Director, buy-back activity on Hong Kong exchange plunges due to short trading week

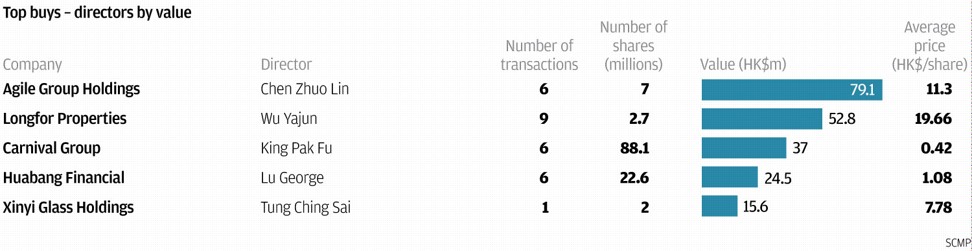

The director and buy-back activity plunged based on filings on the Hong Kong stock exchange during the holiday shortened week of October 3 to 6. A total of 30 companies recorded 142 buys worth HK$284 million (US$36.4 million) versus seven firms with 14 disposals worth HK$62 million.

The three-day totals were sharply down from the previous week’s five-day totals of 51 companies, 335 buys and HK$483 million on the buying side and 14 firms, 48 disposals and HK$436 million on the selling side.

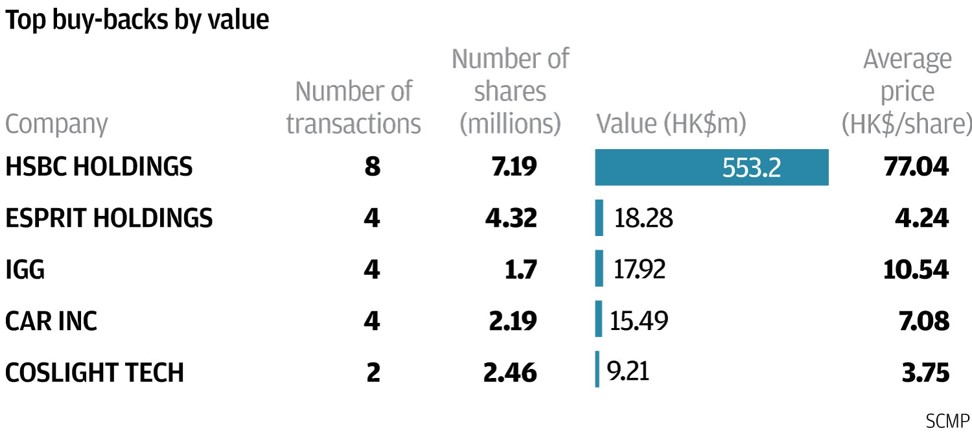

On the buy-backs side, a total of 17 companies recorded 54 transactions worth HK$647 million based on filings from September 29 to October 4. The three-day totals were sharply down from the previous five-day totals of 31 firms, 151 trades and HK$1.107 billion.

Despite the short trading week and the sharp fall in the director and buy-back activity, there were several significant trades last week with buy-backs in online games developers Boyaa Interactive International and IGG Inc and insider buys in yarn and fabrics manufacturer Texhong Textile Group and property developer Agile Property Holdings.

Boyaa Interactive International bought back 235,000 shares on September 29 at HK$3.13 each. The group previously acquired 90,000 shares in June 2014 at an average of HK$8.19 each. The trades since June 2014 are the company’s first buy-backs since listing in November 2013. The stock closed at HK$3.17 on Friday.

Significant Points

-- The group recorded its first buy-back since 2014

-- The recent buy-back was made on the back of the 68 per cent drop in the share price since August 2014 from HK$9.65

-- The group’s last buy-back price was lower than the IPO price of HK$5.35

IGG bought back 2.5 million shares from September 27 to October 3 at HK$9.98 to HK$10.66 each or an average of HK$10.24 each. The group previously acquired 8.5 million shares from January 4 to 18 at HK$5.17 to HK$5.92 each or an average of HK$5.65 each.

Investors should note that six directors sold a combined 21.3 million shares from April 6 to July 19 at HK$10.49 to HK$14.14 each or an average of HK$11.29 each. Among the sellers was chairman and CEO Cai Zong Jian with 4.7 million shares sold from April 24 to July 19 at an average of HK$11.49 each, which reduced his holdings to 268.165 million shares or 19.78 per cent of the issued capital. The chairman’s sales since April are his first on-market trades since his appointment in October 2007. The stock closed at HK$10.86 on Friday.

-- IGG resumed buying back after the stock rose by as much as 106 per cent from its acquisition prices in January

-- The recent buy-backs accounted for 5 per cent of the stock’s trading volume

COO Tang Dao Ping purchased 89,000 shares of Texhong Textile Group from September 21 to October 4 at HK$10.00 to HK$10.48 each or an average of HK$10.22 each. The trades increased his holdings to 3.089 million shares or 0.34 per cent of the issued capital. He previously sold 700,000 shares in November 2016 at an average of HK$11.78 and his entire holdings of 200,000 shares in May 2013 at HK$9.04 each. Tang joined the group in 1998. The stock closed at HK$10.58 on Friday.

Significant Points

-- Tang recorded his first buys since the stock was listed in 2004

-- Tang turned from a seller from 2013 to 2016 to a buyer from September to October this year

-- The buys were made after the stock rebounded by as much as 27 per cent from HK$8.24 in July

-- The group announced its interim results on August 15 with profit up by 41.2 per cent to 645 million yuan

Prior to his trades this year, the chairman acquired 500,000 shares in December 2009 at HK$10.67 each, 7.2 million shares from July to August 2008 at HK$6.68 each and 5 million shares in June 2007 at HK$10.06 each.

The insider sentiment was not entirely positive in the third quarter as executive director Chen Zhongqi sold his remaining holdings of 187,000 shares from August 30 to September 5 at an average of HK$9.44 each. He previously sold 200,000 shares in April 2015 at an average of HK$5.70 each. The stock closed at HK$12.30 on Friday.

-- Chen resumed buying shares in September after the stock rose by as much as 32 per cent from his acquisition price in August

-- The buys by the chairman since August are his first on-market trades since 2009

Robert Halili is managing director Asia Insider