought back 40.8 million shares from August 30 to September 13 at an average of HK$10.89 each.

The company previously acquired 4.44 million shares on April 3 at HK$6.96 each and 156.9 million shares from January 5 to March 31 at HK$4.05 to HK$6.98 each or an average of HK$4.39 each. Before the buy-backs this year, the group acquired 1.08 billion shares from January to December 2016 at HK$2.85 to HK$4.48 each or an average of HK$3.75 each. The repurchases since January 2016 are the company’s first buy-backs since listing in April 2007.

Before her trades this year, Yang acquired 129.9 million shares from January to October 2016 at HK$2.98 to HK$4.30 each or an average of HK$3.52 each, 6 million shares in March 2014 at an average of HK$3.11 each and 87.5 million shares from June to December 2013 at HK$3.63 to HK$5.06 each or an average of HK$4.32 each. Before her purchases since 2013, the vice-chairman acquired 546,000 shares in May 2009 at HK$3.69 each and 2 million shares in October 2008 at HK$1.78 each. The stock closed at HK$13.56 on Friday.

Significant Points

- Buy-backs and purchases by vice-chairman Yang Hui Yan from August 30 to September 13 accounted for 7 per cent of the stock’s trading volume

- The purchases were made after the company announced on August 22 a 39.2 per cent gain in first-half profit to 7.50 billion yuan (US$1.1 billion)

- The group resumed buying back after the stock rose by as much as 72 per cent from its acquisition price in April

- Yang resumed buying this month after the stock rose by as much as 149 per cent from her acquisition prices earlier this year

- There were purchases by vice-president Liang Guo Kun, executive director Yang Zi Ying and president Mo Bin from May to July at HK$7.59 to HK$9.99 each

Significant Points

- Luye Pharma bought back for the first time since listing in July 2014

- The buy-backs were made after the stock fell by as much as 64 per cent from HK$11.20 in October 2014

- The group recorded buys on 7 out of the 9 trading days from September 4 to 14

- The buy-backs accounted for 14 per cent of the stock’s trading volume

- The group’s buy-back prices were lower than the IPO price of HK$5.92

- Chairman and CEO Tan recorded the first trades by a director of Bocom since the stock was listed on May 18

- The chairman’s purchases accounted for 15 per cent of the stock’s trading volume

- The purchases were made on the back of the 12 per cent drop in the share price since May from HK$2.72

- The chairman’s purchase price was below the IPO price of HK$2.68

Robert Halili is managing director of Asia Insider