Exclusive | HNA eyes US$43b Thai economic zone as it aligns shopping spree with China’s state policies

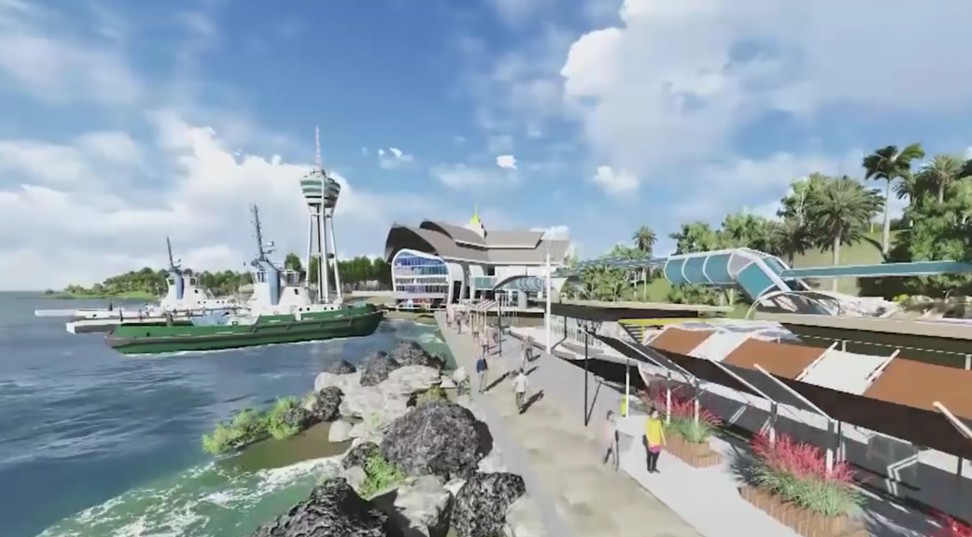

HNA Innovation Finance and CT Bright will contribute equally to 20 per cent of a fund, which may reach US$5 billion next three to five years, to invest in Thailand’s US$43 billion Eastern Economic Corridor project.

HNA Group is poised to invest in Thailand’s biggest infrastructure development project, as the airline-to-hotels conglomerate switches its offshore acquisitions to align closer to Chinese state policy, eight months after its global shopping spree landed it under a regulatory spotlight.

HNA Innovation Finance, a unit of Chen Feng’s privately held HNA Group, will establish a fund with CT Bright, the investment unit of Thailand’s largest conglomerate CP Pokphand, to invest in the Southeast Asian nation’s US$43 billion Eastern Economic Corridor (EEC) project, according to a source familiar with the project.

HNA Innovation and CT Bright will contribute equally to 20 per cent of the fund, raising the remainder of the capital from Chinese and Thai investors for a war chest of US$5 billion in the next three to five years, for investing in the EEC, the source said, speaking to the South China Morning Post on condition of anonymity.

The Thai project follows HNA’s US$1 billion purchase in April of Singapore’s CWT, a supply chain engineering and logistics company. HNA Innovation plans to use CWT as its toehold to enter Southeast Asia for trading bulk commodities, management and ancillary financial services, chief executive Guo Ke said in an interview last month with the Post.

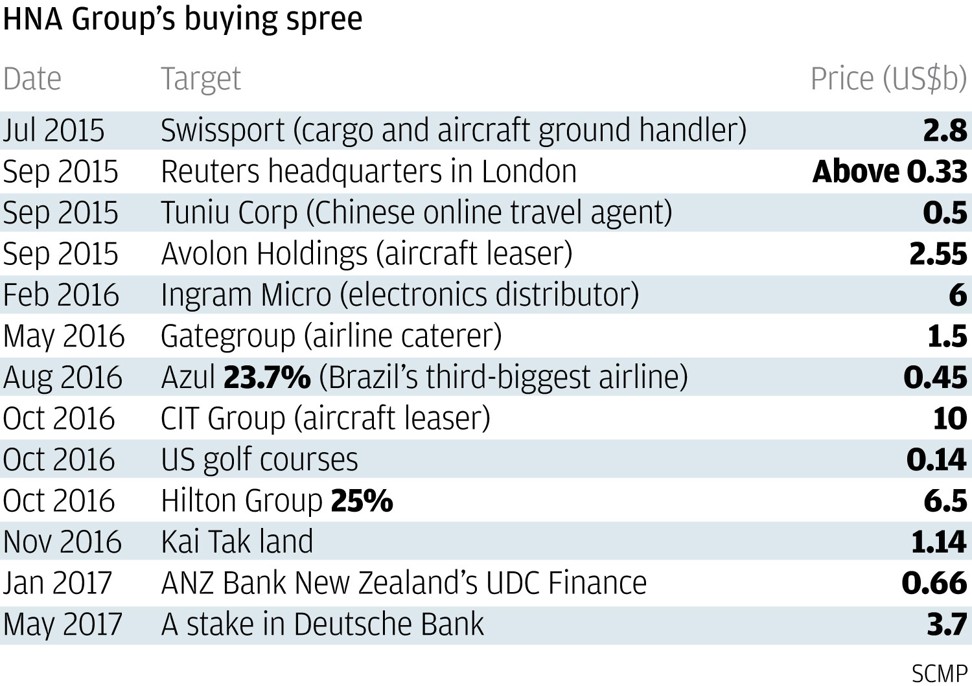

The investment is also a strategic switch for HNA, which has racked up huge debts on its US$36.3 billion shopping spree around the world since 2015, for everything from Reuters’ London headquarters building to a stake in Hilton Hotels to land in Hong Kong. In April, the group was among four Chinese private companies to be scrutinised by China’s financial regulators for their debt exposure.

With its wings clipped, HNA switched gear. It will stick closer to the Chinese government’s state policy of encouraging investments and infrastructure along the “Belt and Road Initiative”, as the government’s modern iteration of the ancient Silk Road trading routes is called, and consider disposing off assets that deviate from that strategy, HNA Group’s chief executive Adam Tan said last moth.

The Hainan-based company would “listen to orders” and “not invest a cent in areas forbidden by the government”, and would sell properties they had bought, he said.

Headquartered in Hong Kong, HNA Innovation was set up in March, and mainly engages in commodity trade, financial investment and consumer finance.