Technology stocks hog the limelight and outperform the old economy in Hong Kong and mainland China

The best performing stocks on the main indices of Hong Kong, Shanghai and Shenzhen in 2017 were all related one way or another to technology.

Hong Kong’s stock market operator and regulator pushed through a controversial overhaul of their listing rules this year to attract so-called new economy companies - including technology firms and biotechnology researchers - to raise capital in the city.

They have good reason to do so. The best performing stocks on the main indices of Hong Kong, Shanghai and Shenzhen in 2017 were all related one way or another to technology, or at least have a business strategy that taps into the new economy.

“Technology companies have overtaken financial, energy, industrial and commercial firms as the ones with the biggest market values and the most influence,” said Citic Securities’ analyst Xu Yingbo, who recommends buying Tencent Holdings, AAC Technoligies Holdings, Hanzhou HikVision Digital Technology and Sanan Optoelectronics. “China has already become one of the two global forces of technology innovation.”

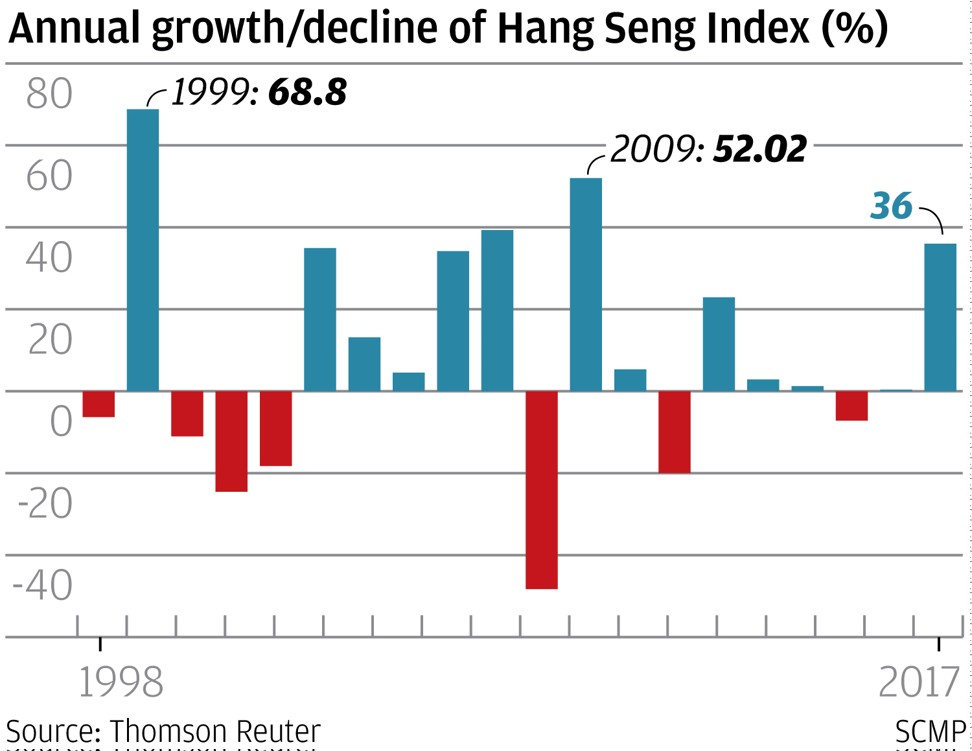

Hong Kong’s key Hang Seng Index rose 36per cent this year, while the China Enterprise Index (CEI) advanced 24.6 per cent.

The biggest winner on the China Enterprise Index, Ping An Insurance Group’s 109.7 per cent return, is making fintech and insurtech the signatures of its business strategy.

The pattern is similar in mainland China. Six of the 10 biggest gainers among the 1,434 stocks on the Shanghai Composite Index were technology-related, led by manufacturing systems designer PNC Process Systems, which rose 10-fold this year.

In Shenzhen, a claimant to being China’s Silicon Valley, seven of the top 10 advancers among the 2,123 stocks on the Shenzhen Composite Index were involved in genomics, new materials, biotechnology.

“Solid fundamentals of technology innovation and fast earnings growth are fuelling the rally in technology stocks this year, and the relatively loose global liquidity has also enriched their valuations,” said Chen Hao, a strategist at KGI Securities in Shanghai. “Looking forward to 2018, global investors will still be positive on the sector as technology innovation is showing signs of acceleration.”

Chinese companies are investing their higher valuations into research and development, with the country’s aggregate R&D expenditure rising by 19 per cent, the fastest pace in the world, according to Citic Securities, the country’s biggest listed brokerage.

The boom has propelled Tencent, operator of China’s dominant social media network, into Asia’s most valuable company, with a market value that briefly broke the US$500 billion barrier, putting it among Amazon, Apple, Facebook and Google’s parent Alphabet among the aristocracy of technology.

Tencent is the second-largest stock on the Hang Seng index, with a weighting less than half a percentage point smaller than HSBC, but accounts for about 7 per cent of the value of stocks that changed hands everyday on the entire Hong Kong bourse last year. HSBC made up less than 2 per cent of average daily turnover.

To be sure, Hong Kong is a latecomer to the technology stakes. Before ZhongAn Online P&C Insurance’s initial public offering in September, the city’s bourse was dominated by property developers, banks, Chinese oil companies and industrial firms. The extent of technology among Hong Kong-listed stocks was limited to China’s biggest mobile phone networks. And Chinese technology companies from Alibaba Group Holding to search engine operator Sogou Inc chose to raise capital in New York, not Hong Kong.

That changed with the HK$13.68 billion (US$1.75 billion) IPO by ZhongAn, which sells insurance online. That paved the way for a series of technology-related IPOs in quick succession in Hong Kong.

Razer Inc, a maker of consoles and accessories for video gamers backed by the city’s wealthiest man Li Ka-shing, staged its HK$3.93 billion in early November.

The HK$9.6 billion IPO by Tencent’s China Literature Limited unit in late November was Hong Kong’s most sought-after sale in decades. Investors placed 600 times more money than stocks on offer, locking in HK$520 billion of capital, equivalent to one third of the entire city’s money supply.

Still, stock market valuations obey the microeconomic laws of supply and demand, the same way physical objects can’t defy gravity. Stock prices that have overtaken corporate earnings will be in for a tough year in 2018, as rising interest rates mark the end of cheap financing, some traders said.

“Technology stocks are too risky now, even if they continue to be chased by investors,” said Joseph Tong Tong, chairman of Morton Securities in Hong Kong. “Many technology stocks that surged in 2017 are now trading at a high valuation. Investors are investing in them with the expectation they have a high growth. Once their growth rate slow in 2018, investors will start to sell the stocks.”