Mixed ownership reform an opportunity for private equity to invest in state enterprises

But government-led funds will drive change, Beijing forum hears

Chinese private equity will have more opportunities to invest in state-owned enterprises under the mixed ownership reform, but its initial investment is likely to be in the form of collaboration with state-owned restructuring funds, a recent Beijing private equity forum heard.

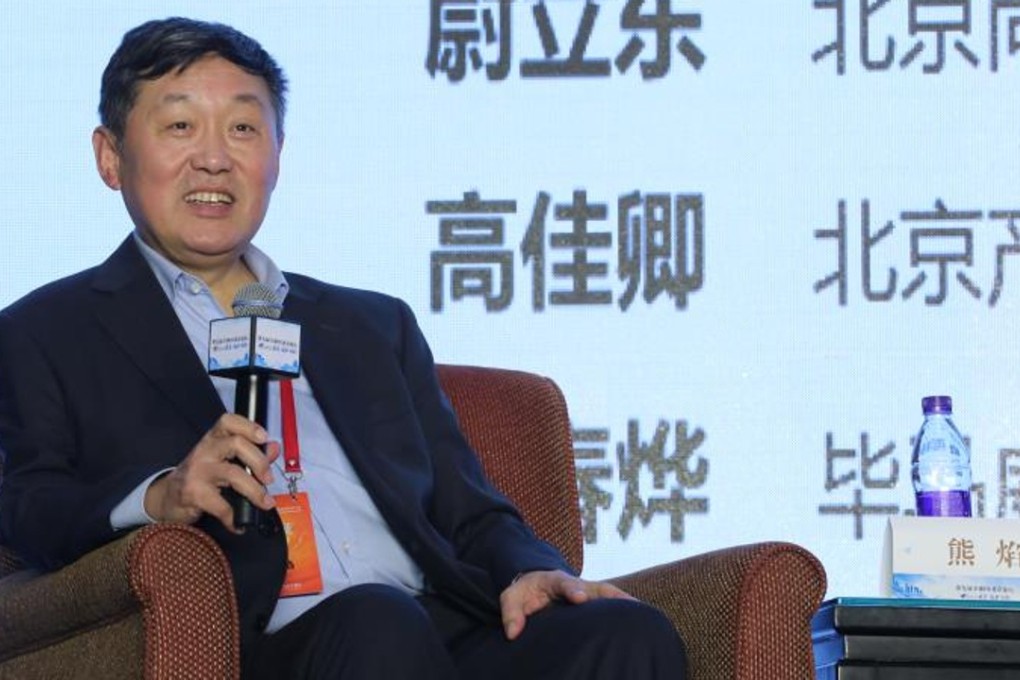

Xiong Yang, chairman of the Beijing-based private equity company Wealth Capital, said the mixed ownership reform, which is entering its third pilot scheme involving 31 state-owned enterprises, will provide the biggest investment opportunities for institutional investors over the next two decades.

“State-owned enterprises today enjoy a lot of advantages over the private sector … they enjoy a substantially lower cost of funds than those extended to private enterprises. Yet, they are not showing a satisfactory level of economic efficiency,” Xiong told the 9th Global PE Beijing Forum over the weekend.

Wealth Capital in August formed a 5 billion yuan (US$756 million) investment fund in Beijing targeting state-owned enterprises undergoing mixed ownership reform. The state-backed China Structural Reform Fund, a 350 billion yuan state enterprise restructuring fund backed by shareholders such as China Chengtong Holdings Group, China Merchants Group and China Mobile, has invested in the fund. Wealth Capital is the sole fund manager allocating capital to targeted companies.

Mixed ownership reform will allow investors such as those from the private equity sector to help state-owned enterprises improve their governance structure and implement more market-driven decision-making and higher efficiency, the forum heard.

The China Structural Reform Fund, set up by China Chengtong Holdings in September last year, is backed by the State-owned Asset Supervision and Administration Commission, the parent of China’s state-owned enterprises. The fund took part in China Unicom’s mixed ownership reform and subscribed to shares in the China Unicom A-share listed company in August to become its third-largest shareholder.