Don’t get burnt: Hong Kong biotech stock Genscript is hot stuff but also high risk

Without profit model details of a new R&D work for cancer immunotherapy contract and commercialisation success records, analysts warned investors to ‘handle with care’

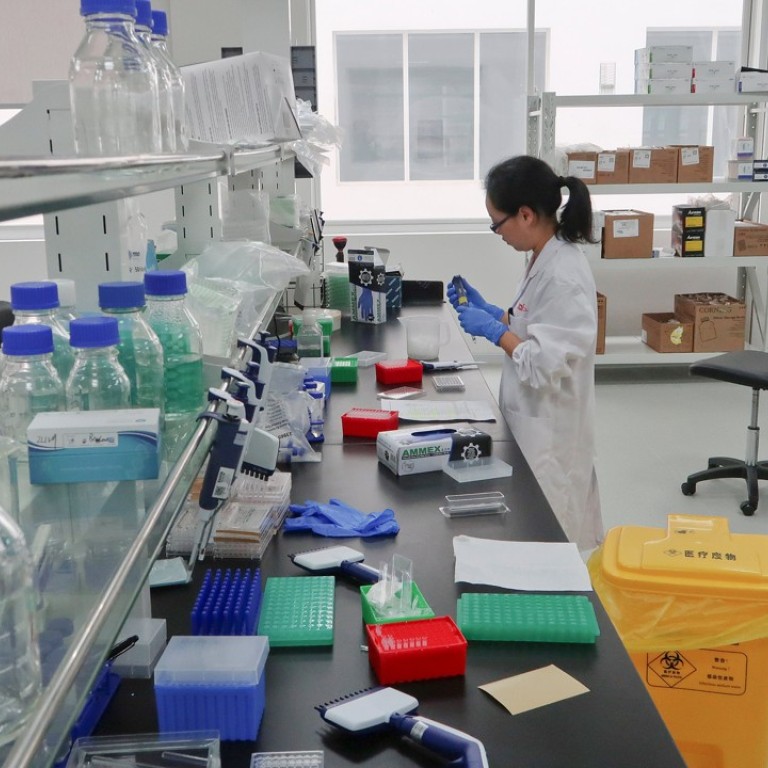

Hong Kong shares of life sciences research services provider and preclinical cancer treatment developer Genscript Biotech Corp soared 27 per cent to another fresh record, raising concerns that investors are taking extremely high risk on the low success rate of typical drug development.

The price surge came after the Nanjing-based firm announced it won a contract to provide preclinical research and development work for Shenzhen-listed Harbin Gloria Pharmaceuticals on a cancer immunotherapy almost identical to the commercialised antibody Ipilimumab.

“Ipilimumab is a fully human monoclonal antibody, which specifically recognises and blocks CTLA-4, which is overexpressed in many cancer patients leading to abnormal growth of tumour cells,” Genscript said in a filing to Hong Kong’s stock exchange on Wednesday.

It did not provide the contract’s value, duration, revenue and profit model.

The company, which went public two years ago, has seen its share price surge 3.4-fold in the past four months, and is 20 times its initial public offering price of HK$1.31.

It closed at the intraday high of HK$26.80 on Wednesday, 220 times its earnings per share last year and with HK$1.37 billion (US$175.3 million) worth of shares changing hands, making it the 11th most traded stock in the local bourse.

Albert Jin, a health care sector analyst at CCB International, said the source of the firm’s existing revenue and profit – gene synthesis service and industrial enzyme production – was completely different from the drug research hope that investors are buying into.

“Explosion of the company’s valuation is based on the assumption that its cancer treatment development will be successfully commercialised,” he said. “But it is still in an early stage of the process which means there is a very high possibility of failure.”

Jin called it “a high risk, high return proposition similar to that taken by venture capitalists”.

But it is still in an early stage of the process which means there is a very high possibility of failure

Genscript last month sealed a deal in which the biotechnology unit of American health care giant Johnson & Johnson agreed to pay Genscript an upfront US$350 million to develop treatment for a type of blood cancer called multiple myeloma.

The two firms will later share development costs and profit.

Genscript posted revenue of US$63.38 million in last year’s first half, of which 83.6 per cent came from life sciences research services and 3.5 per cent from preclinical drug development services.

The rest were from life sciences research “catalogue products” such as antibodies found in the immune system, and industrial synthetic biology products including those used in the food industry.

Net profit grew 13.6 per cent to US$14.98 million in the six months from the same period in 2016.

VC Wealth Management managing director Louis Tse Ming Kwong said given the lack of information about the contract with Harbin Gloria, it appeared that investors were chasing the stock for fear of missing out.

“Handle with care is all I would say to them,” he said.