Is Hong Kong’s IPO fever over after Nissin and Shandong Int’l fail to excite?

One leading broker says ‘investors are waiting for the next big name to come to town’

The Hong Kong initial public offerings of Nissin Foods and Shandong International Trust (SIT) this week have received less investor enthusiasm than previous tech and internet share offerings, raising fears that the recent IPO fever has peaked.

Nissin Foods, the Japanese instant-noodle legend that owns big selling Demae Itcho and Cup Noodles brands, has recorded a retail demand for IPO margin financing of HK$1.33 billion so far, nearly 12 times its amount to be raised from the retail offering, based on Hong Kong brokerage firms’ public order information.

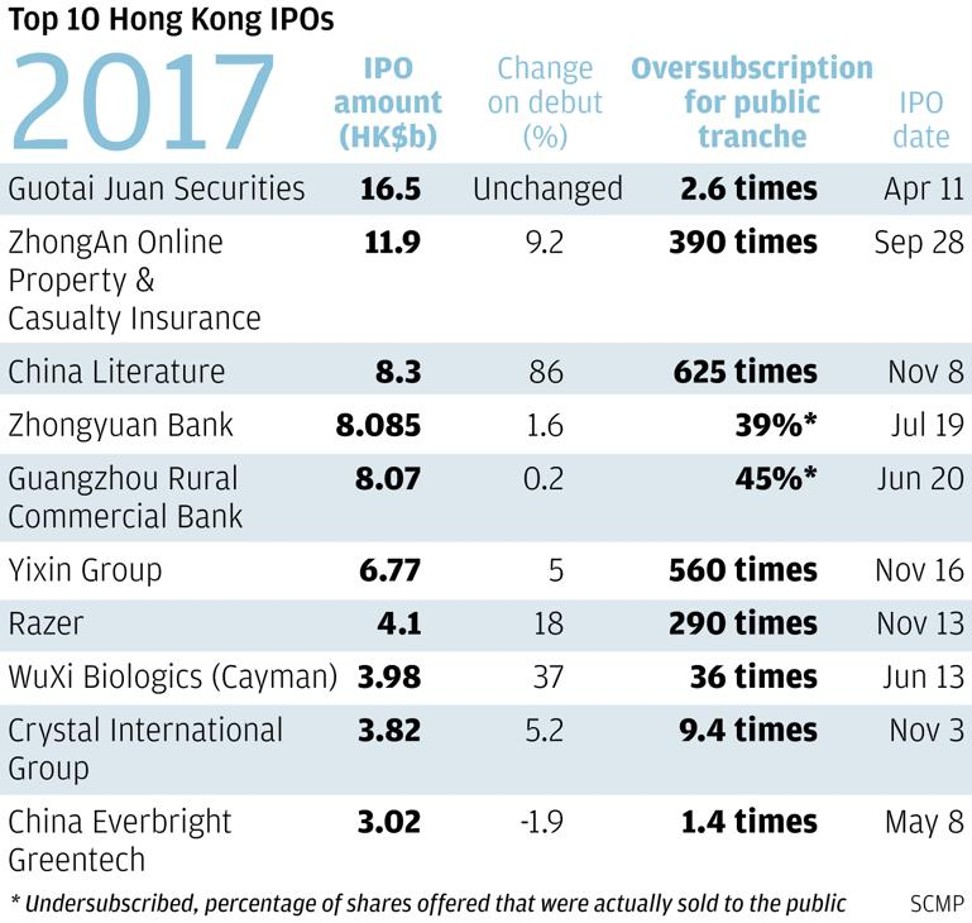

That oversubscription rate pales in contrast with several high-profile IPOs in the past two months, including Yixin Group, Razer, China Literature, and ZhongAn Online Property & Casualty Insurance.

Those four IPOs had all received investor demand several hundred times their number of shares on offer.

Separately, Shandong International Trust, the first Chinese trust to be listed in Hong Kong, has also received tepid investor interest. Its public offering, which closed on Friday, has just about been fully subscribed.

“I do think the IPO fever is passed, especially after the listing of Yixin Group last month,” said Ben Kwong, executive director of KGI Asia.

“Investors are waiting for the next big name to come to town.”

He blamed the less-furious IPO responses on “investors not being attracted by the new listings’ underlying fundamentals”.

“Investors don’t necessarily just flock to tech and internet IPOs. But they need to either see strong growth potential, or some ‘sexy elements’, such as innovative business models.”

“If a business is mature and doesn’t have much growth potential, investors may not buy it.”

“Financial stocks, especially smaller ones, don’t perform well on the Hong Kong market.”

Investors don’t necessarily just flock to tech and internet IPOs. But they need to either see strong growth potential, or some ‘sexy elements’, such as innovative business models

Nissin Foods plans to provide 10 per cent of its 268.58-million-share global offering to the Hong Kong public, or around 26.86 million shares. It has set an indicative price range of HK$3.45 to HK$4.21 per share. The total fundraising amount is as much as HK$1.13 billion.

The retail offering for Nissin kicked off on Wednesday and will end on Monday. The stock is set to debut on the main board on December 11.

In the first six months of 2017, Nissin Foods suffered a decline of more than 10 per cent in net profit, although revenues increased slightly, by 1.6 per cent to HK$1.34 billion.

The drop was “primarily due to the increase in the cost of sales”, the IPO document said, including the cost of raw materials such as palm oil.

Separately, SIT plans to provide 10 per cent of its 647-million-share offering to retail investors, with an indicative price range of HK$4.46 to HK$5.43 per share. The total fundraising amount is as much as HK$3.5 billion. Its shares are expected to start trading on December 8

For the first five months of 2017, SIT said its net profit increased 41 per cent year on year to 400 million yuan.