Trump’s folly to cut corporate tax will change nothing

When government spends more and does not spend it wisely the poor just get lower wages and pay higher rents and other costs

Hong Kong would not reduce taxes across the board despite an anticipated global race to make corporate rate cuts following a US Senate vote to lower the amount businesses pay, the city’s finance chief said (Sunday).

- SCMP, December 11

There is a simple story here and it is a false one that Financial Secretary Paul Chan Mo-po is quite right to reject although I am not sure he understands why he is right.

The story is that economic growth is slow across the world is because corporate taxes are too high. Bring these taxes down and everything will be fine except for Hong Kong, which will see erosion of the competitive edge it has long enjoyed from low tax rates.

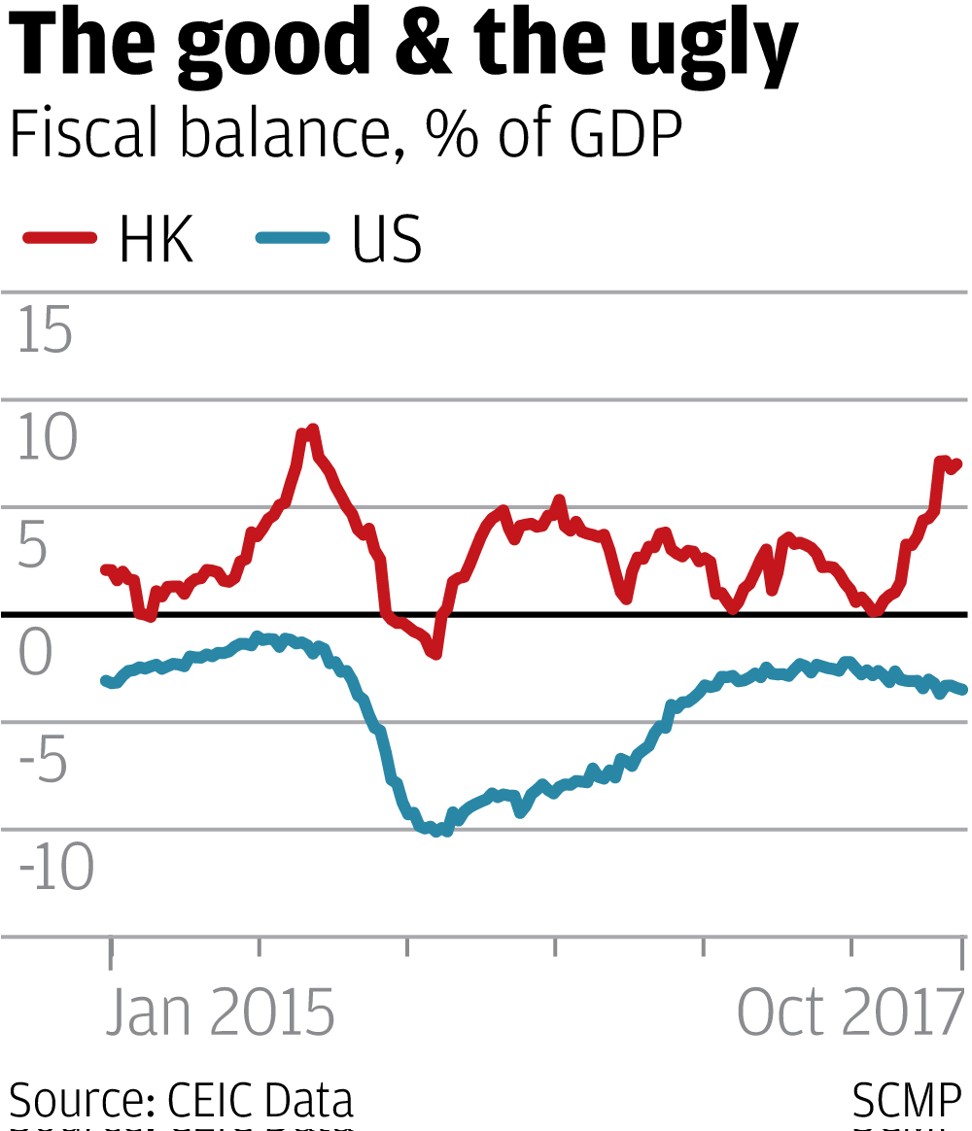

Now to the chart to set the background. It shows you that Hong Kong runs a consistent fiscal surplus except briefly in very bad times and that this surplus now stands at an annual average of 7 per cent of gross domestic product (GDP).

The US in contrast is in consistent fiscal deficit as steep as 10 per cent of GDP in bad times. This is now 3.5 per cent of GDP.

So here is a question with an obvious answer: If you cut taxes when you are running a big deficit and you keep expenditure rolling along unchanged, which the US is doing, how do you get the money you need?

Obvious answer: By borrowing it, which the US is doing like an Italian Renaissance prince. Total federal borrowings now stand at more than US$20 trillion or 103 per cent of GDP. We in Hong Kong, by contrast have net savings equivalent to about 75 per cent of GDP.

So here is the next question: What is the difference between taxation and public borrowing?

Answer: With taxation you take money from people and tell them you will not pay it back, which is true. With public borrowing you take money from people and tell them you will pay it back, which is a lie.

If you are the US government you just keep borrowing more to pay back your first debtors

Elsewhere we would call this a Ponzi scheme. Sovereign debt, however, is reckoned beyond doubt although more governments in history have defaulted on their debt than ever paid it back.

But we shall leave this aside.

My point here is rather that if economic growth is slow because government has taken too much of the money, or wastes what it spends, then what matters is the scale of public expenditure and how well it is spent, not how it is funded.

The US is thus unlikely to gain any benefit from cutting corporate taxes. It is not cutting public expenditure. Total spending, both hidden and open, of almost US$1 trillion a year on the Pentagon death machine, is also pretty sound evidence that it is not well spent.

No burdens are lifted from corporations. They may now pay less tax but they will find it harder to raise debt with Uncle Sam crowding them out of the bond market. The one offsets the other.

What is more, there is not really much advantage to any segment of society in whether the money is raised from taxpayers or bond investors. The rule in these matters is that the bottom stones always carry the greatest weight of the pyramid and the working poor always carry the greatest burden of government.

When government spends more and does not spend it wisely the poor just get lower wages and pay higher rents and other costs. The average percentage return on investment for the rich remains the same.

I confidently predict that this latest Trump folly will change nothing.