Hong Kong companies most optimistic about future growth prospects, global survey finds

Mid-size firms in the city expect strong growth in revenue next year as they expand overseas, ride a wave of mergers and takeovers and embrace new technology, accounting firm EY says

Hong Kong’s medium-sized companies are the most optimistic about their future growth prospects as they seek to expand overseas, take advantage of merger and acquisition opportunities and adopt new technologies, according to a global survey released on Tuesday.

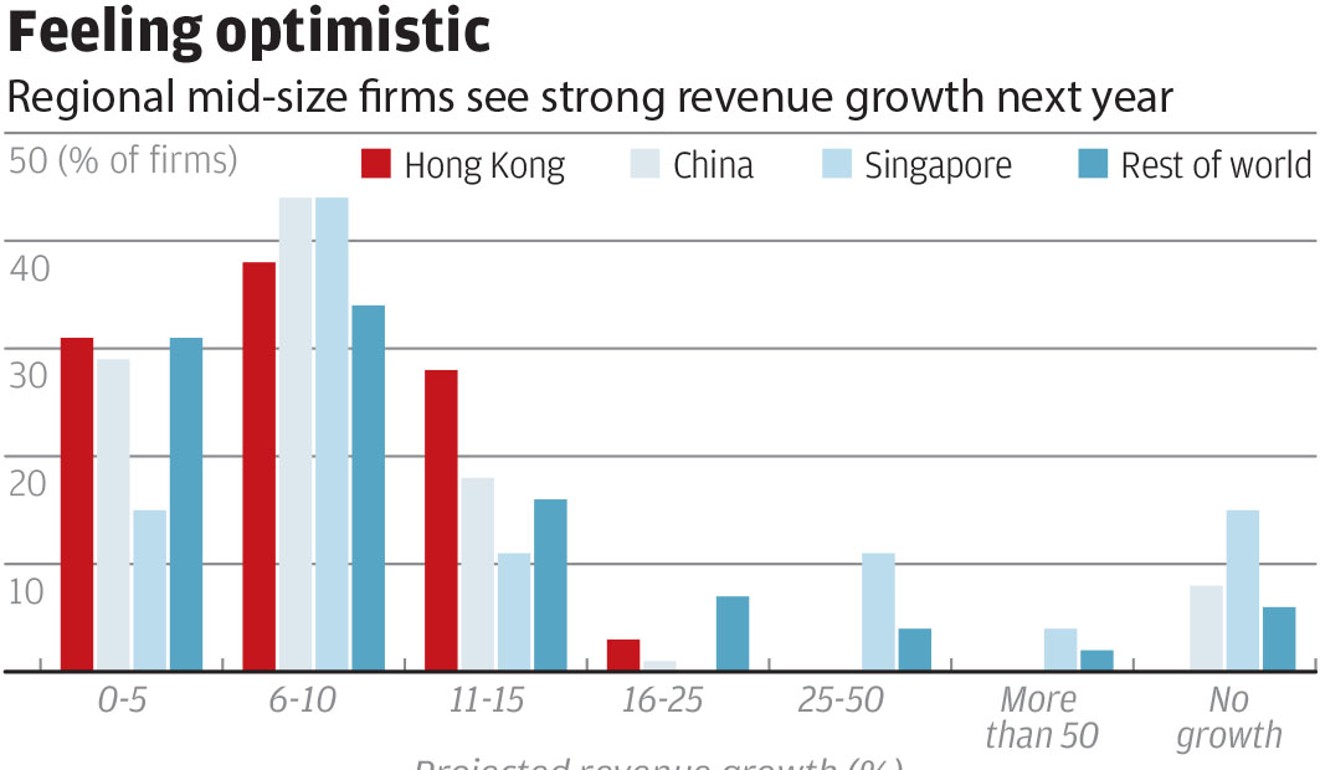

In the survey by accounting firm EY of 2,340 companies with annual revenue of between US$1 million to US$3 billion in 30 markets, 69 per cent of Hong Kong respondents expected revenue growth of between 6 per cent and 25 per cent next year, higher than the World Bank’s global GDP growth forecast of 2.7 per cent.

Thirty-one per cent of Hong Kong respondents believed they could achieve double-digit revenue growth next year, compared with 19 per cent in mainland China and 26 per cent in Singapore.

No Hong Kong respondents expected a decline in income next year, compared with 8 per cent in mainland China, 15 per cent in Singapore and 6 per cent of the rest of the world.

The survey was titled “EY Growth Barometer” and was conducted between March and May. Most respondents were chief executives or senior officials.

“Hong Kong middle-market leaders are not only attuned to uncertainty, but are seizing it to grow, disrupt other markets and drive their growth agendas,” said Agnes Chan, managing partner of EY Hong Kong and Macau.

“This explains why no Hong Kong middle-market leaders are expecting negative growth compared to the rest of the world. Instead, Hong Kong middle-market executives are bullish on growth.”

She said Hong Kong respondents believed they could grow better by expanding into new markets, with 26 per cent of respondents wanting to set up outside Hong Kong, against 24 per cent of firms from elsewhere in the world wanting to expand beyond their home bases.

Firms in Hong Kong also want to hire both full-time and freelance staff: 38 per cent want more full-time staff, higher than the 27 per cent of firms in other markets in the survey.

Hong Kong executives also showed their belief in adopting new technology, Chan said.

“We see companies reaching out to start-ups to access new, leading-edge technologies and new business models,” Chan said.

“In a similar vein, tasking small teams with experimental projects is Hong Kong middle-market C-suite leaders’ second priority for sparking innovation, along with harnessing the power of staff creativity and insight.”

The survey found that the opportunity for mergers and takeovers is another reason for Hong Kong firms’ optimism.

“This reflects Hong Kong’s continuing role as the gateway to mainland China and the world. In the past 20 years, the city has seen M&A activity jump fivefold as mainland Chinese firms use the city to ‘go global’ and Western multinationals buy into Hong Kong-based companies to deepen their penetration into the region,” Chan said.

The value of M&A deals involving Hong Kong companies climbed 387 per cent from US$31.06 billion in 1997 to US$151.59 billion in 2016, according to Thomson Reuters.

Companies in the survey also said increasing competition was their major threat, followed by sluggish demand from customers and political instability around the world.