Hong Kong poised to be toppled from top of global IPO league table for first time in two years

Lack of blockbuster deals leads to 77 per cent slump in the amount of listing proceeds in the third quarter

Hong Kong is poised to lose its crown as the world’s top market for initial public offerings this year after seeing the value of deals plummet 77 per cent in the third quarter in the absence of blockbuster listings.

During the period, US$2.69 billion was raised from 32 deals on both the main board and the Growth Enterprise Market, data from Thomson Reuters showed, a sharp fall from the US$11.74 billion seen a year earlier, when Postal Savings Bank of China raised US$7.3 billion in the world’s largest flotation since 2014.

For the first nine months of this year, there were a total of 98 listings on the two boards to raise US$9.14 billion, down 52.2 per cent year on year.

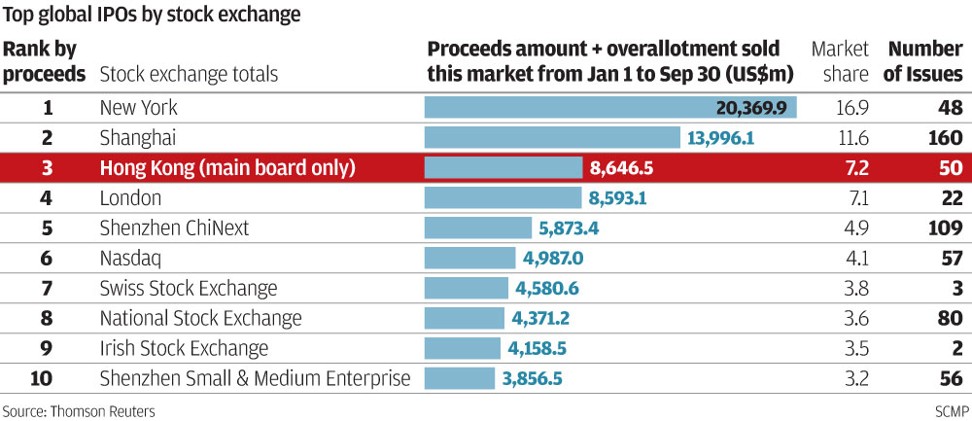

The main board saw 50 deals worth US$8.65 billion to take a 7.2 per cent global share, ranking it third among the world’s top stock exchanges by the amount of proceeds raised. It had topped the global rankings for the past two years.

The New York Stock Exchange took the top spot with US$20.4 billion from 48 deals, giving it a 16.9 per cent global share. The amount of proceeds jumped 170.9 per cent from a year earlier after Snap chose to launch its US$3.9 billion flotation there in March.

Hong Kong also lost out to the Shanghai Stock Exchange, which raised just under US$14 billion in 160 deals to take an 11.6 per cent global share.

“With only three months to go until the end of the year and no news of any big players planning to list in Hong Kong, the exchange is unlikely to return to the top,” said Gordon Tsui, managing director of Hantec Pacific.

“It has lost out to other markets such as New York as we have not done enough to attract new-economy companies to list here. We should change our listing regime quickly.”

Last month, Hong Kong Exchanges and Clearing completed a consultation to set up a new board to allow listings by companies with a dual-class share structure and start-ups.

Chief executive Charles Li Xiaojia said the consensus pointed towards carrying out reform to capture new-economy firms but a second consultation had been planned later this year before the new board could be launched.

The financial sector accounted for the biggest share of listing proceeds raised in the city in the first nine months of this year, at 60 per cent, followed by health-care firms with 10 per cent and the consumer sector with 9.4 per cent. Hi-tech firms accounted for just 5.1 per cent.

The biggest listing in Hong Kong so far this year was the US$2.2 billion deal by Guotai Junan Securities in March, followed by mainland online insurance broker Zhong An Online P&C Insurance, which just raised US$1.5 billion last week.

The city’s global ranking for technology listings was a lowly 13, way behind New York, Shenzhen and Singapore.