Verdict turns jailed tycoon into private capital’s touchstone in quest for role in Communist China

Gu Chujun, who bought five listed firms more than a decade before China’s outsize asset purchases made headlines, was jailed for seven years. He explains in an interview with the Post why he’s on a quest for justice

Gu Chujun, feted more than a decade ago as China’s role model in applying private entrepreneurship to revive sickly state companies, may become the country’s new poster boy for a second act: a crusade to protect private property in the nation governed by the world’s largest Communist Party.

A week before the new year, China’s highest judicial body ruled that it would review a 2005 case previously tried in a lower court, which convicted Gu and jailed him for seven years. The review could be the first tentative step towards returning justice to the 59-year-old financier, who had been on a quest since 2013 to overturn what he called trumped up charges by corrupt officials leery of his fortune.

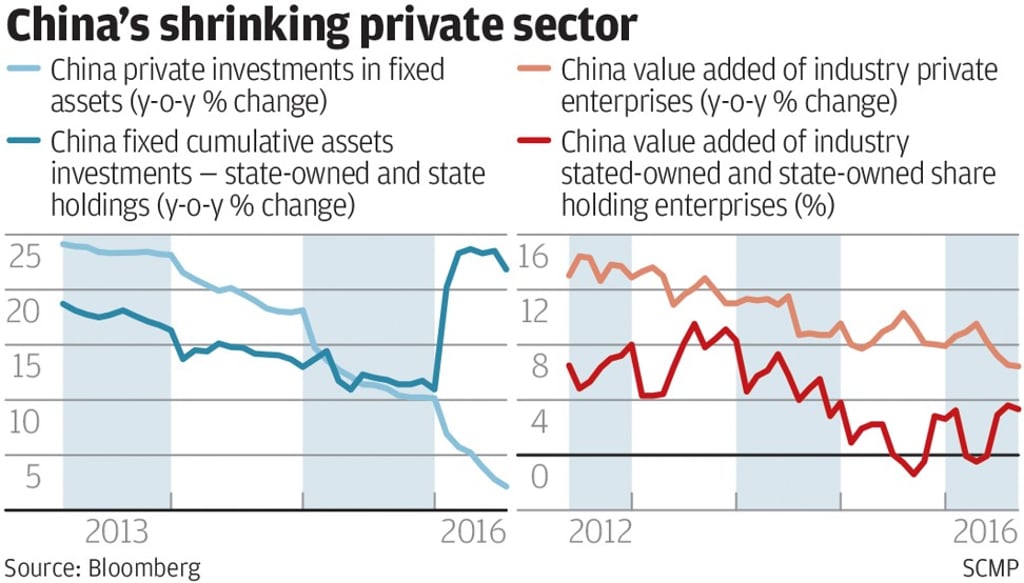

Xi’s government had good reasons to assure private businesses. Their combined investments in China had declined steadily after reaching a peak in 2011, coinciding with Xi’s promotion to the party’s top post in November 2012. Instead, the trickle of funds heading offshore turned into a flood, causing China’s foreign exchange reserves to shrink by 25 per cent starting in June 2014. It would take 18 months of crackdowns and concerted administrative efforts by China’s currency and banking regulators to stem the slide and restore stability in the reserves.