With IPO rules reboot, Hong Kong is primed for 2018’s big China technology listings

Proposal to allow dual-class shares will boost city’s competitiveness vis-à-vis New York

With big Chinese technology and internet initial public offerings potentially in the pipeline, Hong Kong’s decision to revamp its IPO rules could tip the balance in its favour as it battles for China listings with New York.

“Companies are increasingly more positive on Hong Kong as a preferred listing destination,” said Mervyn Chow, the co-head of investment banking and capital markets, Asia-Pacific, and Greater China chief executive at Credit Suisse.

The Hong Kong stock exchange said on Friday it would propose rule changes to allow dual-class shares on the main board, with a formal public consultation to be launched as early as the first quarter of 2018. The overhaul in listing regulations could be the city’s most drastic in three decades.

“The rule changes to allow dual-class shares will enhance Hong Kong’s competitiveness vis-a- vis the US, especially for Chinese technology IPOs. It is the right timing for Hong Kong to make these changes. It will be a game changer,” Chow said.

As a group of rapidly expanding Chinese technology and internet companies nears the stage of going public, the battle for big Chinese listings has intensified between Hong Kong and its fundraising rivals, such as New York.

Xiaomi, the privately owned Chinese smartphone maker, has been in talks with investment banks for a possible IPO as soon as next year, which might value the company at more than US$50 billion, versus a valuation of US$46 billion at its most recent funding round in 2014, according to media reports. Either Hong Kong or New York could host the listing, the reports said.

If valued at US$50 billion, Xiaomi’s float will be the third-largest technology IPO in history, surpassing Snap’s US$24 billion listing in March.

Alibaba Group Holding, which owns the South China Morning Post, and Facebook rank No. 1 and No. 2, with valuations of US$167 billion and US$104 billion, respectively, when they were listed in 2014 and 2012 in New York.

Elsewhere, Tencent Music, the music streaming unit of Tencent Holdings, has also invited investment banks to handle its planned listing next year, which could value the unit at US$10 billion, Bloomberg reported recently, citing unnamed sources.

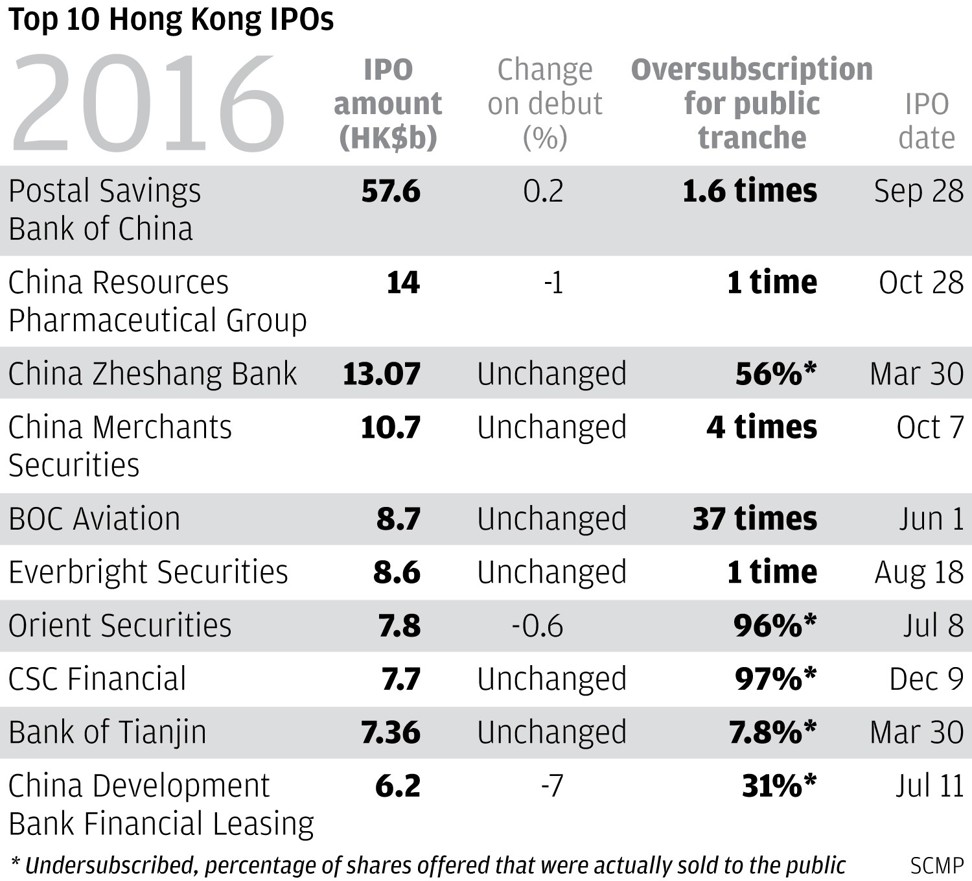

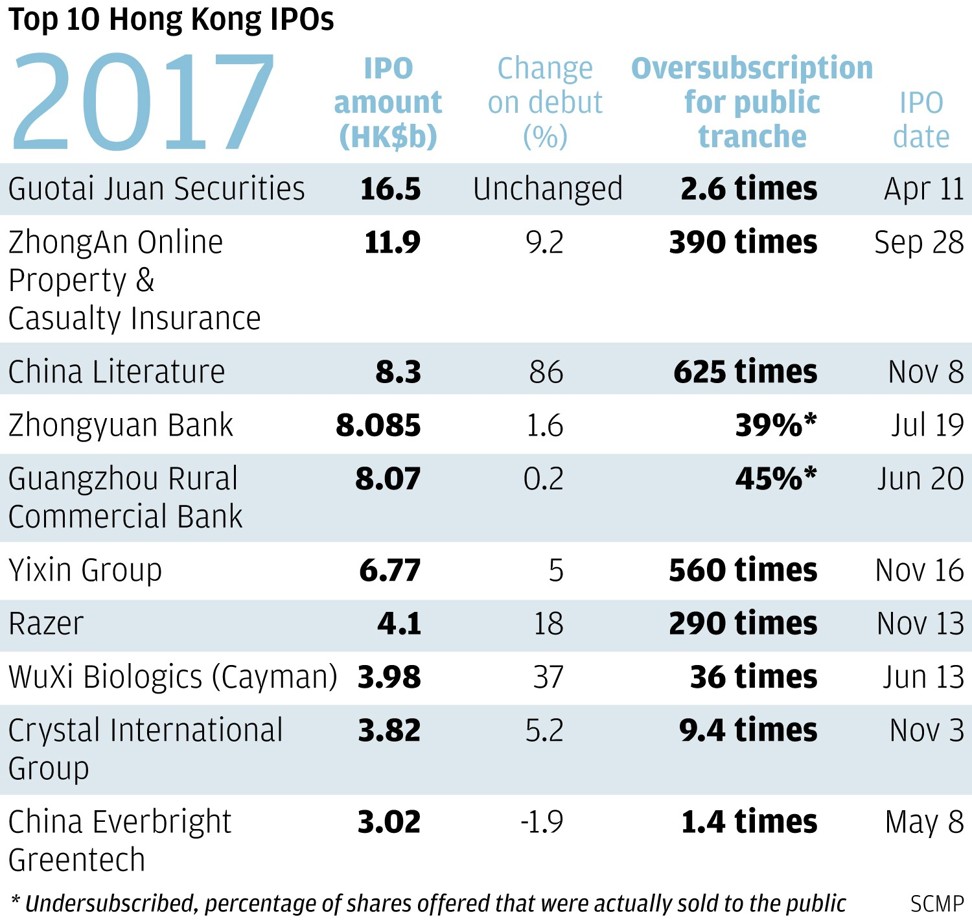

The city has already seen a flurry of fundraising in 2017 by technology and internet companies, with five of its 10 largest IPOs by companies operating in the new economy, compared with none last year. Listings by banks and securities companies, staples of Hong Kong’s capital market, have halved to 30 per cent of this year’s top IPOs, from 60 per cent last year, in line with regulators’ goals to draw more new economy companies to float here.

In November, Tencent’s China Literature debuted on the Hong Kong market, and its US$1.06 billion IPO attracted overwhelming investor demand, in what was the hottest listing in a decade.

Other potential technology IPOs in the forthcoming year could include: Ping An Insurance (Group) Company of China’s peer-to-peer online-lending platform Lufax, which could raise up to US$5 billion in a planned Hong Kong IPO as soon as the first half of 2018; its Chinese rival Dianrong.com, backed by Singapore’s GIC, which is also considering a Hong Kong listing to raise least US$500 million; as well as Hong Kong’s online finance lending platform WeLab, with a possible listing size of US$500 million.

Baidu’s video streaming site iQiyi is targeting an IPO as soon as next year, to value it at up to US$10 billion, with New York a possible listing destination, according to reports this year.

Ant Financial, the Alibaba Group fintech affiliate that operates Alipay, has delayed its IPO. Jack Ma Yun, the Alibaba chairman, said last month he would possibly consider an IPO for Ant Financial in two years, but not in the next 12 to 18 months. The venue for this listing is also undecided. Ant Financial was valued at US$60 billion in its last funding round in 2016.

Credit Suisse’s Chow said Chinese issuers usually prefer a Hong Kong listing, as it is closer to their home market and enables access to a larger pool of international as well as mainland investors, who typically have a good understanding of the business models and the products that tend to be relevant locally. “This has been important for Chinese technology firms, which are largely ‘product companies’ focused on building and selling products to consumers.”

With the proposed move to a dual-class share structure, more innovative companies might choose Hong Kong as a listing destination. Moreover, the changes might bring new opportunities for investors, which would boost the liquidity of the city’s capital market, Chow said.

“These opportunities include new IPO products, such as potentially a trading link to enable mainland investors to buy into Hong Kong IPOs.”

Ronald Wan, chief executive at Partners Capital, said he had already seen a rising willingness among his clients in China to favour Hong Kong as an IPO destination. Wan said he expected the first dual-class share company to appear on the Hong Kong market as early as the second half of 2018.

“This year we’ve had several hot tech IPOs, such as ZhongAn Online, China Literature and Razer, which have ignited investors’ enthusiasm towards new-economy stocks and raised expectations about more tech and internet listings coming to Hong Kong, such as the highly anticipated IPOs of Lufax and Ant Financial,” said Kenny Shui, a senior researcher at Our Hong Kong Foundation, a Hong Kong-based think tank.

But a key issue would be how Hong Kong can protect retail investors at the same time, as dual-class shares give company founders much more power over their business even if they hold a small portion of the shares, he added.