Exclusive | Last brokers left standing on the floor set to turn out the lights on 126 years of Hong Kong trading

With three staff and just 10 clients, the Shu sisters run one of Hong Kong’s smallest brokerage firms, and are among only a handful of ‘red jackets’ left on the exchange’s famous trading floor

After 30 years of tireless dealmaking on Hong Kong’s famous stock trading floor, the Shu sisters – who run one the city’s smallest brokerage houses – will be packing up their belongings on Thursday and heading out the door for the last time.

Tammy Shu Yee-nar, chief executive of Wader Securities, and her sister Shu Yee-har, are among just 30 traders left in the vast trading floor, once abuzz daily with hundreds of red-jacketed dealers.

Wader is very much a family affair. Their elder sister works from an office nearby handling the back-office function.

The all-sister outfit is among the smallest of around 500 stockbrokers in Hong Kong, but they have a wealth of memories of the glory days, when the world’s largest banks and brokers packed the hall’s floor with more than 1,000 staff, all hungry for the biggest deals.

“We three run the firm, which has just 10 clients. The commission from the clients trading are not high, of course. But that’s not a problem as most of our income comes from our own stock trading,” says Tammy, still resplendent to the end, in her crimson sleeveless jacket.

“We have always taken a long-term view and have held many blue chips, such as HSBC or Hong Kong Exchanges and Clearing, for many years. We also invest in property,” she adds.

“We are not the smallest broker in town. There is a firm owned by a couple – the husband trades on the floor and his wife handles the admin from an office.”

Their firm may be small – but that’s the way the Shu sisters have always liked it. They say their key to success is never having more than 10 clients, meaning they have never had to employ more staff.

When there was a rally on, it was a sheer joy to work. The gossip was electric, with brokers discussing which stocks to buy and sell – it was much better than staying in the office

Their booth in the now cavernous trading hall actually costs them just HK$7,000 (US$897) a month (the jackets are provided free).

They and their fellow remaining handful of floor traders are mostly family affairs.

Wader was founded by their father, Shu Jen-chiu in 1971 – at the height of the boom days for small brokers, as the Far East Stock Exchange liberally issued trading licences, boosting the number of local operators to a peak of over 900 throughout that decade.

Back in those halcyon days, there were four stock exchanges, which only merged in 1986 to form the Stock Exchange of Hong Kong, and which again morphed with the futures exchange and related clearing houses to form the Hong Kong Exchange and Clearing (HKEX).

Tammy recalls proudly that their father had been considered a formidable stock investor in his heyday.

“Every time he traded HSBC shares [which was infrequently] we would buy a new car. Back then, brokers earned a lot of money from their own trading, and commission income was also much better,” she said.

“But after the banks entered the securities business, small brokers could not compete as more customers chose to trade with them as they were bigger, stronger, and could provide more services.”

When their father passed away, in stepped his four daughters to take up the reins. The two younger Shu sisters took to the trading floor in 1987, straight from school, while their eldest sister ran the administration function from a small office in Central.

Their other sister helped with the firm in their early days, too, but she married and became a housewife, leaving the trading troika to battle on, in what then became a black year for the stock market.

Floor trading first began in Hong Kong in 1891, while the current hall – located at Exchange Square – has been open since 1986.

The property belongs to the Hong Kong government, which collects rent from HKEX, at HK$3.58 million per year, unchanged since 2008.

The vast floor area covers 45,000 square foot, and there are 906 two-person booths, which at their peak were daily homes to some 1,400 traders in the 1980s.

The Shu sisters said at that time, every trade was paper-based, and conducted on the floor between the brokers themselves.

The introduction of electronic, paperless trading in the early-1990s meant brokers could then deal from computers at their office, which acted as the first real nail in the coffin for the trading hall as more moved to sites elsewhere.

The exchange downsized the hall in 2006 to a third of its original size, and today just 0.2 per cent of trades are carried out by those 30 last survivors.

Its closure was announced in August.

Shu Yee-har insists it will be business levels as usual for Wader, after they pack up and move back to the office. But admits she’ll miss the excitement of the floor.

“It’ll be much less fun. We’ve loved trading on the floor and came here straight from school, only to be met in October of that year, in 1987, by a market crash, which shocked and saddened us all.

“But when there was a rally on, it was a sheer joy to work. The gossip was electric, with brokers discussing which stocks to buy and sell – it was much better than staying in the office.”

While nearly all stock traders are office-bound today, they still flock to the floor in numbers for special occasions, or whenever there are political leaders paying a visit.

“I’ve taken pictures of all the great occasions over the years,” adds Tammy. “With Premier Wen Jiabao in 2003 and then vice-premier Li Keqiang in 2011, when they visited the hall.”

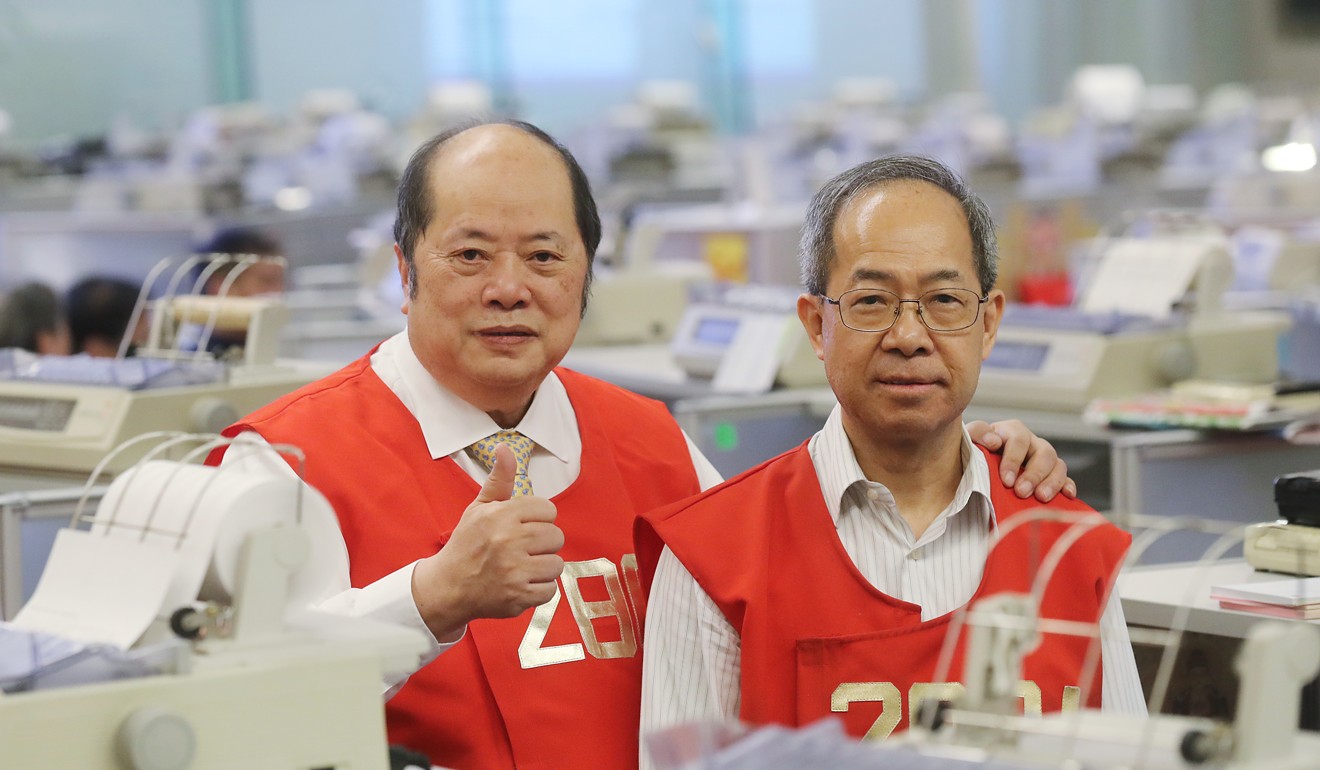

Among other great names still left in their jackets are Christfund Securities, founded by Christopher Cheung Wah-fung, which was one of the largest with 12 floor traders at its peak, now down to just one.

“When I hired floor traders, they needed to be honest and provide good service to customers,” Cheung said, who started his career as a floor trader himself, back in the 1970s.

The stock exchange is yet to announce an actual closing ceremony for the hall, saying only it plans to turn it into a “a showcase to promote the city’s financial market, and its history”.

But Cheung, much like the Shu sisters and others of their generation, want something a little special to mark what’s the end of an era for Hong Kong’s financial community.

“I urge the exchange to host a ceremony to mark the closure,” he said. “Technology evolution means we no longer need to trade on the floor – but its iconic status needs to be recognised as playing such an important role in Hong Kong history. We shouldn’t just turn off the lights, and leave.”