Hong Kong-listed firms urged to step up efforts on environmental, social and governance disclosure

Survey shows efforts will help companies to improve their investment value

Hong Kong-listed companies need to act fast to raise their environmental, social and governance (ESG) reporting and quality disclosure to match international standards to attract global investors and maintain the city’s status as a leading global financial hub, according to global accountancy firm BDO.

Last year, the Hong Kong stock exchange made ESG disclosure mandatory for listed firms based on measurable key performance indicators such as targets and achievements.

“There is still a lot of room for improvement in the ESG disclosure required by the Hong Kong companies compared to the internationally recognised global reporting initiative standards,” said Ricky Cheng, BDO director and head of risk advisory. “As the listed companies have gained basic experience on first year ESG reporting, the Hong Kong stock exchange may consider raising these standards further.”

However, most Hong Kong-listed companies spend only HK$100,000 (US$12,818) or less on ESG reports, and have no plans to increase budgets for it in the coming year.

But despite benefits from issuing ESG reports, companies may face difficulties in collecting data for the report because they have limited resources.

“Such firms should start off with small pilot projects before setting up centralised ESG functions within the company to handle ESG data collection,” said Cheng, BDO director and head of risk advisory.

For example, some small and medium-sized companies have reduced carbon footprint and saved costs simply by switching to energy-efficient lighting systems, streamlining transport practices, or implementing paperless operations, he said.

A BDO survey of 68 listed companies, including eight SMEs showed that 80 per cent of respondents believe that the ESG report enables better internal control and risk management, or enhances the investment value of the company.

Hong Kong investors increasingly view sustainable investing as a way to generate profits and not just as a philanthropic pursuit.

“We are beginning to see more investors approach sustainability as a profitability question rather than

an altruistic one,” said Jessica Ground, global head of sustainability at Schroders. “This is to be welcomed. Those companies able to adapt and thrive will continue to benefit disproportionately, while others will fall further behind.”

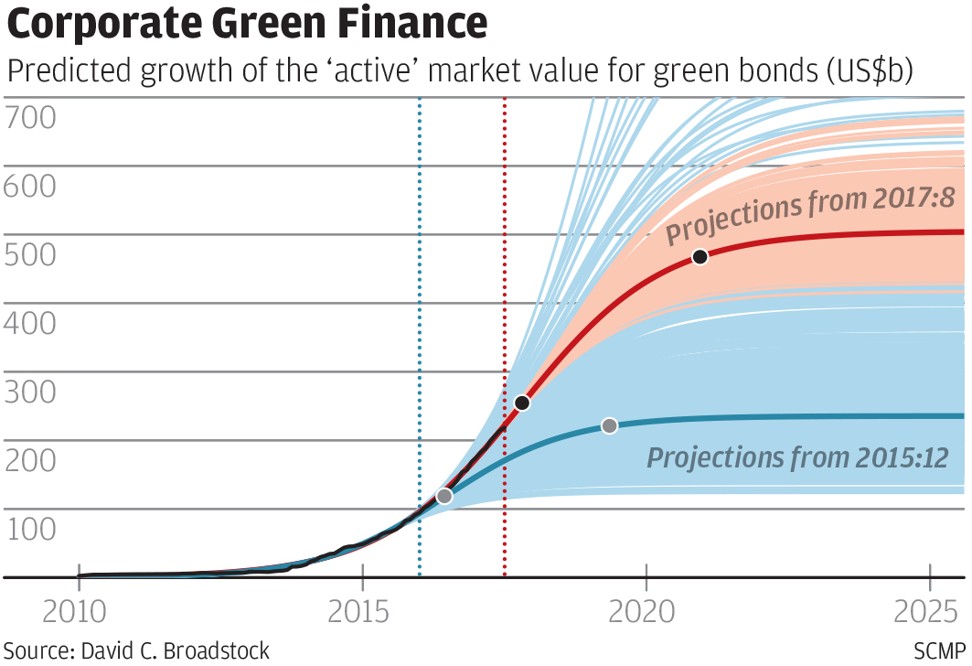

Hong Kong is working with China’s government to develop green financing, in line with the nation’s top policy to promote Belt and Road Initiative.

Hong Kong’s monetary authority is also considering plans to issue green bonds in the city in the next financial year, setting a benchmark for companies to issue debt to fund environment related projects.

At the same time, experts are urging the government to set up a green investment bank or introduce schemes that can verify green bonds complying with well-recognised standards such as the Climate Bond Standard and China’s Green Bond Endorsed Project Catalogue.