The cost of ‘Oops’: Misplaced article on regulator’s website sends ZhongAn shares reeling

ZhongAn plunged after the Hainan branch of the China Insurance Regulatory Commission posted an opinion piece on its website, misleading readers into thinking it was a regulatory notice. The article was later removed.

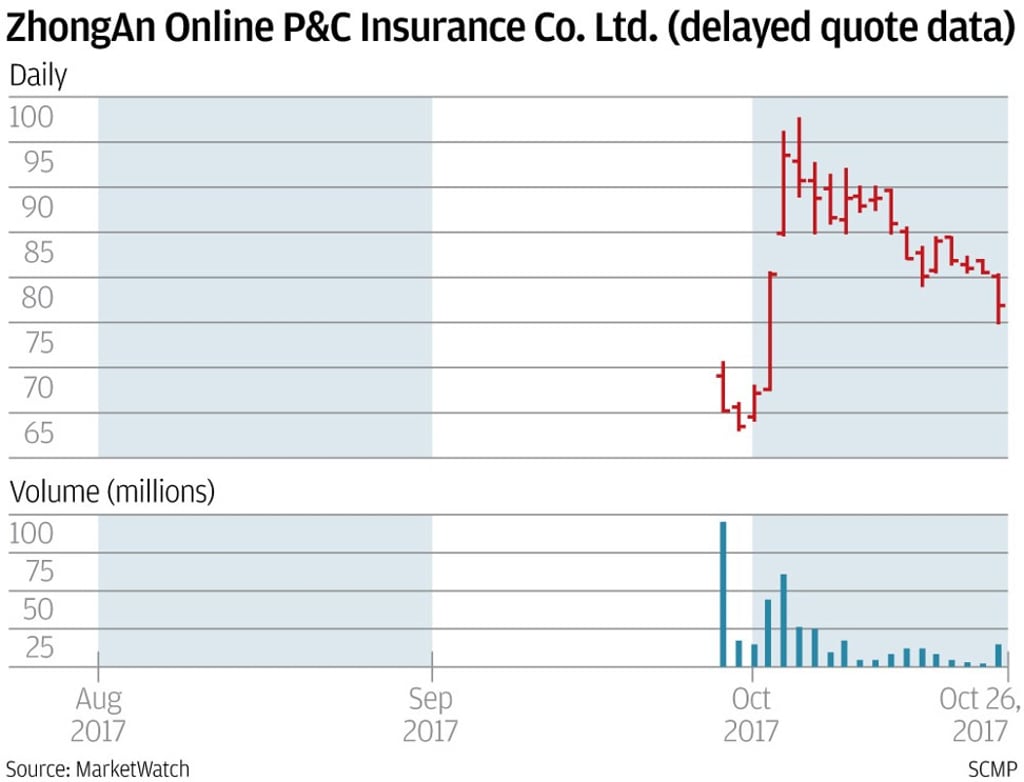

ZhongAn Online Property & Casualty Insurance fell as much as 7 per cent on Thursday in Hong Kong, dragged down by an article warning of potential risks in the insurer’s business model that appeared temporarily on the website of a branch of the nation’s top insurance regulator. The article was removed from the website.

Shares of China’s first online insurer closed at HK$76.85 in Hong Kong, down 4.7 per cent from its previous close. Thursday’s drop, reflecting the fourth straight session of losses, occurred against a weaker trading session as the Hang Seng Index ended 0.36 per cent lower at 28,202.38.

The Hainan bureau of the China Insurance Regulatory Commission, posted an article on its website on Thursday warning of potential risks in ZhongAn’s business model, saying the online insurer allows other insurance agencies to use its website to sell products, blurring the boundaries between online and offline insurance business.

However, the article was withdrawn from the website later in the day. A bureau official told the South China Morning Post that the article was merely an opinion piece open to debate and was mistakenly posted on the regulator’s website and misled readers into thinking it was an official, regulatory notice.

Still, investors in Hong Kong were unnerved.