It’s Shanghai and not New York that Hong Kong has to worry about in the 2018 IPO stakes

Deloitte expects Hong Kong’s IPO value to rebound by up to 48pc next year on the back of HKEX’s IPO rule changes and China easing off on the sale of H shares

It was a disappointing year for Hong Kong as a global fundraising hub.

The city lost the IPO crown to New York after two straight years in the spot and slipped behind Shanghai for the first time. Hong Kong’s IPO value for 2017 dropped to the lowest level since 2012 to US$16.3 billion, compared with US$49.5 billion in the US and US$31.7 billion in China, according to data from Dealogic as of December 20.

But Edward Au, co-leader of the national public offering group at Deloitte China, is positive about 2018. He expects Hong Kong’s IPO value to jump by 25 per cent to 48 per cent to between HK$160 billion to HK$190 billion.

The rebound will be fuelled by two catalysts – Hong Kong exchange’s IPO rule changes to allow dual-class shares and China lifting the ban on share sales of owners of state-owned enterprises, or so-called “full circulation of H shares”, Au said.

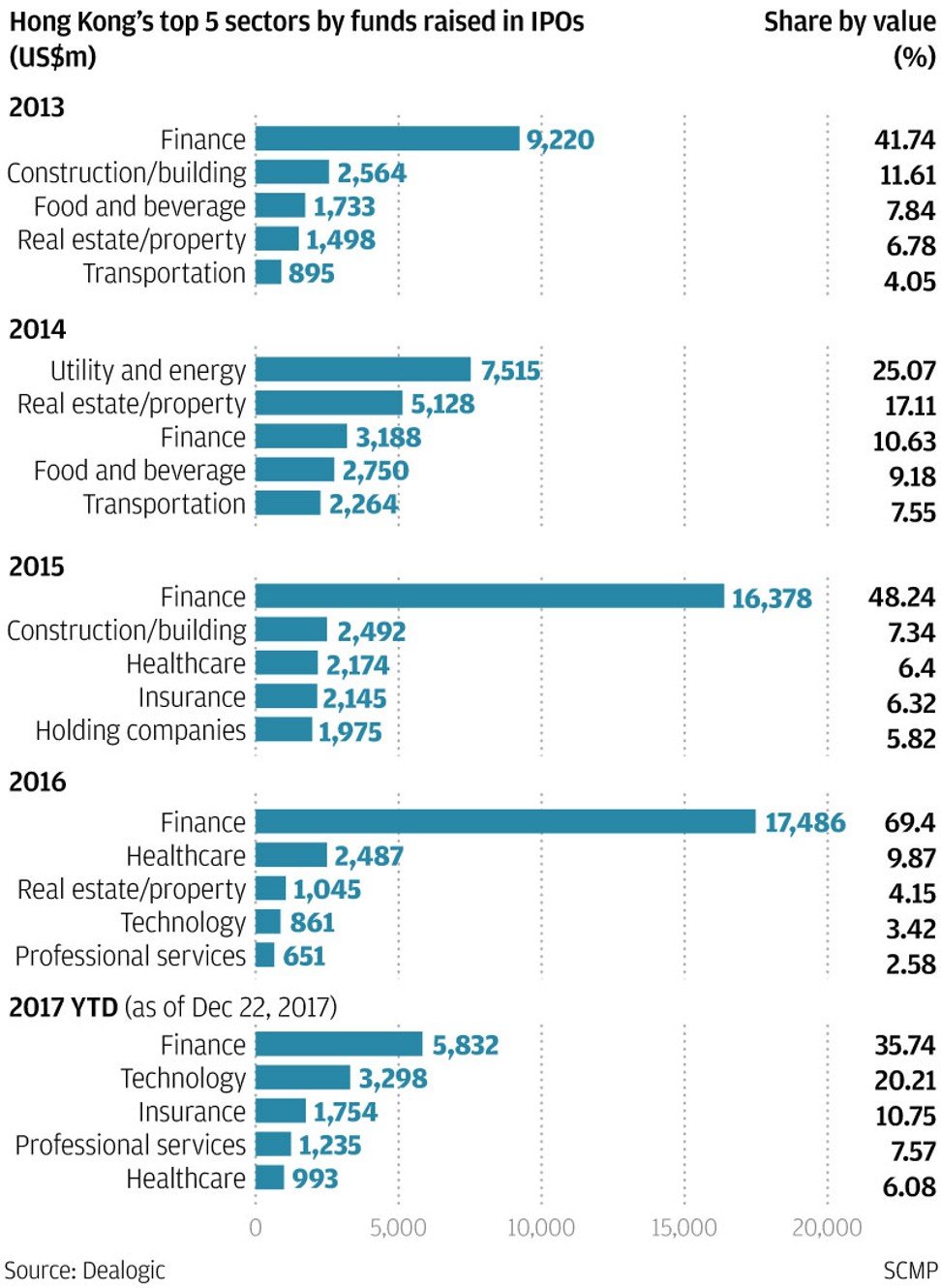

Coming back to 2017, 18 tech IPOs raised US$3.3 billion in Hong Kong, accounting for 20.2 per cent of the pool, the second biggest source of floats, according to Dealogic. The fundraising also more than tripled compared with the average US$933 million from 2013 to 2016.

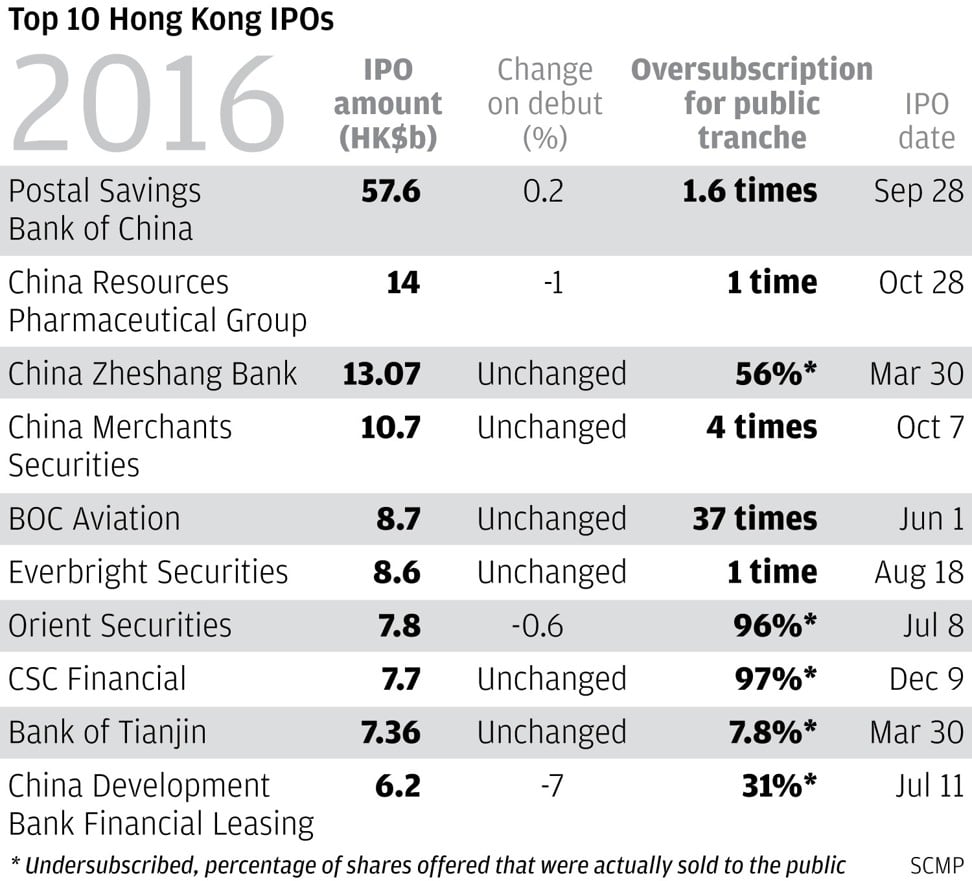

Finance IPOs still took the lion’s share at 36 per cent, but it was markedly lower from 69 per cent in 2016.

Insurance came in at No 3, replacing property from last year’s rankings, thanks largely to ZhongAn Online Property and Casualty Insurance’s US$1.5 billion float in September.

A similar trend was seen in the US. Tech replaced finance as the biggest source of IPOs, with its share rising to 24.4 per cent from 16.6 per cent in 2016. The value of tech IPOs also increased three fold to US$12.3 billion from last year’s US$4.2 billion.

In Asia ex-Japan, technology listings also ranked No 1 by sector, making up 16.7 per cent of the region’s IPOs in 2017 by value, compared with 8.5 per cent in 2016. Finance slipped to No 3 from last year’s No 1, with a share of 11.6 per cent.

Hong Kong investors gave a warm welcome to the flurry of tech IPOs.

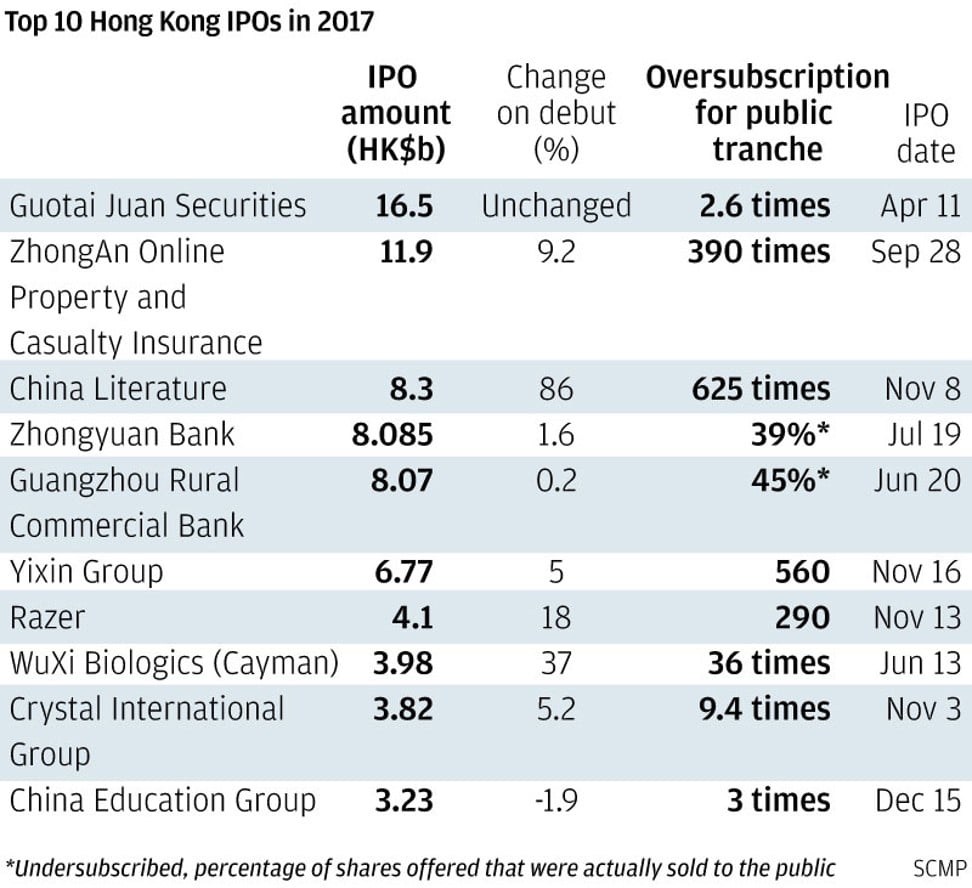

For the nine tech and internet IPOs on the main board, the average public oversubscription rate was 367 times.That was in stark contrast with the average 2.2 times for the eight finance IPOs on the main board, among which were two big listings – Zhongyuan Bank and Guangzhou Rural Commercial Bank – that did not even garner enough subscription and had to price their offer lower.

Tech stocks jumped by an average 56 per cent from the IPO price on the first day of trading, while financial shares only rose 5 per cent on average on debut.

On the flip side, tech stocks, which usually have a lot of expectations riding on them, were also prone to sharp price swings.

“Technology stocks usually have higher beta and are more volatile in nature compared with stocks of real asset-backed businesses,” said Alex Wong, director of asset management at Ample Financial Group. “People trade mainly on expectations.”

The trend was seen in shares of the year’s four biggest tech IPOs – ZhongAn Online, China Literature, Yixin Group, and Razer – which quickly soared to peaks within the first few trading sessions after debut before embarking on a downward trajectory. The shares have since dropped more than 20 per cent from their highs. Yixin and Razer even breached their IPO levels.

That shift in sentiment has led to a cooling-off in the market in the past month.

“These shares surged initially amid enthusiasm, but then when the frenzy receded, the stock price pulled back and the trading turned more quiet,” Wong said.

“Hong Kong investors arelearning from their experiences in new economy listings.”

Some of the companies and investment banks may also have priced the IPOs too high when the market was feverish, which made the shares more vulnerable to a pull back after listing.

Still, Wong expected the sentiment to warm up next year, with big Chinese tech and internet listings potentially in the pipeline.

“ZhongAn and China Literature’s cases have told us investors’ appetite is strong for these innovative companies.”

Besides, China accounts for more than a third of the world’s unicorns, with 98 start-ups valued at over US$10 billion, second only to the 106 in the US, according to a recent estimate by Deloitte.

Mervyn Chow, the co-head of investment banking and capital markets for Asia-Pacific at Credit Suisse, noted that Chinese issuers usually prefer a Hong Kong listing, as it is closer to their home market and enables access to a larger pool of international as well as mainland investors, who typically have a good understanding of the business models and the products that tend to be relevant locally. “This has been important for Chinese technology firms, which are largely ‘product companies’ focused on building and selling products to consumers.”

With the Hong Kong stock exchange planning an overhaul of its listing regulations and China’s State Council reportedly considering a possible lifting of the ban on public float of H shares – Hong Kong probably has a fair shot at regaining the IPO crown.