China embraces smart factory technology in manufacturing arms race with Germany, Japan

China is turning to foreign robotics and smart factory technologies to enhance competitiveness as it seeks to close the gap in manufacturing prowess with Japan and Germany by 2035 under Premier Li Keqiang’s “Made in China” strategy.

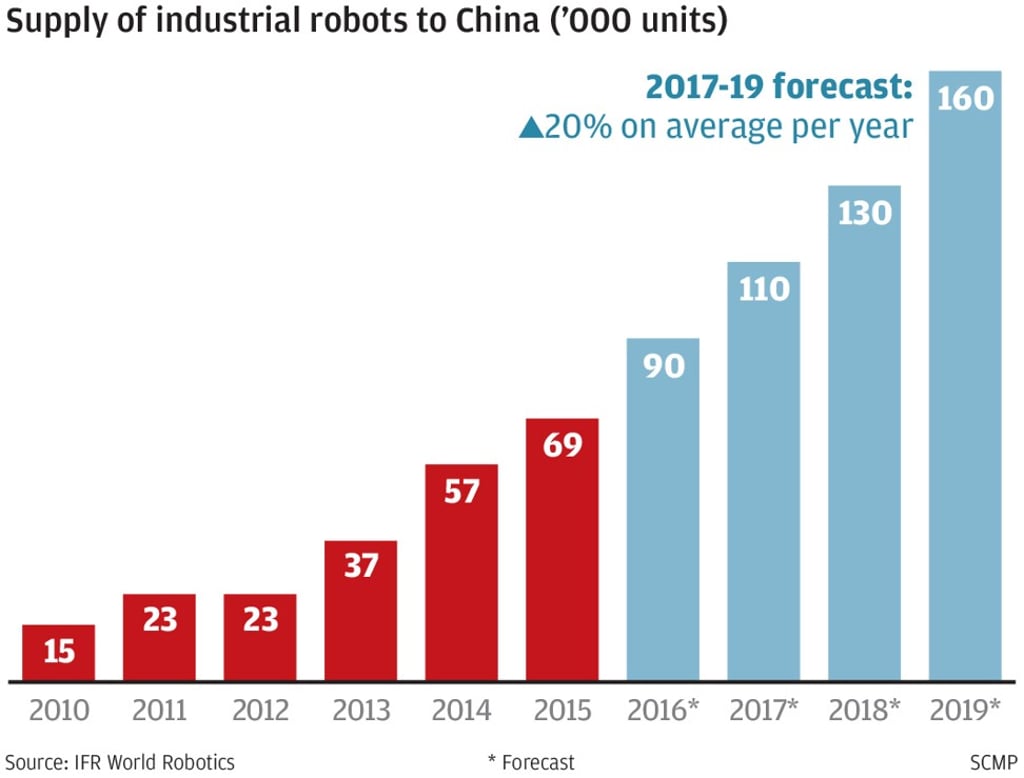

Faced with rising labour costs owing to its shrinking labour force, China has already overtaken Japan as the world’s largest industrial robot market. Industrial robot sales in China this year are estimated to reach US$4.2 billion, according to the Chinese Institute of Electronics.

But a lack of core technology means the nation has been highly dependent on foreign supply.

Imports from well established overseas major producers such as Swedish-Swiss firm ABB, Germany’s Kuka, and Japan’s Fanuc and Yaskawa Electric account for more than 60 per cent of all robots bought by Chinese manufacturers.

For specialised six-axis robots, which provide greater flexibility and applications than earlier generations, overseas manufacturers account for 90 per cent of market share in China, according to a Huatai Securities research report.

In a move that signals the growing importance of the mainland market, German industrial giant Siemens said last week that its China subsidiary will lead the company’s global effort in research in autonomous robotics.