Hong Kong overhauls city’s stock listing rules to attract biotech firms, tech giants to raise capital

The overhaul in the listing regulations and procedures, the most drastic in three decades, will take effect in mid-2018, according to the exchange operator.

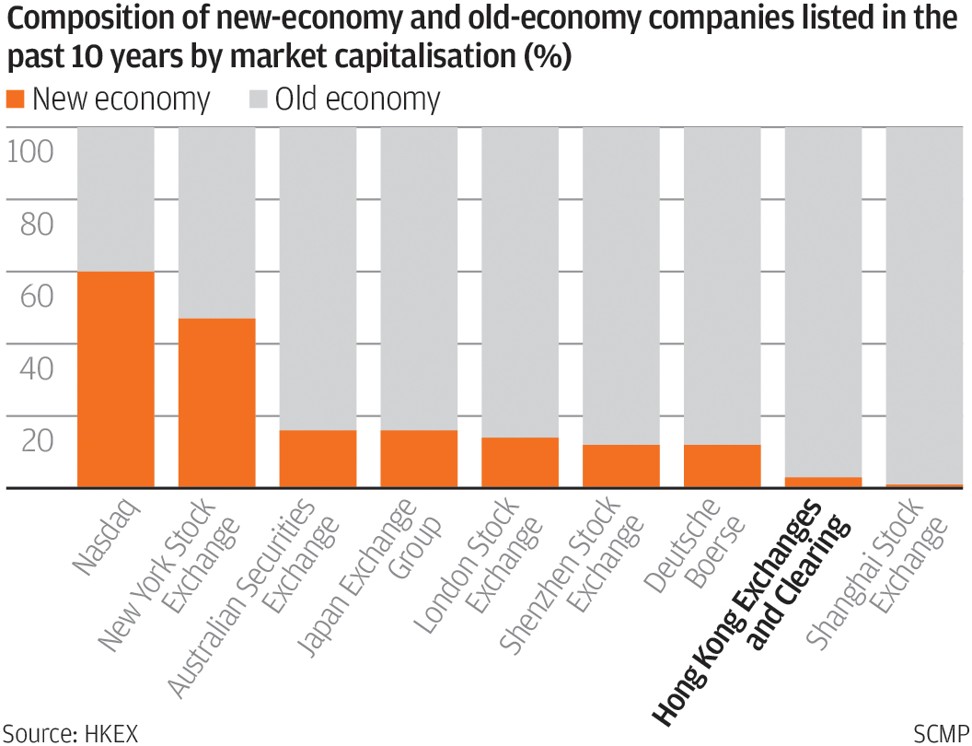

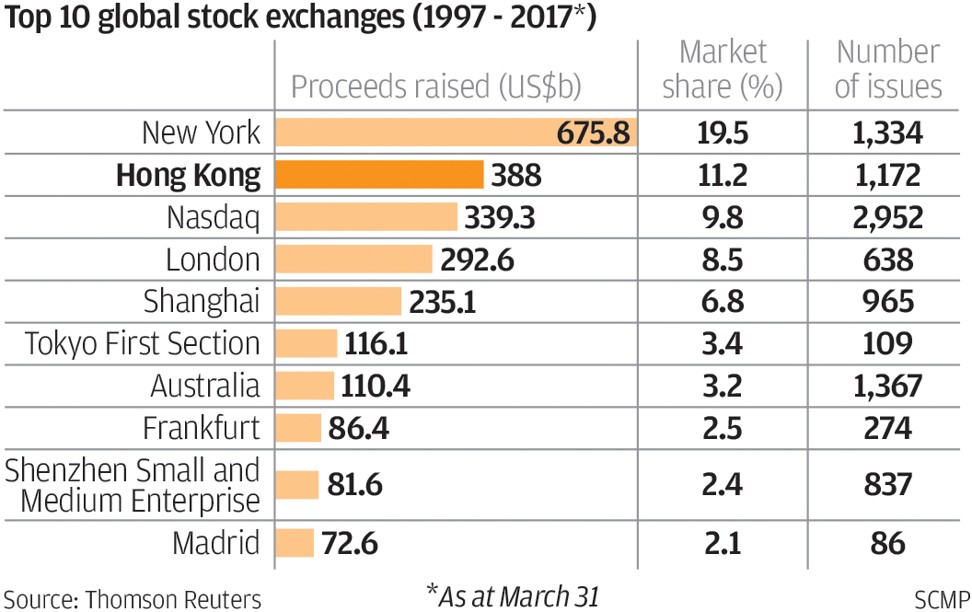

Hong Kong’s stock exchange has unveiled the biggest overhaul in its listing rules and procedures in three decades, in an overture to giant technology companies seeking to raise capital, as the city tries to catch up with New York and Shanghai in the race to be the world’s largest market for initial public offers.

The bourse will abandon an earlier plan for a so-called Third Board for start-ups, but instead create two additional chapters in its listing regulations for biotechnology firms and companies with multiple classes of shares to raise capital, according to the Hong Kong Exchanges and Clearing Limited, the market operator.

“The market has changed substantially in 30 years, it’s time to make a change,” said chief executive of the bourse, Charles Li Xiaojia, in response to a media inquiry. “If we don’t change our listing rules, we will miss the boat.”

The founders of Alibaba – owner of the South China Morning Post –have special rights to appoint directors to the company’s board. That privilege, although it must be ratified at a shareholders meeting, contravened Hong Kong’s “one share, one vote” principle, resulting in a deadlock on the company’s listing application that ultimately drove Alibaba to take its stock offer to New York.

“We may have missed some big players, but it is not too late,” Li said in Hong Kong . “After the change in the rules, many of the Chinese companies that are seeking to list in the US may also consider listing in Hong Kong.”

To settle the debate, Hong Kong’s market operator and securities regulator called for a public consultation in June to find the best way to remake the listing regulations, as competition sharpened with New York, Shanghai, London and Singapore to attract companies to raise capital.

The overhaul in the rules is “definitely the right move, if Hong Kong intends to attract more new economy companies,” said Brian Gu, JPMorgan Chase & Co’s chairman of Asia-Pacific investment banking, adding that more Chinese companies are likely to be attracted by Hong Kong as a result. “It’s positive for Hong Kong.”

Under the HKSE’s new rules effective in mid-2018, biotech firms need at least HK$1.5 billion in valuation at the time of their listing, but they need not have any revenue track record to raise funds in the city.

Companies with multiple classes of shares must be engaged in businesses classified as new economy, with at least HK$10 billion in valuation and annual revenue of at least HK$1 billion. Businesses with valuations exceeding HK$40 billion (US$5.1 billion) can raise funds in Hong Kong with a lower revenue threshold, according to the new rules.

New rules will be in place to protect shareholders, whereby the ratio of the rights of the different classes of shares cannot exceed 1 to 10. Sunset clauses must also be inserted for the special voting rights in the case of the company founder’s demise, stock disposals or resignation as directors.

“We will be mindful of the public’s views on the various safeguards now being proposed, as well as the criteria delineating those companies which may be eligible under the new regime,” said Ashley Alder, the chief executive of the Securities and Futures Commission (SFC), the market regulator, in a statement.

Technology companies with more than HK$10 billion in market value that are already listed elsewhere will be eligible for a secondary listing in Hong Kong, with their existing shareholding structure, according to the new rules.

Li said HKEX will have all the rules ready “by the middle of 2018” .

“If there are companies that want to apply earlier, I can recommend the listing division to consider a conditional review, subject to the new rules.”

Hong Kong Exchanges’ shares, listed in the city since 2000, have risen 76 per cent since 2014. They declined as much as 2 per cent in Friday trading before the bourse’s announcement to HK$224.40, closing the week at HK$226.40 per share.

With additional reporting by Peggy Sito.