From shampoo to boats and North Pole tickets: how China’s online shopping frenzy evolved

Singles’ Day has grown into a retail phenomenon that has spread well beyond China’s 1.3 billion population to snare shoppers from Southeast Asia to the US

Savvy Chinese consumers, as well as the newbies are counting down to the annual shopping binge known as Singles’ Day, known for bargains on everything from shampoo to 37-foot Aston Martin AM37 powerboats.

Well before the doors to China’s virtual shopping centre open at the stroke of midnight Saturday, consumers like New York college student Yu Yifan, 23, have spent days, if not weeks, doing their homework.

For Yu, her biggest concern is having fast and steady internet access, because the rush of orders in the first few minutes of the shopping spree has overwhelmed telecommunications networks and computer servers in the past. The most popular items sell out within seconds.

“There are certainly good deals during Singles’ Day, but it’s hard to get those kinds of deals as they are sold out in minutes,’’ said Yu, who has spent as much as 20,000 yuan (US$3,000) on previous Singles’ Days, buying clothes, home appliances and electronic goods for the family.

Shanghai resident Celine Lin, 38, plans to spend several tens of thousands of yuan on skincare and small electronic goods this year after picking up good deals on a previous Singles’ Day sale when she was renovating her flat. “I saved quite a bit on renovation by buying on Singles’ Day, although I didn’t pay attention to how much,” she said.

Among the wares on offer: reservations for a seven-day package to Finland to see the Northern Lights for 399 yuan – a steal compared with the usual price of 12,999 yuan. Another merchant is offering the first 500 buyers a 50 per cent discount on an infant car seat that usually costs almost 5,000 yuan.

The 24-hour shopathon has grown since Alibaba – which operates the Taobao and Tmall shopping platforms – trademarked the name in 2012, partly as a nod to the celebration of singlehood every November 11, but also to capitalise on the tradition of single people buying consolation gifts for themselves on that day. Since then, Singles’ Day has exploded into a retail phenomenon that has swept China and spread well beyond its 1.3 billion population to snare shoppers from Southeast Asia to the US.

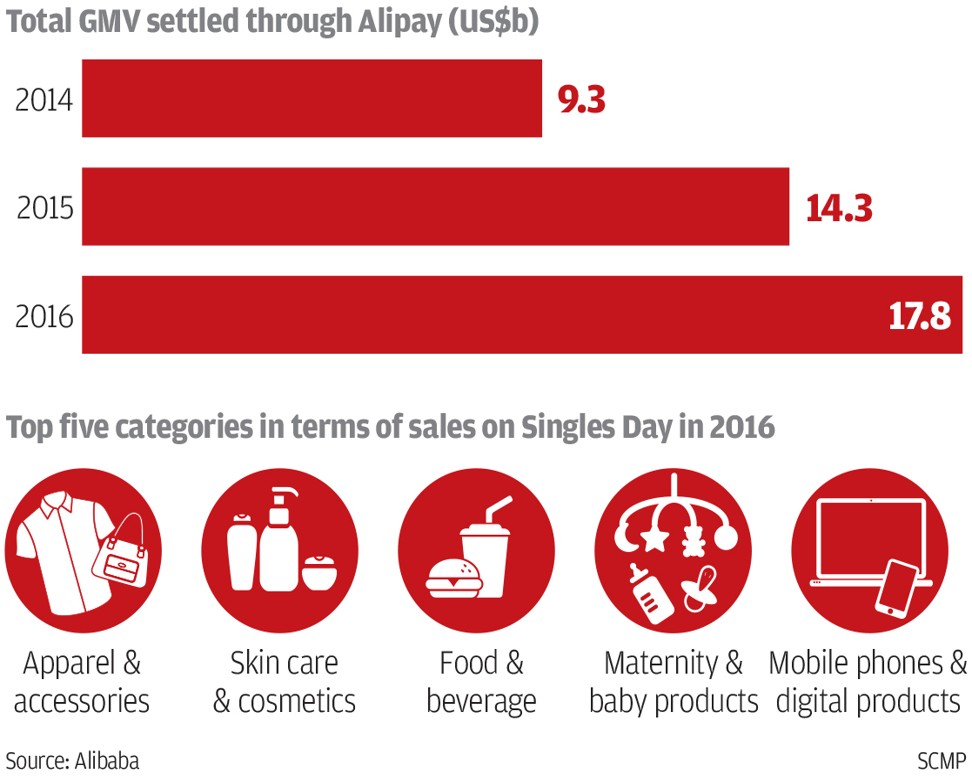

Last year’s Singles’ Day recorded 120.6 billion yuan (US$18.1 billion) in sales, a 32 per cent increase over 2015.

That’s more than 18 times the sales on Amazon’s Prime day, and 2.5 times bigger than Black Friday and Cyber Monday combined, the two other major US retail sales events. It is the largest 24-hour shopping binge on the planet.

“The 11.11 global shopping festival is a large-scale business collaboration bringing together consumers, retailers, logistics companies, financial institutions, online as well as offline stores and shopping centres around the world,” Alibaba CEO Daniel Zhang said in a statement.

This year, more than 140,000 brands offering more than 15 million products will take part, according to Alibaba, which owns the South China Morning Post.

Alibaba said foreign brands including Gap, Bose, Casio, C&A, Vero Moda, Jack Jones and Miss Sixty would be shown in its smart stores, where customers can experience a new facial recognition-powered payment solution and receive discount recommendations on Tmall/Taobao apps.

Tmall will open 60 pop-up stores in 52 malls across 12 mainland cities, partnering with more than 100 domestic and international brands such as P&G, Estée Lauder, Beats, Siemens, Wyeth, Unilever, Casio, L’Oreal, and Lego.

The total sales tally – known as gross merchandise volume (GMV) – should surpass 150 billion yuan this year, according to IDC, a research firm that tracks retail spending.

The success of Singles’ Day has attracted other retailers to join the fray with their own shopping promotions. November 11, represented by the numerals 11.11, is now one of the most recognisable days in China, with more than 70 per cent of mainland consumers surveyed by AC Nielsen saying they will participate in this year’s event.

Many other companies are timing their annual promotions for this month to tap into the surge in spending. Among them, Beijing-based rival JD.com advertised numerous deals in the lead-up to November 11. Sundan, an electronics retailer based in Shenzhen, has also been heavily marketing its promotions timed for Singles’ Day.

“For us, the two biggest shopping events are June 18 and November 11, so they are equally important,” said Gloria Li, A vice-president at JD.com. “Of course, the background of these two days is different.”

JD.com, founded by Chinese tech entrepreneur Richard Liu Qiangdong, started its own June 18 company anniversary sale in 2010, but also offers promotions on November 11.

“JD.com’s focus on November 11 is quality. We attract middle class customers and this is different from other platforms,” said Li, adding that she is confident of this year’s sales in spite of slower growth in China’s economy. “Throughout the 12 days leading up to November 11, we have different and new promotions, so we believe we should be able to boost customer spending.”

Retailers and consumers aren’t the only winners – investors have sent the shares of logistics companies like SF Holding and New York-listed ZTO Express higher since October as companies kicked off their warm-up events. Alibaba’s logistics arm, Cainiao Network, offered 1.5 billion yuan to its Chinese merchandisers and partners to build more warehouses to improve delivery efficiency. In April, JD.com announced plans to subsidise merchants for the additional storage and distribution costs involved in stocking up for Singles’ Day.

While Singles’ Day remains the most important day of the year for many retailers, the blitz of advertising aimed at consumers has turned at least some shoppers off, according to a Nielsen survey, which found that 28 per cent of respondents thought the novelty was wearing off so they wouldn’t shop as impulsively as before just because of discount prices.

And 45 per cent of consumers were concerned about the authenticity of some of the steeply discounted bargains, according to the survey.

For Gartner’s research director, Sandy Shen, this shows that while price is still the key consideration for online shoppers, consumers are demanding better quality. “I don’t know if they are going to be shopping there just because there are big promotions,” she said.

JD.com, on the other hand, said it would leverage its offline stores presence on November 11 and has been working with its partner stores in smaller cities to ensure they have steady supply of authentic products.

“The line between online and offline retail will continue to blur” as e-commerce firms in China expand efforts to engage directly with customers in physical stores, said Sunny Chen, a market analyst at IDC.

That may be just as well because it is one thing to buy discounted shampoo from your participating neighbourhood supermarket, but quite another to place an online order for that 1.2 million yuan Aston Martin powerboat – before a 20 per cent discount and free delivery – without testing it in the real world.